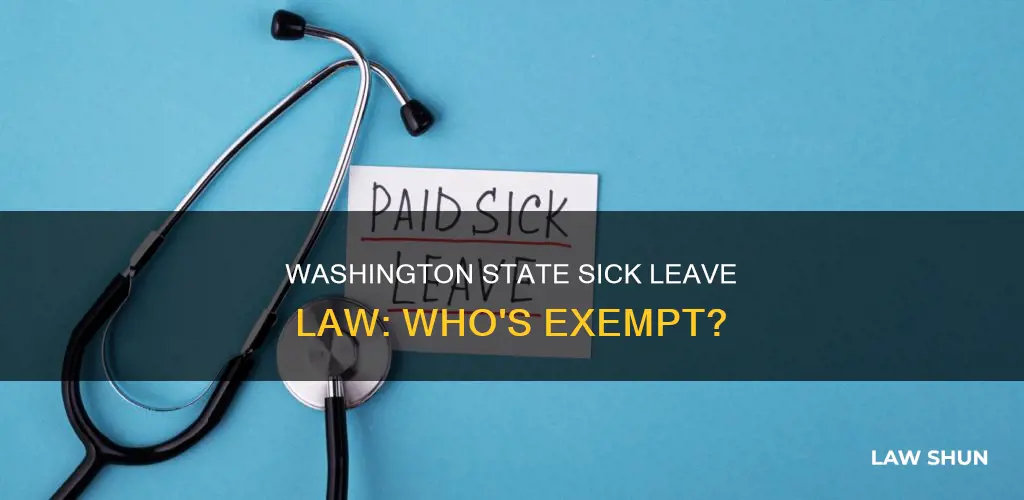

As of 2018, Washington State law requires employers to provide paid sick leave to their employees. This law applies to all employees in the state, including full-time, part-time, and temporary workers, with a few exceptions. Apprenticeship instructors, who are typically considered employees, would generally be covered by this law and would be entitled to accrue and use paid sick leave. However, it is important to note that certain individuals, such as doctors, lawyers, and salaried executive managers, are exempt from this requirement. Therefore, the applicability of Washington State's sick leave law to apprenticeship instructors would depend on their specific job duties, employment status, and other factors.

| Characteristics | Values |

|---|---|

| Who does the law apply to? | All employees in Washington, except federal employees, doctors, lawyers, dentists, and most executive managers who supervise two or more full-time employees and are paid a salary. |

| How much sick leave can be earned? | 1 hour of paid sick leave for every 40 hours worked. |

| Is there a limit on how much sick leave can be earned? | No limit, but employers don't need to allow more than 40 hours of paid sick leave per year to be carried over. |

| When can sick leave begin to be used? | 90 calendar days after the start of employment. |

| What can sick leave be used for? | To recover from physical/mental illness or injury; to seek medical diagnosis, treatment, or preventative care; to care for a family member who is ill or needs medical diagnosis, treatment, or preventative care; when the worker’s place of business is closed by order of a public official for any health-related reason or to care for a child whose school or childcare provider has been closed by order of a public official for any health-related reason; or to address certain needs that may arise if the worker or a family member are victims of domestic violence, sexual assault, or stalking. |

What You'll Learn

Who is eligible for paid sick leave in Washington State?

Washington's Paid Sick Leave Law was passed in 2016 as part of State Initiative 1433. As of January 1, 2018, employers in Washington State are required to provide paid sick leave to their employees. This law gives workers the right to paid time off to recover from physical or mental illness or injury, to seek medical diagnosis, treatment, or preventative care, or to care for a family member who is ill or needs medical attention. This law covers full-time, part-time, and temporary workers but does not cover federal employees.

Employees in Washington State earn at least one hour of paid sick leave for every 40 hours worked, and there is no limit on how much sick leave an employee can earn. Employers are not required to allow employees to carry over more than 40 hours of paid sick leave per year, but they can choose to provide a more generous carry-over policy if they wish. Employees can start using their paid sick leave 90 calendar days after their first day of work.

Paid sick leave can be used for the following reasons:

- To care for the employee's physical or mental health needs, including doctor or dentist visits.

- To care for a family member's physical or mental health needs, including children, spouses, registered domestic partners, parents, grandparents, siblings, and grandchildren.

- When the employee's workplace or their child's school or childcare is closed by order of a public official for any health-related reason.

- To address needs that may arise if the employee or a family member are victims of domestic violence, sexual assault, or stalking.

It's important to note that employers in Washington State are required to notify their employees about their right to paid sick leave in writing, either on paper or electronically. This notification must include information about the employee's eligibility, accrual, and usage of paid sick leave, as well as the prohibition against retaliation for using paid sick leave.

Does Justin Bieber Stand Above the Law?

You may want to see also

How much paid sick leave can be earned?

In Washington State, employees earn a minimum of one hour of paid sick leave for every 40 hours worked. This applies to all employees, regardless of whether they are full-time, part-time, or temporary workers. There is no limit to how much sick leave an employee can earn, but employers are not required to allow a carryover of more than 40 hours of paid sick leave per year. If an employee does not use all their paid sick leave by the end of the accrual year, their employer must carry over any balance of 40 hours or less to the next year.

For example, if an employee works full-time, they will accrue about six and a half days of sick leave over a year. This calculation is based on a 40-hour workweek and assumes that the employee works throughout the year without taking any sick leave.

It is important to note that employers in Washington State are required to provide paid sick leave to their employees, and they may choose to offer more leave than the minimum requirement. Additionally, employees are protected by law from any retaliation or negative consequences for using their earned paid sick leave.

Hawaii County Law: Vacation Rentals and Legal Compliance

You may want to see also

When can paid sick leave be used?

Washington's Paid Sick Leave Law, passed in 2016 as part of Initiative 1433, gives workers the right to take paid sick leave for a variety of reasons. This law applies to all employees in Washington State, regardless of their full-time, part-time, or temporary status, with a few exceptions such as federal employees, doctors, and lawyers. Here are the scenarios in which paid sick leave can be used:

- Mental or Physical Health Needs: Paid sick leave can be used to address an employee's own mental or physical health needs, including illnesses, injuries, or health conditions. This also includes seeking a medical diagnosis, treatment, or preventative medical care.

- Family Care: Employees can take paid sick leave to care for ill family members or to help them get a medical diagnosis, treatment, or preventative care. Family members include children, stepchildren, foster children, spouses, registered domestic partners, parents, grandparents, siblings, and grandchildren.

- Workplace, School, or Childcare Closure due to Health Reasons: Paid sick leave is applicable when a workplace, a child's school, or childcare facility is closed by order of a public official for any health-related reason. This does not include closures due to inclement weather.

- Domestic Violence, Sexual Assault, or Stalking: Paid sick leave can be used to address safety needs and other concerns if an employee or their family member is a victim of domestic violence, sexual assault, or stalking. This may include seeking a restraining order or relocating to a safe place.

- COVID-19 Related Reasons: During the COVID-19 pandemic, employees could use paid sick leave for certain COVID-19-related reasons, including exposure to the virus.

- Medical Appointments: Employees can take paid sick leave for doctor or dentist appointments.

It is important to note that employees can start earning sick leave immediately but can only use it 90 calendar days after their first day of employment. Additionally, employers are required to pay employees their normal hourly rate for paid sick leave hours and cannot discipline or retaliate against employees for taking sick leave.

HIPAA Laws and Minors: Privacy Rights Explained

You may want to see also

What are the employer's responsibilities?

As an employer in Washington State, you have several responsibilities under the Paid Sick Leave law. This law was passed in 2016 as part of State Initiative 1433 and came into effect on January 1, 2018.

Firstly, you must provide every employee with paid sick leave, except for those who are exempt under the Fair Labor Standards Act (FLSA). This includes traditionally exempt employees such as salaried executive managers, independent contractors, and those working for tribes on tribal lands. Additionally, doctors, lawyers, and dentists, as well as most executive managers who supervise at least two full-time employees, are also exempt.

For employees who are not exempt, you must offer at least one hour of paid sick leave for every 40 hours worked. This applies to all employees, regardless of their full-time, part-time, temporary, or seasonal status. You must allow employees to carry over a minimum of 40 hours of unused paid sick leave from one year to the next, and there is no cap on the total number of hours that can be accrued. Employees can begin using their paid sick leave after 90 days of employment, and this period does not reset if they leave and are rehired within 12 months.

You must notify your employees of their right to paid sick leave in writing, either on paper or electronically. This initial notice must include information on their eligibility, accrual, and usage of sick leave. It must also state that you are prohibited from retaliating against employees for using paid sick leave for any reason allowed by the law or for exercising their rights under the Minimum Wage Act.

At least once a month, you must provide employees with a statement (either on paper or electronically) detailing their accrued leave since the last notice, the amount of leave used, and their current accrued, unused sick leave. This information can be included in employees' regular pay statements.

You cannot require employees to cover their shifts before taking paid sick leave, nor can you mandate that they work a substitute shift. However, employees may choose to work a different shift or trade shifts with a colleague instead of using paid sick leave if both parties agree.

It is important to note that you are not required to pay out accrued and unused paid sick leave when an employee leaves the company, unless another state law or collective bargaining agreement mandates it. However, if an employee is terminated or leaves and returns to the company within 12 months, their unused paid sick leave balance must be reinstated.

Applying Early Decision to UVA Law: Worth It?

You may want to see also

What are the penalties for non-compliance?

Washington's Paid Sick Leave Law gives workers the right to sick leave to recover from physical/mental illness or injury, to seek medical diagnosis, treatment, or preventative care, to care for a family member who is ill or needs medical diagnosis, treatment, or preventative care, and to address certain needs that may arise if the worker or a family member are victims of domestic violence, sexual assault, or stalking.

The law applies to all employees in Washington State, except federal employees and those exempt under the Fair Labor Standards Act (FLSA), such as doctors, lawyers, dentists, and salaried executive managers. Employers are required to provide written notification of an employee's right to paid sick leave and include specific information about accrual and usage.

So, what are the penalties for non-compliance?

The Washington State Department of Labor & Industries is responsible for enforcing the Paid Sick Leave Law. Employers who fail to comply with the law may face penalties, fines, and lawsuits. Non-compliance can result from not providing the required paid sick leave, not paying the correct amount, or retaliating against employees for using their sick leave.

Employees who believe their employer is not providing them with the correct amount of paid sick leave or violating their rights under the Minimum Wage Act can report their employer to the Department of Labor & Industries. This includes any instances of retaliation, such as threats, discipline, demotion, reduction in hours, or termination for using sick leave or filing a complaint.

To avoid penalties for non-compliance, employers must understand how to classify their employees under the FLSA and ensure they are providing the correct amount of paid sick leave. They must also refrain from any retaliatory actions against employees who use their sick leave or exercise their rights under the law.

In addition to the state-level law, cities and counties in Washington, such as Seattle and Tacoma, have their own paid sick leave ordinances. Employers must comply with the provisions of each law that most benefits the employee. This means that employers with employees working in multiple jurisdictions must ensure compliance with all applicable federal, state, and local laws.

Cougar Law: Jackie's Legacy and Regular Cars

You may want to see also

Frequently asked questions

Yes, the Washington State Sick Leave Law applies to all employees in the state, including apprenticeship instructors.

Apprenticeship instructors can earn 1 hour of paid sick leave for every 40 hours worked. There is no limit on how much sick leave they can earn, but their employer is not required to allow a carry-over of more than 40 hours of paid sick leave per year.

Apprenticeship instructors can start using their sick leave 90 calendar days after their first day of employment.

Apprenticeship instructors can use their sick leave for recovery from physical or mental illness or injury, seeking medical diagnosis, treatment, or preventative care, caring for an ill family member, or addressing certain needs that may arise if they or a family member are victims of domestic violence, sexual assault, or stalking.

Apprenticeship instructors can use their sick leave if their workplace or their child's school is closed by order of a public official for any health-related reason. A "health-related reason" refers to a serious public health concern that could result in bodily injury or exposure to hazardous materials.