Insider trading laws do apply to private companies, as demonstrated by the case of SEC v. Stiefel Laboratories Inc. in 2011. The case involved the SEC bringing an enforcement proceeding against Stiefel and its CEO, Charles W. Stiefel, for defrauding shareholders by over $110 million. The SEC alleged that Stiefel and its CEO violated Rule 10b-5 and engaged in insider trading by buying stock from employees at prices that did not reflect the per-share prices implied by acquisition offers the company was receiving from third parties. This case highlights that insider trading laws are applicable to both private and public companies and that the SEC will prosecute cases involving private companies and employee shareholders.

| Characteristics | Values |

|---|---|

| Insider trading laws | Apply to both private and public companies |

| Insider trading | Buying or selling a company's securities based on non-public, material information |

| Insider | An officer, director, 10% shareholder, or anyone with access to non-public, material information |

| Insider trading laws | Prohibit insiders from using confidential corporate information for personal gain |

| Insider trading laws | Require insiders to register transactions with the SEC |

| Insider trading laws | Impose civil and criminal penalties for violations |

| Insider | Can include family members, friends, and third parties who receive inside information |

| Insider trading | Can be legal if it complies with SEC rules and regulations |

| Insider trading laws | Monitored and enforced by the SEC and other regulatory agencies |

What You'll Learn

- Insider trading laws apply to private companies

- Insider trading is the buying or selling of a company's securities by individuals with non-public information

- Insider trading laws apply to transactions with employees and employee stock plans

- Insider trading laws apply to both civil and criminal charges

- Insider trading laws apply to all types of companies, not just public ones

Insider trading laws apply to private companies

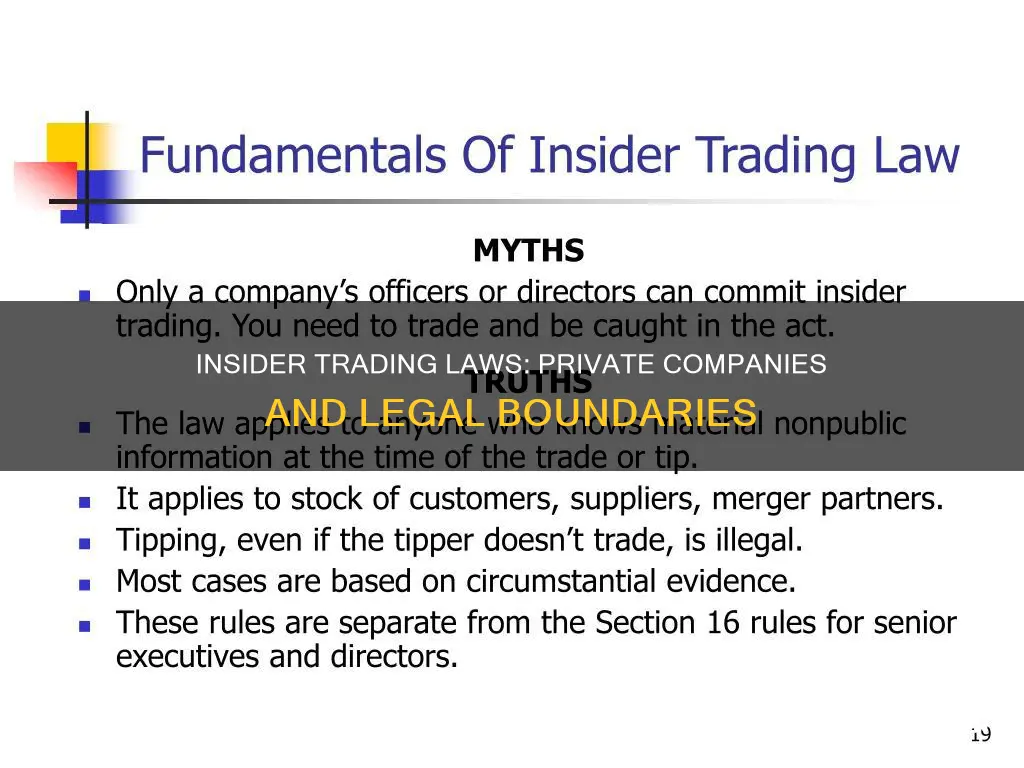

Insider trading laws do apply to private companies. In the US, the Securities and Exchange Commission (SEC) enforces insider trading laws, which prohibit the buying or selling of a company's securities by individuals with access to material nonpublic information. This applies to both public and private companies.

Insider trading laws are complex and vary from country to country, but the basic principle is that it is illegal to trade based on nonpublic information that provides an unfair advantage. In the US, this is regulated by the SEC, which requires insiders to file reports of their trades, including purchases, sales, or exercises of stock options. These filings are publicly available and can be found through the SEC's Electronic Data Gathering, Analysis, and Retrieval system.

Insider trading is not always illegal. It is legal when insiders, such as corporate officers, directors, or employees, buy or sell shares of their company in compliance with SEC regulations. This often occurs when a CEO buys back company shares or when employees purchase stock in the company they work for. However, these transactions must be properly registered with the SEC and are done with advance filings.

Illegal insider trading occurs when individuals trade based on confidential information that has not been disclosed to the public, giving them an unfair advantage. This can include company executives, their friends or relatives, or anyone who gains access to such information. The SEC actively monitors trading volumes to detect irregular patterns that may indicate illegal activity and differentiates legal trades from unauthorized use of insider information.

The consequences of insider trading violations can be severe, including civil and criminal charges, fines, imprisonment, and damage to one's reputation. It is important for individuals and companies to be aware of and comply with insider trading laws to avoid legal and financial repercussions.

Maritime Law: When Does It Govern?

You may want to see also

Insider trading is the buying or selling of a company's securities by individuals with non-public information

Insider trading is the buying or selling of a company's securities by individuals with access to non-public information. This practice has long been a contentious issue in financial markets, and while it often brings to mind corporate executives secretly profiting from inside knowledge, the reality is more complex. Some forms of insider trading are perfectly legal, while others can result in severe criminal penalties.

Who is an Insider?

The term "insider" covers a broad range, including corporate officers, directors, employees, and significant shareholders (those owning more than 10% of a company's securities). It can also extend to individuals with a close relationship to these insiders, such as brokers, associates, and family members, and even temporary insiders like outside lawyers and accountants.

Legal Insider Trading

Insiders are legally permitted to buy and sell shares of their company, but these transactions must be properly registered and disclosed. Examples of legal insider trading include a CEO buying back company shares or employees purchasing stock in their own company.

Illegal Insider Trading

Illegal insider trading occurs when individuals with access to non-public material information use it for their own gain. This can include not only corporate executives but also their friends, relatives, and anyone else with access to such information. A well-known example is the case of Martha Stewart, who, in 2003, was charged with securities fraud and obstruction of justice for her role in the ImClone case.

Detection and Prosecution

The U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) are the primary authorities responsible for enforcing insider trading laws. The SEC actively monitors trading volumes and uses advanced data analytics to detect suspicious activity. The penalties for illegal insider trading can be severe and include civil fines, criminal fines, imprisonment, and injunctions.

While the laws and regulations surrounding insider trading are complex and vary across jurisdictions, the fundamental principle is that individuals should not use non-public information for personal gain in the securities market. This helps maintain fair and efficient financial markets and protects investors from fraudulent practices.

Employment Laws: Government Workers' Rights Explored

You may want to see also

Insider trading laws apply to transactions with employees and employee stock plans

Insider trading laws prohibit employees from using material nonpublic information to trade securities. Material nonpublic information is any undisclosed information that could significantly impact an investor's decision to buy or sell a security. This includes information about upcoming mergers or acquisitions, significant changes in financial performance, new product launches, and major changes in senior management. Employees who engage in insider trading can face civil and criminal charges, as well as disciplinary action from their company, including termination of employment.

To prevent insider trading, companies often implement insider trading policies and guidelines. These policies may include rules such as prohibiting trading on material nonpublic information, requiring pre-clearance of trades, and restricting tipping of confidential information to third parties. Employees should be aware of their company's insider trading policy and comply with its rules to avoid legal consequences.

Conflict of Interest Laws: Do They Bind the President?

You may want to see also

Insider trading laws apply to both civil and criminal charges

Civil Charges

- Civil fines: The Securities and Exchange Commission (SEC) can impose civil fines of up to three times the profit gained or the loss avoided due to insider trading. This is known as treble damages under the Insider Trading and Securities Fraud Enforcement Act of 1988.

- Disgorgement: Individuals found guilty of insider trading must disgorge or return any ill-gotten gains, including profits made or losses avoided due to the illegal trades.

- Injunctions: The SEC can seek court orders to prohibit individuals from serving as officers or directors of public companies if found guilty of insider trading. These injunctions can be permanent or temporary.

Criminal Charges

- Imprisonment: Insider trading can lead to criminal prosecution, with individuals facing up to 20 years in prison for each violation. The sentence depends on the amount of profit gained and the offender's history of similar offenses.

- Criminal fines: In addition to imprisonment, criminal fines can be imposed. Individuals can be fined up to $5 million, while corporations can face fines of up to $25 million per violation under the Securities Exchange Act of 1934.

It's important to note that the prosecution of insider trading cases may involve parallel investigations by both the SEC and the U.S. Department of Justice, with the Attorney General's Office responsible for filing criminal charges. The specific laws and regulations related to insider trading, such as the Securities Exchange Act of 1934 and SEC rules, provide the basis for these civil and criminal charges.

Landsknecht Luxury: Sumptuary Laws and Military Retirement

You may want to see also

Insider trading laws apply to all types of companies, not just public ones

The rationale behind prohibiting insider trading is to prevent unfair advantages and to protect the interests of all investors. Insider trading laws aim to ensure that all investors have access to the same information, creating a level playing field in the market. Additionally, these laws help maintain public trust and confidence in the financial markets.

The consequences of violating insider trading laws can be severe. Civil and criminal charges may be brought against individuals engaged in insider trading, resulting in fines, imprisonment, and even dismissal from their positions. It is important to note that even if an individual is not directly involved in trading but tips off others about non-public information, they can still be held liable.

To ensure compliance, companies should establish clear guidelines and policies regarding insider trading. This includes educating employees about what constitutes insider information and the consequences of misuse. It is also crucial for companies to maintain transparency and provide current and accurate valuations when buying shares from employees.

In summary, insider trading laws apply to all companies, and it is essential for individuals and businesses to understand and adhere to these laws to maintain the integrity and fairness of the financial markets.

Deposit Discrimination: Legal Protection for Your Money

You may want to see also

Frequently asked questions

Insider trading is the buying or selling of a company's securities by individuals who possess material, nonpublic information about that company.

No. Insiders are legally permitted to buy and sell shares, but the transactions must be registered with the Securities and Exchange Commission (SEC).

An "insider" is generally someone with access to confidential, non-public information about a company. This includes company executives, directors, and large shareholders who own more than 10% of the company's stock.

Insider trading can result in civil or criminal charges, including fines, imprisonment, and disgorgement of ill-gotten gains.