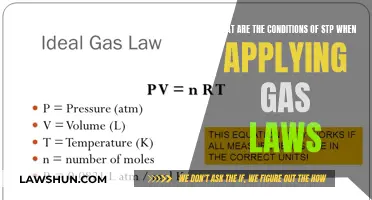

US laws can apply to US citizens living and working abroad, as well as foreign nationals with no connection to the US. Federal US employment laws, for example, apply to US citizens employed outside the US by a US firm or a company under US control. US laws can also apply to conduct that occurs overseas if some part of it took place in the US. For instance, it is illegal under the Foreign Corrupt Practices Act (FCPA) for US citizens to bribe foreign officials, regardless of where they are in the world.

| Characteristics | Values |

|---|---|

| U.S. laws governing international activities | Antiboycott Laws, Bribes & Corruption, Crime Reporting, Economic Sanctions, Export Control Regulations |

| U.S. laws governing conduct in foreign countries | Foreign Corrupt Practices Act (FCPA), Export Administration Act (EAA), Export Control Statutes, US Economic Sanctions |

| U.S. laws governing U.S. citizens abroad | The PROTECT Act of 2003, Tax laws, Military laws, Maritime laws, Federal property laws, Counterfeiting laws, Sexual conduct laws, Conspiracy charges, Attempt charges |

| U.S. employment laws governing U.S. citizens abroad | Title VII of the Civil Rights Act, The Age Discrimination in Employment Act (ADEA), The Americans with Disabilities Act (ADA), The Uniformed Services Employment and Reemployment Rights Act (USERRA) |

What You'll Learn

US laws that apply to US citizens abroad

US citizens are subject to US laws, even when they are abroad. However, the US government can only enforce these laws in certain places, such as on military bases and embassies, and in matters pertaining to US-registered ships and aircraft.

US citizens are also subject to the laws of the country they are visiting, which may be very different from US laws. For example, the minimum legal drinking age in the US is 21, but in many countries, it is 18 or lower.

- The Foreign Corrupt Practices Act (FCPA): This law prohibits US citizens from bribing foreign officials. It also applies to unlawful gifts and payments given to foreign governments or political officials to influence decisions.

- US Economic Sanctions: The Office of Foreign Assets Control (OFAC) administers and enforces economic and trade sanctions to protect against threats to national security, foreign policy, or the economy. These sanctions may include comprehensive embargoes or targeted restrictions on specific activities.

- US Export Control Regulations: These regulations control the export of equipment, materials, software, and technology from the US. They may apply to US citizens abroad who are shipping or carrying these items.

- US Tax Laws: US citizens are generally required to pay US taxes on their worldwide income, even if they live abroad.

- The PROTECT Act of 2003: This law makes it illegal for US citizens to engage in illicit sexual conduct with minors while abroad.

Levitical Law: Still Relevant or Archaic Today?

You may want to see also

US laws that apply to foreign nationals abroad

US laws can apply to US citizens living and working abroad, and sometimes they do not. US citizens working for a US company or subsidiary abroad are protected from discrimination under Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act (ADEA), and the Americans with Disabilities Act (ADA). However, laws such as the Fair Labor Standards Act, the Family and Medical Leave Act, and the National Labor Relations Act do not apply extraterritorially.

In the case of foreign individuals working or applying to work within the US, their work within the country must be more than minimal for them to be protected by US anti-discrimination laws. Foreign nationals based in a foreign country are generally not covered by these anti-discrimination laws, as demonstrated in a case where ten foreign nationals who were not hired by a US airline to work as flight attendants based in London sued, arguing that the ADEA and Title VII applied to them. The court found that the position was considered extraterritorial as the flight attendants would have spent most of their work time in international airspace and only 20% within the US, and denied the foreign nationals coverage.

Foreign Corrupt Practices Act (FCPA): This prohibits individuals or entities from directly or indirectly paying or offering to pay money or anything of value to a foreign official to obtain an improper advantage in securing or retaining business. It also prohibits inducing a foreign official to misuse their official position to obtain preferential treatment. Violations of the FCPA can result in serious criminal penalties.

Export Administration Act (EAA) and Export Control Regulations: These prohibit US individuals and entities from participating in boycotts that are not approved by the US government. The Department of Commerce (DoC) enforces these prohibitions through the 1976 Tax Reform Act, denying tax benefits to those who violate them. The DoC regulations prohibit actions such as refusing to do business with Israel or blacklisted companies, furnishing information about business relationships with blacklisted companies, or discriminating against others based on race, religion, sex, national origin, or nationality.

US Economic Sanctions: The Office of Foreign Assets Control (OFAC) administers and enforces economic and trade sanctions to protect against threats to national security, foreign policy, or the economy. These may take the form of comprehensive embargoes or targeted sanctions. OFAC also prohibits transactions with persons or entities designated as "Specially Designated Nationals" (SDNs), and violations may result in civil or criminal penalties.

Currency & Foreign Bank Account Reporting: Amounts exceeding $10,000 must be reported to US Customs and Border Protection when entering or leaving the country. Individuals with a financial interest or authority over a foreign financial account exceeding $10,000 in a calendar year must also report this on the Treasury Form TD F 90-22.1. Structuring cash transactions to avoid reporting requirements is prohibited under US law.

Uconnect and Driving Laws: Texting and Legalities

You may want to see also

US laws that apply to US companies abroad

US companies operating abroad are subject to a range of US laws that apply to their activities in foreign countries. These laws cover various aspects, from anti-corruption measures to export controls and sanctions. Here is an overview of some key US laws that US companies must comply with when doing business internationally:

- Foreign Corrupt Practices Act (FCPA): This law prohibits US companies and individuals from offering, paying, or promising to pay money or anything of value to any foreign official to secure or retain business. It also forbids inducing a foreign official to misuse their position for preferential treatment. Violations can result in criminal penalties for both the individual and the company involved.

- Antiboycott Compliance: The US government has a policy of opposing restrictive trade practices or boycotts imposed by foreign countries against nations friendly to the US. US organizations are prohibited from participating in such boycotts, especially against Israel, and from providing information for boycott-related purposes.

- Export Control Statutes: The US Department of Commerce's Export Administration Regulations (EAR) and the US Department of State's International Traffic in Arms Regulations (ITAR) control the export of research-related materials and information. These regulations restrict the dissemination of goods, services, information, software, and technology, and US companies must ensure compliance to avoid penalties.

- US Economic Sanctions: The Office of Foreign Assets Control (OFAC) administers and enforces economic and trade sanctions to protect national security, foreign policy, and economic interests. These sanctions can be comprehensive embargoes or targeted restrictions against specific countries, regimes, narcotics traffickers, and proliferators of weapons of mass destruction.

- Currency and Foreign Bank Account Reporting: US companies must comply with regulations regarding the import and export of currency. While there are no restrictions on the amount of currency that can be imported or exported, amounts exceeding $10,000 must be reported to US Customs and Border Protection.

- Employment Laws: While most US employment laws apply primarily to employees working in the US or its territories, there are exceptions. For example, Title VII of the Civil Rights Act, the Age Discrimination in Employment Act (ADEA), the Americans with Disabilities Act (ADA), and the Uniformed Services Employment and Reemployment Rights Act (USERRA) have some application abroad, covering US citizens employed by US firms or companies controlled by US firms outside the US.

US companies operating abroad must navigate a complex legal landscape that involves complying with both local laws in the host country and relevant US laws. It is essential for companies to thoroughly research the legal requirements of their host country and seek legal advice to ensure compliance with all applicable laws and regulations.

Online Laws: Global Reach or Country Specific?

You may want to see also

US laws that apply to foreign companies abroad

The Foreign Corrupt Practices Act (FCPA)

The FCPA prohibits US companies or individuals from offering, promising, or giving money or anything of value to foreign officials to gain an improper business advantage or influence decisions. This includes indirect payments and applies to both the private and public sectors. Violations can result in criminal penalties for both the individual and the company.

Antiboycott Compliance

The US has a policy of opposing restrictive trade practices or boycotts imposed by foreign countries against nations friendly to the US, such as Israel. US companies must not participate in or provide information to support such boycotts. The Department of Commerce enforces these regulations through the 1976 Tax Reform Act, denying tax benefits to violators.

Export Control Statutes

The US Department of Commerce Export Administration Regulations (EAR) and the US Department of State International Traffic in Arms Regulations (ITAR) control the export of research-related materials and information. These regulations may apply to shipping items overseas, sharing information with certain foreign nationals, or interacting with sanctioned countries and entities. Violations can result in severe fines and imprisonment.

US Economic Sanctions

The Office of Foreign Assets Control (OFAC) administers and enforces economic sanctions to protect national security, foreign policy, and economic interests. These sanctions may be comprehensive embargoes or targeted restrictions on specific activities, entities, or countries. OFAC also maintains a list of "Specially Designated Nationals" (SDNs) with whom transactions are prohibited. Violations may result in civil or criminal penalties.

Currency and Foreign Bank Account Reporting

US law requires the reporting of cash amounts exceeding $10,000 when entering or leaving the country. Additionally, individuals with financial interests or authority over foreign financial accounts exceeding $10,000 in a year must report this on Treasury Form TD F 90-22.1. Structuring transactions to avoid these reporting requirements is prohibited.

US companies operating abroad must navigate a complex web of local and US laws, particularly in areas such as financial regulations, employment laws, intellectual property protection, and compliance with economic sanctions and export controls.

Christians and Dietary Laws: What's the Verdict?

You may want to see also

US laws that apply to US government employees abroad

US laws can apply to US citizens working abroad, including US government employees. There are a few key US employment laws that apply extraterritorially to US citizens working for US companies or subsidiaries overseas. These include Title VII of the Civil Rights Act, the Age Discrimination in Employment Act (ADEA), and the Americans with Disabilities Act (ADA). These laws protect US citizens working for US companies abroad from discrimination based on race, colour, sex, national origin, religion, age, and disability.

The Uniformed Services Employment and Reemployment Rights Act (USERRA) is another example of a US law with extraterritorial application. USERRA protects veterans and reservists working overseas for the federal government or a firm under US control.

Additionally, the Foreign Corrupt Practices Act (FCPA) prohibits US citizens from bribing or offering gifts to foreign officials to obtain improper advantages or influence decisions. This law is particularly relevant for US government employees abroad, as they represent the United States and its interests in foreign countries.

Furthermore, US economic sanctions laws, such as those enforced by the Office of Foreign Assets Control (OFAC), apply to US citizens and entities worldwide. These sanctions may include comprehensive embargoes or targeted restrictions on specific activities, individuals, or entities associated with threats to national security, foreign policy, or the economy.

It is important to note that while these US laws apply to US citizens working for US government entities abroad, they may not apply in the same way as they do within the United States due to the potential conflict with the laws of the host country. In such cases, the host country's laws may take precedence to avoid penalties and criminal consequences.

Lemon Law: Does It Cover Your Home Appliances?

You may want to see also

Frequently asked questions

US citizens are generally covered by US laws regardless of where they are in the world. However, they are usually outside of the jurisdiction of US laws when outside of the US. There are some exceptions, such as the Foreign Corrupt Practices Act (FCPA), which prohibits bribing foreign officials, and the "PROTECT Act of 2003", which makes it illegal for US citizens to partake in illicit sexual conduct abroad with minors.

Yes, US citizens can be prosecuted for breaking some US laws while on foreign soil. For example, US citizens are liable for US taxes regardless of where they live.

Federal US employment laws generally only apply to employees who work in the US or its territories. However, there are a few exceptions, including Title VII of the Civil Rights Act, the Age Discrimination in Employment Act (ADEA), the Americans with Disabilities Act (ADA), and the Uniformed Services Employment and Reemployment Rights Act (USERRA).

Non-US citizens are generally covered by US employment laws when they work within the US and its territories. However, they are not covered by these laws when working outside of the US, even if they work for a US firm.

Yes, the US government can prosecute both US citizens and foreign nationals for acts committed outside of the US through the concept of extraterritorial jurisdiction. This has been used in cases involving money laundering, drug trafficking, and corruption.