The Bland-Allison Act was passed by the US Congress on February 28, 1878, despite being vetoed by President Rutherford B. Hayes. The act required the US Treasury to buy a certain amount of silver and put it into circulation as silver dollars. The bill was introduced by Representative Richard P. Bland of Missouri and amended by Senator William B. Allison of Iowa.

| Characteristics | Values |

|---|---|

| Date passed | 28 February 1878 |

| Passed by | U.S. Congress |

| Required | U.S. Treasury to buy silver bullion and mint $2-4 million worth of silver coin per month |

| Introduced by | Representative Richard P. Bland of Missouri |

| Amended by | Senator William B. Allison of Iowa |

| Vetoed by | President Rutherford B. Hayes |

| Overridden by | Congress |

What You'll Learn

The bill was vetoed by President Rutherford B. Hayes

The Bland-Allison Act, also known as the Grand Bland Plan of 1878, was a bill in the United States Congress that required the US Treasury to buy a substantial amount of silver and put it into circulation as silver dollars. The bill was introduced by Representative Richard P. Bland of Missouri and amended by Senator William B. Allison of Iowa.

However, Congress was able to override Hayes' veto on the same day it was issued, and the Bland-Allison Act became law. This act helped restore bimetallism, with gold and silver supporting the currency. Nevertheless, gold remained heavily favoured over silver, paving the way for the gold standard.

Lawyer Without a Law Degree: Is It Possible?

You may want to see also

Congress overrode the veto

The Bland-Allison Act, also known as the Grand Bland Plan of 1878, was a significant piece of legislation in American economic history. It required the U.S. Treasury to buy and mint a specified amount of silver into silver dollars each month. While the bill was initially vetoed by President Rutherford B. Hayes, Congress overrode his veto on February 28, 1878, marking a pivotal moment in the country's monetary policy.

The act came about as a response to the economic crisis of 1873, known as the "Panic of 1873," which caused a five-year depression. This crisis led to the collapse of several major banks and had a profound impact on the nation's economy. In an attempt to address this situation, Congress passed the Coinage Act of 1873, which embraced the gold standard and demonetized silver. However, this decision faced strong opposition from silver miners and debtors, who advocated for a return to the bimetallic standard, using both gold and silver to back the currency.

The Bland-Allison Act was introduced by Representative Richard P. Bland of Missouri, hence the name. It incorporated the demands of Western radicals for free and unlimited coinage of silver. While the bill was passed by the House, it faced resistance from the conservative Senate. This is where Senator William B. Allison's role becomes crucial. He offered an amended version of the bill, which was more acceptable to the Senate. The act, as adopted, required the U.S. Treasury to purchase between $2 million and $4 million worth of silver bullion each month at market prices. This silver was then coined into silver dollars, which were made legal tender for all debts.

Despite the act's passage, attempts by free-silver forces to replace it with provisions for unlimited coinage were unsuccessful. Similarly, efforts by gold-standard advocates to repeal the act altogether also failed. However, President Hayes and his successors weakened the impact of the act by purchasing only the minimum amount of bullion required. This limited the increase in the money supply consisting of silver coinage. Nonetheless, the Bland-Allison Act represented a victory for silverites and a compromise between free coinage and a conservative monetary regime.

Nursing Policy to Law: Understanding the Transition Process

You may want to see also

The Act required the purchase of silver bullion

The Bland-Allison Act, also known as the Grand Bland Plan of 1878, was a United States Congress act that required the US Treasury to purchase a certain amount of silver bullion and put it into circulation as silver dollars. The Act mandated that the US Treasury purchase silver bullion worth between $2 million and $4 million each month at market price, to be coined into silver dollars. This was a significant step towards restoring bimetallism, with gold and silver supporting the currency.

The Act was driven by economic motives and political pressures, with interest groups advocating for the impact of monetary policy on their livelihoods. The "free silver" movement, which sought the bimetallic coinage of both gold and silver, believed that coining silver with gold would expand the money supply, leading to inflation that would benefit debtors, particularly farmers and miners. The Act was also a response to the economic depression of the 1870s, which caused cheap-money advocates to urge a return to bimetallism.

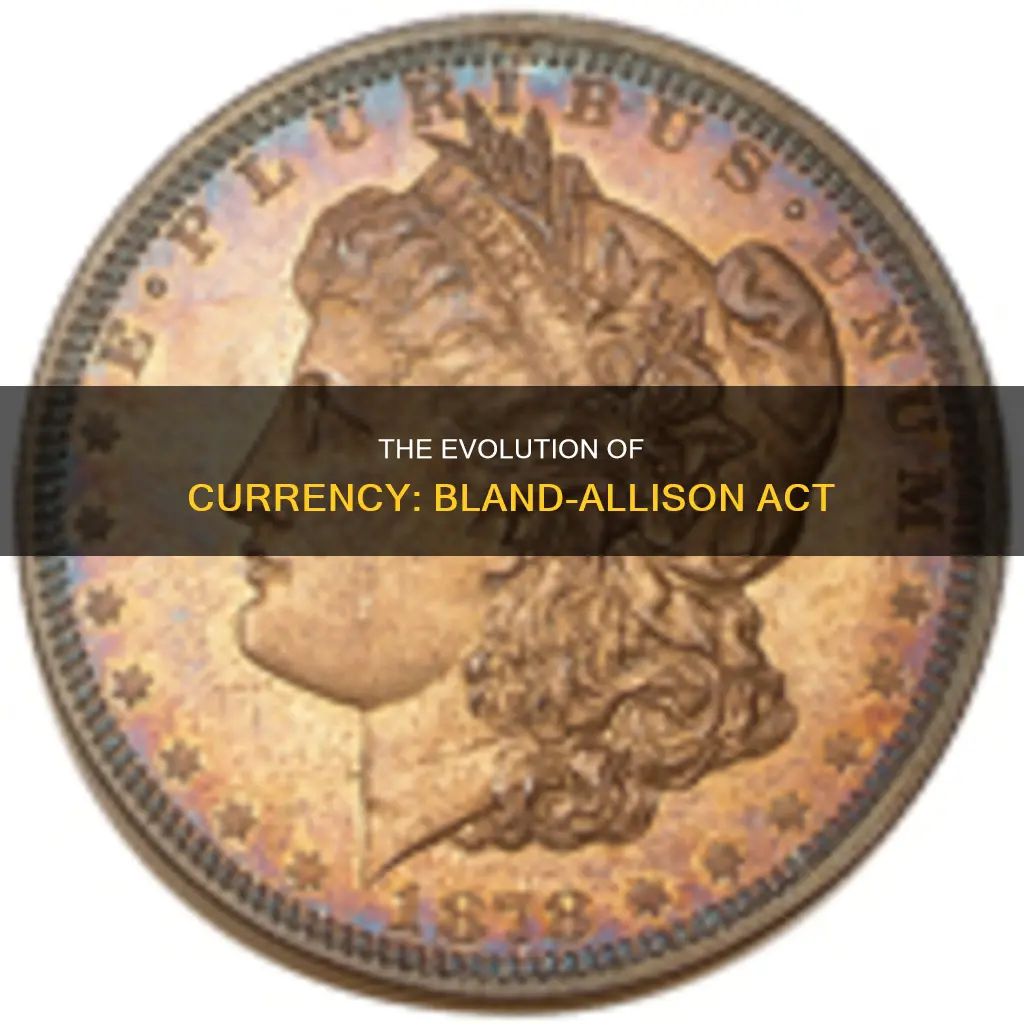

The silver purchased under the Bland-Allison Act was minted into legal tender silver dollars, which carried a monetary value far exceeding the market value of the silver contained within. This act resulted in the first Morgan Silver Dollars being minted, and it played a critical role in the late 19th-century economic and political landscape of the United States.

While the Act reintroduced silver coinage, its impact was limited by government actions and broader economic forces. The Treasury made purchases closer to the minimum amount required, which limited the expansion of the money supply. The Act did not end the "free silver" debate, and further legislation, such as the Sherman Silver Purchase Act of 1890, was enacted in the following decades.

Social Policy to Law: Understanding the Process

You may want to see also

The Act was replaced by the Sherman Silver Purchase Act in 1890

The Bland-Allison Act, also known as the Grand Bland Plan of 1878, was a United States Congress Act that required the U.S. Treasury to buy a substantial amount of silver and put it into circulation as silver dollars. The Act was a response to the 5.5-year depression that followed the Panic of 1873, which caused a decline in the world market price of silver. The Act was vetoed by President Rutherford B. Hayes, but Congress overrode the veto on February 28, 1878, to enact the law.

The Act required the U.S. Treasury to purchase silver bullion worth $2-4 million every month at market price and coin the bullion into standard silver dollars. However, the Treasury Department, never in favour of the legislation, purchased the minimum amount of silver required, limiting the increase in the money supply consisting of silver coinage. This led to universal pressure on Congress for new legislation, resulting in the Sherman Silver Purchase Act of 1890.

The Sherman Silver Purchase Act was passed in response to the growing complaints of farmers and miners. Farmers had immense debts that they could not pay off due to deflation, and they urged the government to pass the Act to boost the economy and cause inflation, allowing them to pay their debts with cheaper dollars. Mining companies, on the other hand, had extracted vast quantities of silver from western mines, resulting in an oversupply that drove down prices. The Act required the federal government to purchase 4.5 million ounces of silver bullion every month, nearly twice the amount previously mandated by the Bland-Allison Act.

The Sherman Silver Purchase Act threatened to undermine the U.S. Treasury's gold reserves, and after the Panic of 1893, President Cleveland called a special session of Congress and secured the repeal of the Act. The silver-induced monetary inflation of the Bland-Allison and Sherman Acts came to an end, but the threat to the U.S. gold standard increased due to continuing silver agitation in Congress.

The Journey of a Bill: Jamaica's Lawmaking Process

You may want to see also

The Act led to the creation of the Morgan Silver Dollar

The Bland-Allison Act, also known as the Grand Bland Plan of 1878, was a United States Congress act that required the US Treasury to purchase a specific amount of silver and put it into circulation as silver dollars. The act was passed on February 28, 1878, after Congress overrode President Rutherford B. Hayes's veto.

The Act was a response to the economic crisis and the Panic of 1873, which caused a five-year depression. This crisis was caused by several factors, including railroad over-extension, speculation, bank failures, and a decline in European investors. The Coinage Act of 1873, which demonetized silver and embraced the gold standard, further exacerbated the situation. Silver miners were particularly aggrieved by this change and demanded a return to the silver standard.

The Bland-Allison Act was introduced to Congress in 1878 to address these concerns. It mandated that the US Treasury purchase $2 million to $4 million worth of silver bullion each month, to be coined into silver dollars. This policy was driven by economic motives and political pressures, as interest groups were impacted by the monetary policy.

The Act led to the creation of the first Morgan Silver Dollars, which were minted from 1878 to 1904, with a brief resumption in 1921. The coins were designed by George T. Morgan, the United States Mint Assistant Engraver, and were named after him. Morgan's design featured a profile portrait of Liberty, modelled by Anna Willess Williams, on the obverse, and an eagle with wings outstretched on the reverse.

The Morgan Silver Dollar gained popularity among coin collectors, and its creation was an unintended outcome of the Bland-Allison Act. While the Act did not fully resolve the country's monetary debate, it represented a compromise between pro-gold and pro-silver factions and played a critical role in the late 19th-century economic and political landscape of the United States.

The Lawmaking Process: How a Bill Becomes Law

You may want to see also

Frequently asked questions

The Bland-Allison Act became law on February 28, 1878, after Congress overrode President Rutherford B. Hayes's veto.

The purpose of the Bland-Allison Act was to bring back the silver standard and require the purchase of silver bullion by the U.S. Treasury for use in coining.

The Act required the U.S. Treasury to purchase between $2 million and $4 million worth of silver bullion each month at market prices, to be coined into silver dollars, which were made legal tender for all debts.

The impact of the Act was limited as President Hayes and his successors only purchased the minimum amount of bullion required. The Act was replaced by the Sherman Silver Purchase Act in 1890, which further increased the government's purchase of silver.