Medicare is a federal health insurance program for individuals aged 65 and above, or for certain people with disabilities, regardless of income. The program covers hospitalization and other medical costs at free or reduced rates. While Medicare isn't mandatory, it is offered automatically in some situations and opting out can result in losing Social Security or Railroad Retirement Board benefits. The best time to enroll in Medicare is when you turn 65, as failing to do so at the right time can have financial consequences.

| Characteristics | Values |

|---|---|

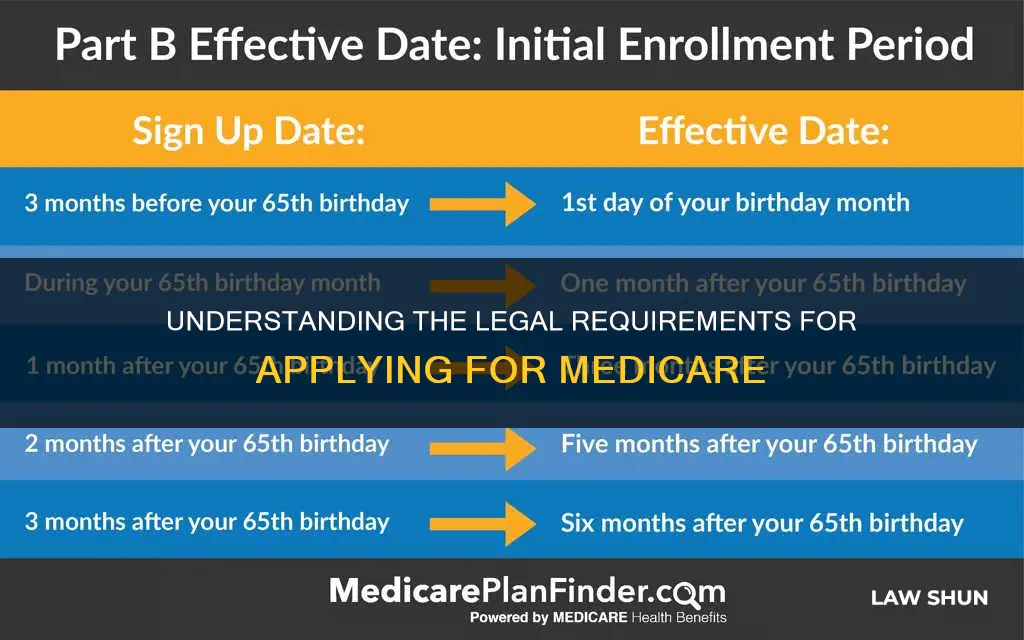

| When to apply | Generally, when you turn 65. This is called the Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65 and ending 3 months after you turn 65. |

| Late application penalty | If you miss the Initial Enrollment Period, you may have to pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty increases the longer you wait. |

| Premium-free Part A eligibility | Aged 65 or older and eligible for monthly Social Security or Railroad Retirement Board (RRB) cash benefits. |

| Premium Part A eligibility | File an application to enroll by contacting the Social Security Administration; enroll during a valid enrollment period; and also enroll in or already have Part B. |

| Premium Part A late enrollment penalty | If you did not enroll in premium Part A when first eligible, you may have to pay a higher monthly premium if you decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years they could have had Part A but did not sign up. |

| Part B late enrollment penalty | If you choose not to sign up for Part B when you first become eligible, you could face a penalty of 10% of the standard premium for each 12-month period you were not signed up, and you will have to pay this penalty for as long as you are enrolled in Medicare. |

| Part C | Optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within the Medicare Advantage plan. |

| Part D late enrollment penalty | If you don’t sign up for Part D during your initial enrollment period, you will pay a penalty amount of 1% of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage. |

What You'll Learn

When you turn 65

If you qualify for premium-free Part A, your coverage starts the month you turn 65. If your birthday is on the first of the month, coverage starts the month before. Part A coverage can also begin 6 months back from when you sign up or when you apply for benefits from Social Security or the Railroad Retirement Board. Coverage cannot start earlier than the month you turn 65.

For Part B and premium Part A, coverage starts based on the month you sign up: before the month you turn 65, the month you turn 65, or during the 3 months after.

If you are still working when you turn 65, Medicare works a little differently. If you or your spouse have health insurance from a job, you may be able to wait to sign up for Medicare without paying a late enrollment penalty. Ask the employer that provides your health insurance if you need to sign up for Part A (Hospital Insurance) and Part B (Medical Insurance) when you turn 65. If you don't, your job-based insurance might not cover the costs for services you get.

If you have retiree coverage from a previous job, ask your benefits administrator how your retiree coverage works with Medicare. You don't want to risk losing your retiree coverage, so check before joining a plan.

If you have health insurance that is not from a job, such as insurance from Medicaid, the Marketplace, or another private company, contact your health insurance plan to get more information about when to sign up for Medicare.

If you don't have health insurance and are still working, sign up for both Part A and Part B when you're first eligible (usually when you turn 65). If you sign up later, you may have to pay a penalty.

Applying the Royal Law: A Guide to Christian Living

You may want to see also

If you have Chronic Renal Failure or Amyotrophic Lateral Sclerosis (ALS)

If you have been diagnosed with Chronic Renal Failure, also known as End-Stage Renal Disease (ESRD), you are eligible for Medicare regardless of your age. ESRD patients do not have to wait 24 months to be eligible for Medicare, unlike those with other disabilities.

Medicare coverage for those with ESRD begins on the first day of the fourth month of dialysis treatment. If you opt for at-home dialysis, coverage can begin as early as the first month of treatment. If you are hospitalised for a kidney transplant, you are also eligible for Medicare coverage. After a successful kidney transplant, Medicare will cover medical expenses for three years.

If you have been diagnosed with Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig's Disease, you are also eligible for Medicare regardless of your age. There is no waiting period for Medicare coverage for those with ALS. You are eligible for Medicare as soon as you begin receiving Social Security Disability Insurance (SSDI) benefits.

Medicare is a federally funded insurance plan that provides health insurance to people aged 65 and older, as well as younger people with certain disabilities and conditions, including ALS and ESRD.

Understanding ADA Law Compliance for Public Buildings

You may want to see also

If you are eligible for Medicaid

Most people with Medicaid do not pay a premium for Medicare Part A. In most cases, your state will pay your monthly Part B premiums while you have Medicaid. If you have to pay a premium for Part A, you can ask if your state will pay it for you. This may require you to contact Social Security to sign up for Part A. Depending on the type of Medicaid you have, you may also qualify to get help paying your share of Medicare costs.

Inertia's Law: Understanding the Basics of Motion and Resistance

You may want to see also

If you are still covered by an employer

If you work for a large company (20 or more employees), you can delay enrolling in Medicare until you stop working or lose your health insurance, whichever happens first. You are entitled to a Special Enrollment Period (SEP) to sign up for Medicare before or within eight months of losing your job-based coverage. This will help you avoid a late enrollment penalty.

During this period of employer-based coverage, you may choose to enroll in Medicare Part A (hospital insurance) when you turn 65, especially if you qualify for premium-free Part A. Most people qualify for premium-free Part A if they have worked for at least 10 years (40 quarters) and paid Medicare taxes during that time. However, if you are contributing to a Health Savings Account (HSA), you may want to delay enrolling in Part A, as you cannot contribute to an HSA after enrolling in Medicare.

You can also delay enrolling in Medicare Part B (medical insurance) if you have employer-based coverage. Part B comes with a monthly premium, so you may choose to wait until you or your spouse stop working and no longer have group health insurance. If you decide to enroll in Part B while still having employer coverage, the employer insurance will be the primary payer, and Medicare will cover a certain amount of the remaining expenses.

If you work for a small company (fewer than 20 employees), Medicare becomes your primary insurer at age 65, and you will need to sign up to ensure complete coverage. In this case, your employer coverage will be secondary.

It is important to carefully evaluate your specific situation and healthcare needs when deciding whether to delay Medicare enrollment. Consult with your employer's benefits administrator or HR department to understand how your employer plan interacts with Medicare.

The Parasha Shelach Lecha: Understanding the Applicable Laws

You may want to see also

If you have a Health Savings Account (HSA)

Whether you should delay enrolling in Medicare so you can continue contributing to your HSA depends on your circumstances. If you work for an employer with fewer than 20 employees, you may need Medicare in order to have primary insurance, even though you will lose the tax advantages of your HSA. This is because health coverage from employers with fewer than 20 employees pays secondary to Medicare. If you fail to enrol in Medicare in this case, you may have little or no health coverage because your health plan does not have to pay until after Medicare pays. On the other hand, if you work for an employer with 20 or more employees, health coverage pays primary to Medicare, so you may choose to delay Medicare enrolment and continue putting funds into your HSA.

If you decide to delay Medicare enrolment, make sure to stop contributing to your HSA at least six months before you do plan to enrol in Medicare. This is because when you enrol in Medicare Part A, you receive up to six months of retroactive coverage, not going back farther than your initial month of eligibility. If you do not stop HSA contributions at least six months before Medicare enrolment, you may incur a tax penalty.

Additionally, if you choose to delay Medicare enrolment because you are still working and want to continue contributing to your HSA, you must also wait to collect Social Security retirement benefits. This is because most individuals who are collecting Social Security benefits when they become eligible for Medicare are automatically enrolled in Medicare Part A. You cannot decline Part A while collecting Social Security benefits. Therefore, if you wish to continue contributing funds to your HSA, you should delay Social Security benefits and decline Part A.

Texas Blue Laws: How Do They Affect Bars?

You may want to see also

Frequently asked questions

The best time to enrol in Medicare is when you turn 65. You can also enrol when you leave an active insurance plan after turning 65, but this will result in a lifetime penalty.

Signing up for Medicare late can result in a gap in your coverage and a monthly penalty for as long as you have Medicare Part B. The penalty increases the longer you wait to sign up.

If you miss the initial and special enrolment periods, you can apply for Medicare during the General Enrolment Period, which takes place between January 1 and March 31 each year.