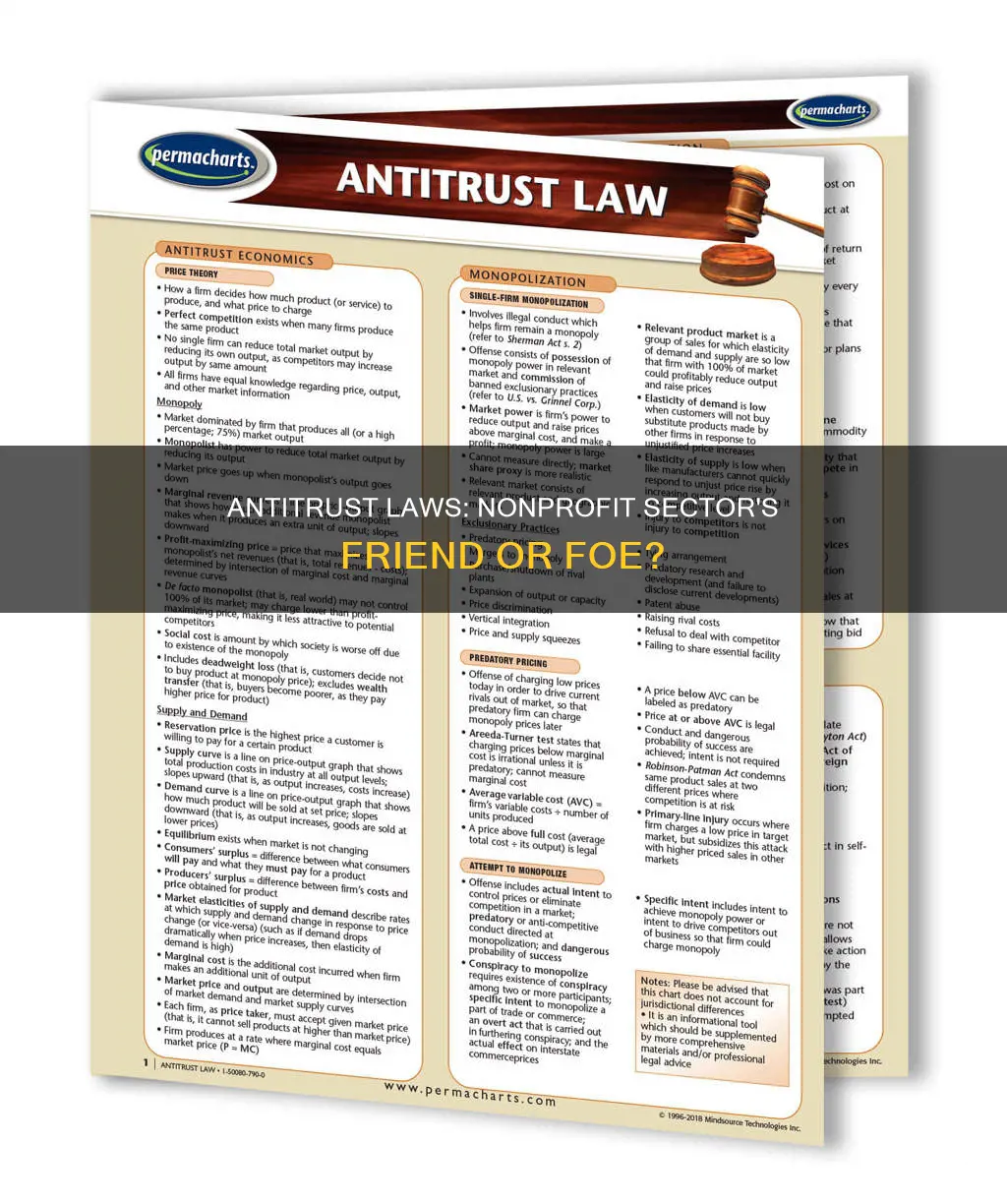

Non-profit organisations are subject to antitrust laws in the same way as for-profit businesses. This means that nonprofits must comply with the Sherman Act, the Clayton Act, the Robinson-Patman Act, and the Hart-Scott-Rodino Act. Antitrust laws prohibit contracts, combinations, or conspiracies that restrain trade and monopolise markets. Nonprofits have been scrutinised for engaging in group boycotts, price-fixing, and agreements not to compete. While there is an exception for non-commercial activities, such as soliciting charitable donations and political fundraising, nonprofits must be cautious when engaging in commercial activities to avoid violating antitrust laws.

| Characteristics | Values |

|---|---|

| Antitrust laws applicable to nonprofits | Yes |

| Antitrust laws applicable to for-profit businesses | Yes |

| Primary antitrust laws applicable to nonprofits in the US | Sherman Act, Clayton Act, Robinson-Patman Act, and Hart-Scott-Rodino Act |

| Entities that can challenge potential antitrust conduct | U.S. Department of Justice, Federal Trade Commission, state attorneys general, and private individuals (rarely) |

| Nonprofits commonly subject to antitrust scrutiny | Hospitals/healthcare providers, academic institutions, and trade associations |

| Antitrust law prohibitions | Contracts, combinations, or conspiracies that restrain trade; monopolization of trade; price discrimination; exclusive dealing; tying arrangements; mergers; acquisitions; interlocking directorates |

| Exception to antitrust law applicability | Non-commercial activities, including soliciting charitable donations, political fundraising, and determining university admissions criteria |

| Penalties for violating antitrust laws | Fines, potential jail time |

What You'll Learn

Non-profits are subject to antitrust laws

The Supreme Court, in 2021, through NCAA v. Alston, clarified that non-profit organizations are subject to antitrust laws, just like for-profit businesses. Non-profits must therefore be aware of their obligations under the primary antitrust laws in the United States, including the Sherman Act, the Clayton Act, the Robinson-Patman Act, and the Hart-Scott-Rodino Act.

Potential antitrust conduct can be challenged by various entities, including the U.S. Department of Justice, the Federal Trade Commission, state attorneys general, and, in rare cases, private individuals. Non-profits commonly face antitrust scrutiny in areas such as healthcare, academia, and trade associations.

Antitrust laws prohibit agreements or practices that restrain trade, such as concerted refusals to deal, group boycotts, price-fixing, and agreements not to compete. Non-profits must also be cautious about activities that may lead to monopolization or the exclusion of competition. Other activities that can trigger antitrust scrutiny include price discrimination, exclusive dealing, tying arrangements, mergers, and acquisitions.

While there is an exception for non-commercial activities, it is narrow, and courts generally define commercial activity as any exchange of something valuable for goods or services. Non-profits must be vigilant when engaging in commercial activities to avoid violating antitrust laws, as the consequences can be severe, including costly litigation and damage to their reputation.

Antitrust Laws: Global Reach and International Application

You may want to see also

Non-profit organisations and maintaining credentials

Non-profit organisations are subject to antitrust laws just as for-profit businesses are. This means that non-profits must be aware of their obligations under antitrust law in the United States, including the Sherman Act, the Clayton Act, the Robinson-Patman Act, and the Hart-Scott-Rodino Act.

Non-profit organisations that tie credentialing (professional certification or entity accreditation) to membership should be cautious. A recent case, Talone v. American Osteopathic Association, has put this practice on antitrust alert. The plaintiffs in this case alleged that the American Osteopathic Association (AOA) engaged in unlawful tying arrangements by requiring AOA-certified Doctors of Osteopathic Medicine (D.O.s) to purchase AOA memberships to maintain their professional specialty certification. The court's refusal to dismiss the case signals a possible answer to the question of whether tie-ins between non-profit organisation memberships and maintaining credentials can violate antitrust laws.

While the Talone case is still in its early stages, it indicates that there may be a decision addressing what constitutes unlawful tying in a non-profit organisation when it links membership to maintaining credentials. Non-profit organisations that tie credentialing to membership should carefully monitor this case, as the result could signal a change or an end to this practice.

To avoid antitrust issues, non-profit organisations should be mindful of the following:

- Any agreements made between members, especially those regarding prices, output decisions, or business relationships with other firms, as these could be seen as a form of restraint of trade.

- The collection and use of data from members to ensure it does not facilitate price-fixing or other anti-competitive practices.

- Decisions to limit membership, expel a member, or restrict the availability of services, as these could unfairly hinder the ability of certain firms or types of firms to compete.

- Codes of ethics, enforceable standards, or other rules that may limit the ability of members to compete, including restrictions on pricing, output, or truthful advertising.

- Implementing an antitrust compliance program to help keep the organisation out of legal trouble and reduce potential penalties for any violations.

American Laws on Indigenous Reservations: Who Has Jurisdiction?

You may want to see also

Non-profit antitrust scrutiny

The primary vehicles of antitrust law in the United States that nonprofits must be aware of are:

- The Sherman Act

- The Clayton Act

- The Robinson-Patman Act

- The Hart-Scott-Rodino Act

Nonprofits have faced antitrust challenges for engaging in group boycotts, price-fixing, and agreements not to compete. Antitrust laws also prohibit monopolies and the unlawful exclusion of competition. Other activities that can implicate antitrust law include price discrimination, exclusive dealing, mergers, acquisitions, and interlocking directorates.

The concept of 'tying' as an antitrust violation is also important for nonprofits to understand. This is where a nonprofit organisation requires membership to be maintained in order to access certain benefits or services. A recent case, Talone v. American Osteopathic Association, has put this issue into the spotlight, with the court refusing to dismiss a class action against the AOA, alleging that they engaged in unlawful tying arrangements.

Nonprofits should be cautious when engaging in commercial activities and should consult with legal professionals to ensure they do not run afoul of antitrust laws.

Anti-Kickback Law: Beyond Medicare, What You Need Know

You may want to see also

Non-commercial activities and antitrust law

Non-profit organisations are subject to antitrust laws in the same way as for-profit businesses. However, there is a narrow exception for non-commercial activities. The commerciality of an activity is determined based on a review of the totality of the circumstances in each case.

Courts have found the following activities to be non-commercial:

- Soliciting charitable donations

- Political fundraising

- Determining university admissions criteria

On the other hand, the following activities have been deemed commercial:

- Medical school and residency programs

- Financial aid policies

The exception for non-commercial activities is narrow, and a court will generally find commercial activity wherever there is an exchange of something of value for certain goods or services.

Nonprofits must be cautious when engaging in commercial activities because antitrust law can be complex and nuanced. Hospitals, trade associations, and academic institutions are the most common subjects of antitrust scrutiny in the nonprofit sector, but any nonprofit can violate antitrust laws.

Nobility and the Law: Who Was Exempt?

You may want to see also

Antitrust compliance for non-profits

Non-profit organisations are subject to antitrust laws in the same way as for-profit businesses. Antitrust laws prohibit contracts, combinations, or conspiracies that restrain trade. Non-profits must be aware of their obligations under the primary vehicles of antitrust law in the United States: the Sherman Act, the Clayton Act, the Robinson-Patman Act, and the Hart-Scott-Rodino Act.

Who Regulates Antitrust Activities?

Potential antitrust conduct can be challenged by the U.S. Department of Justice, the Federal Trade Commission, state attorneys general, and, in rare cases, private individuals. Non-profits such as hospitals, healthcare providers, academic institutions, and trade associations are the most common subjects of antitrust scrutiny.

Antitrust Law Prohibitions

Antitrust laws prohibit contracts, combinations, or conspiracies that restrain trade. Generally, a court will find a contract, combination, or conspiracy where there is some form of agreement between parties that unreasonably restrains trade. Non-profits have faced antitrust challenges for engaging in group boycotts, price-fixing, and agreements not to compete.

Antitrust laws also prohibit monopolies or attempts to unlawfully exclude competition. Other activities that may implicate antitrust law include price discrimination, exclusive dealing and tying arrangements, mergers, acquisitions, and interlocking directorates.

Exception for Non-Commercial Activities

Although antitrust law applies to non-profits, there is a narrow exception for non-commercial activities. The commerciality of an activity is determined by reviewing the totality of the circumstances in each case. Non-commercial activities include soliciting charitable donations and political fundraising. Commercial activities include medical school and residency programs, and financial aid policies.

Compliance Tips for Non-Profits

Non-profits must be cautious when engaging in commercial activities to avoid violating antitrust law. Restraints on trade, attempts to monopolize, and excluding competition are illegal. Non-profits should consult with an attorney and perform due diligence to ensure compliance with antitrust laws.

Some specific tips for compliance include:

- Avoid discussing prices, output decisions, or business relationships with specific firms during association meetings.

- Prepare and distribute agendas and presentations in advance of meetings, and keep minutes that accurately reflect the discussions.

- Ensure that statistical reporting programs do not allow members to derive pricing or output information about specific competitors.

- Avoid making decisions that unfairly limit the ability of some firms to compete, such as restricting the availability of services to members.

- Implement an antitrust compliance program to help keep your organisation out of trouble and demonstrate commitment to compliance.

Understanding ADA Laws: Private Business Obligations

You may want to see also

Frequently asked questions

Yes, as per the Supreme Court's ruling in NCAA v. Alston (2021), nonprofit organizations are subject to antitrust laws in the same way as for-profit businesses. Nonprofits must therefore be aware of their obligations under antitrust laws in the United States, such as the Sherman Act, the Clayton Act, the Robinson-Patman Act, and the Hart-Scott-Rodino Act.

Antitrust laws, or competition laws, aim to ensure that the free-market economy works for consumers by preventing firms or groups of firms from gaining market power through means other than competition. Antitrust laws focus on the actions of firms to gain control over the market and prohibit specific types of conduct, such as contracts, combinations, or conspiracies that restrain trade.

Violating antitrust laws can result in significant fines, with penalties of up to $1 million for individuals and $100 million for organizations. In some cases, individuals may even face jail time. Nonprofits that violate antitrust laws may also face enforcement actions and damage to their reputation, in addition to costly litigation.