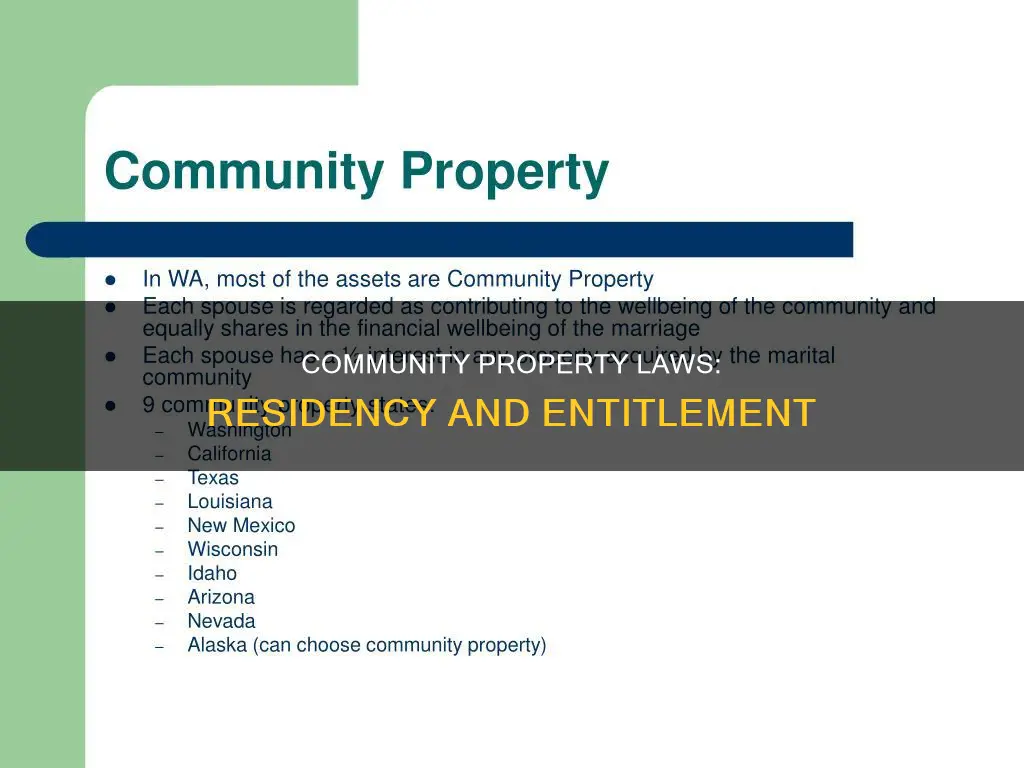

Community property laws apply to married individuals domiciled in a community property state. These laws govern the interests of spouses in property and income acquired or earned during their marriage. In the United States, nine states have community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Alaska, South Dakota, and Tennessee have optional community property systems, where spouses may agree to hold some or all marital property in common.

Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage. Under community property laws, spouses own (and owe) everything equally, regardless of who earns or spends the income.

Community property laws apply to both spouses domiciled in a community property state. If you are a nonresident of a community property state, these laws may not apply to you. However, it is important to consult the specific laws of the state in question to determine your rights and obligations.

| Characteristics | Values |

|---|---|

| Community property laws apply to | Non-resident alien spouses of U.S. citizens |

| U.S. citizens married to non-U.S. citizens | |

| Residents of community property states | |

| Residents of Alaska, South Dakota, and Tennessee | |

| Residents of California, Nevada, and Washington | |

| Residents of Arizona, Idaho, Louisiana, New Mexico, and Texas |

What You'll Learn

How is domicile determined?

The determination of domicile is a crucial step in working out a federal tax case. Domicile is the place where a person has their true, fixed, permanent home and principal establishment and to which, whenever they are absent, they have the intention of returning. A person may have several places of residence, but only one domicile.

Domicile is determined by a person's intention as indicated by their actions. A person's residence may be treated as their domicile unless they assert otherwise or this is contrary to other facts in the case. Objective facts reflecting a taxpayer's intention to maintain a permanent home should be examined, including:

- Whether the taxpayer is on a temporary work detail, attending school, or stationed with the military

- The location of their personal residence(s)

- Where their vehicles are registered

- Where the taxpayer is registered to vote

- Whether the taxpayer files a state tax return

- Other facts reflecting the taxpayer's involvement and ties to the community

Once domicile is established, it is presumed to continue unless proven otherwise. If, after weighing the facts and evidence, doubt remains regarding the correct domicile, the domicile of origin prevails.

The domicile of a person does not change merely because they enter the military and are stationed in another jurisdiction. Physical residence in a new state must concur with the present intention to make that state their new domicile.

Occasionally, spouses reside in different states. In this case, the interest of the spouses is generally determined by the law of the state with the most significant relationship to the spouses and the property. If one spouse is domiciled in a community property state and the other in a common law state, the wages of the spouse in the community property state would be community property, but those of the other spouse would be separate property.

In addition to domicile in a community property state, there must also be a valid marriage between spouses. States generally recognise a marriage performed in another state. Thus, spouses may be married in a common law state and later domicile in a community property state and become subject to that state's community property laws.

Carry Laws: Private Property Exempt?

You may want to see also

What is the difference between community and separate property?

Community property laws apply in nine US states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In these states, property acquired during a marriage is considered community property and is owned jointly by both partners. This includes salaries, wages, housing, and investments. Each spouse is entitled to half of the communal property in the event of a separation or divorce, regardless of who acquired the property.

Separate property, on the other hand, is owned by one spouse only. This includes property acquired before the marriage, gifts or inheritances received by one spouse at any time, and property that was legally defined as separate through a prenuptial agreement.

In states that do not follow community property laws, assets are owned by whoever's name appears on the deed or registration.

There are also differences in tax reporting between community and separate property. In community property states, each spouse must report 50% of their total community income on their tax return if they are filing separately. In separate property states, each spouse reports 100% of their individual income when filing separately.

Understanding ADA Laws: Do They Apply to Churches?

You may want to see also

What are the tax implications of community property?

The tax implications of community property laws can be complex and vary from state to state. However, here is a general overview of the tax implications of community property:

- Community property laws apply to married couples who live in a community property state and file their tax returns separately. In this case, each spouse is generally required to report half of the community income, which includes income from salaries, wages, and other compensation for work performed by either spouse during the marriage, as well as income from any community property such as investments. Additionally, each spouse must report 100% of their separate income, which includes income from property owned separately before the marriage, money earned while living in a non-community property state, and property received as a gift or inheritance during the marriage.

- The basis of community property can also be affected by community property laws. When one spouse dies, the entire value of the community property is included in the estate of the deceased spouse, and each spouse is considered to own an equal and undivided half interest in the property. However, there is a deduction for one-half of the value of the community property interest, which is separate from the marital deduction. As a result, the surviving spouse's share of the community property receives a step-up in basis to the fair market value at the time of the first spouse's death.

- Community property laws can also impact the tax treatment of certain types of income and liabilities. For example, self-employment tax, earned income credit, railroad retirement benefits, US savings bonds, and social security benefits are generally treated as separate property, even if they would be considered community property under state law.

- Community property laws can affect the tax treatment of pensions and retirement accounts, especially in the case of divorce or separation. For example, in community property states, each spouse may be entitled to half of the community interest in the other spouse's pension or retirement account. However, the tax treatment of these assets can become complex, and it is important to seek legal advice in such situations.

- Community property laws can also impact the filing status of married couples. If a couple files their tax returns jointly, community property laws do not directly affect their federal income tax liability. However, if a couple files their tax returns separately, community property laws will determine how their income and deductions are allocated between them.

- Community property laws can have different implications for residents of common law states versus community property states. For example, a married couple living in a common law state who owns property in a community property state may still be subject to community property laws for that property. On the other hand, a couple who moves from a community property state to a common law state may no longer be subject to community property laws for their income and assets.

Anti-Kickback Law: Beyond Medicare, What You Need Know

You may want to see also

How does community property affect divorce and separation?

Community property laws apply in nine US states and determine how property and income are divided between spouses during a divorce. The nine community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

In community property states, the husband and wife are considered to own equal and undivided half interests in each item of community property. Income earned by one spouse is generally treated as if it had been earned half by each.

In the event of a divorce, a judge will divide the community property equally (50/50). This does not require that each asset be divided in half; instead, the net value of the assets received by each spouse must be equal. If the court deems it in the best interests of the parties to award an entire asset to one spouse, it will equalize the distribution by awarding the other spouse assets of equal value. If it is impossible for the court to award assets of equal value, the court may order one spouse to make equalizing payments to the other spouse.

In community property states, the marital community may end in several ways, including divorce or separation. If spouses divorce or separate, the (equal or unequal) division of community property in connection with the divorce or property settlement does not result in a gain or loss.

Each spouse is taxed on half the community income for the part of the year before the community ends. Any income received after the community ends is separate income, taxable only to the spouse to whom it belongs.

In some community property states, such as California, the community property regime terminates when spouses physically separate and both spouses intend to permanently end the marriage. In other community property states, such as Texas, the community property estate is terminated by a final decree of divorce or legal separation.

American Laws: Global Reach or Overseas Limitations?

You may want to see also

What are the rules around gifting and inheriting assets?

The rules around gifting and inheriting assets depend on the state in which you live. In the US, nine states have community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Additionally, Alaska, Tennessee, and Puerto Rico have elective community property laws.

In community property states, all assets can be divided into three categories: one spouse's separate property, the other spouse's separate property, and the community property of the couple. Separate property includes assets acquired by one spouse prior to marriage, or during the marriage by gift or inheritance. Community property consists of assets accumulated during the marriage through the efforts of one or both spouses. Earnings from employment are a good example of community property. The classification of an asset as separate or community property carries over to income received from that asset, the proceeds of the sale of that asset, and any new asset acquired with the original asset or its income or proceeds.

When it comes to gifting assets, the general rule is that the tax basis of the property received as a gift will be the same as the basis of the donor. This is commonly referred to as "carry over basis". Additionally, if any federal gift tax is paid, the amount will be added to the basis of the property for the new owner. It's important to note that the IRS may treat certain transactions as gifts if they are seen as attempts to disguise themselves as gifts to avoid federal income or self-employment tax on the value of the gift received.

In terms of inheriting assets, in most situations, when someone receives an asset due to the death of the previous owner, the basis of the asset for the new owner will be the fair market value of the asset on the day of death. This is commonly referred to as a "stepped-up basis". However, it's important to note that retirement accounts and property considered income in respect of the decedent, such as accounts receivables, do not receive a stepped-up basis.

Hiring Laws: Private Companies and Anti-Discrimination Compliance

You may want to see also

Frequently asked questions

Community property laws apply to individuals domiciled in a community property state. An individual's domicile is a permanent legal home that they intend to use for an indefinite or unlimited period, and to which, when absent, they intend to return. This is distinct from an individual's residence, of which they can have several.

Factors considered in determining domicile include: where you pay state income tax, location of property you own, length of residence, and business and social ties to the community.

Community property laws govern the interests of spouses in property and income acquired or earned during their marriage. In a community property state, the husband and wife are considered to own equal and undivided half interests in each item of community property, and income earned by one spouse will generally be treated as if it had been earned half by each.

Nine states have community property laws: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Alaska, South Dakota, and Tennessee have also adopted a community property system, but it is optional.

Community property is generally property that an individual, their spouse, or both acquire during the marriage while both spouses are domiciled in a community property state. This includes any income received by either spouse during the marriage, any real or personal property acquired with income earned during the marriage, and any debts acquired during the marriage.