California labor laws are renowned for their comprehensive nature and the protections they offer to employees. These laws apply to all workers in California, irrespective of their residency or the location of their employer. This includes employees of non-profit organizations, who are entitled to the same rights and protections as those in the for-profit sector. Non-profit organizations must comply with various federal and state labor laws, including those pertaining to minimum wage, overtime, discrimination, and harassment. Understanding these regulations is crucial for legal compliance and protecting the rights of employees and employers.

What You'll Learn

Volunteers vs. employees

In California, volunteers are defined as individuals who perform work for civic, charitable, or humanitarian reasons for a public agency or non-profit organisation without the promise, expectation, or receipt of compensation. Volunteers are not considered employees and are not covered by the same labour laws.

Compensation

Volunteers are not compensated for their work, whereas employees are paid for their work and are eligible for benefits like overtime, lunch breaks, sick leave, and vacation days.

Protections

Employees are provided with more regulations and better protections under the law than volunteers. Employees who are wrongfully terminated may recover damages and other remedies, while volunteers typically cannot.

Work tasks

Employees tend to have more weighty responsibilities and may need to sign confidentiality agreements, whereas volunteers are typically given simpler tasks and do not have to sign confidentiality agreements.

Work schedule

Employees generally have a strict work schedule, while volunteers can offer their time whenever they want.

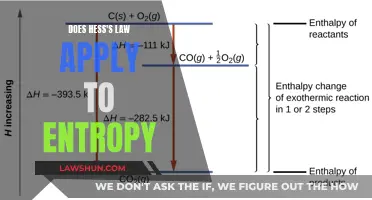

Workplace harassment and discrimination

Both employees and volunteers are protected from workplace harassment and discrimination under the California Fair Employment and Housing Act (FEHA). However, employees have additional protections, such as the right to receive sexual harassment and abusive conduct training if the employer has five or more employees.

Workers' compensation

Employees are covered by workers' compensation laws and insurance policies, while volunteers are generally not covered. However, a California organisation may adopt a workers' compensation policy that includes volunteers or label them as employees for the purpose of allowing them to receive these benefits.

Work for any type of organisation

Employees are generally permitted to work for any type of business or organisation, while volunteers can only work for public and non-profit companies. If a volunteer is hired by a private, for-profit organisation, they will no longer be considered a true volunteer.

Biloxi's Lease Laws: Are Dogs the Only Target?

You may want to see also

Non-profits and minimum wage

Non-profits generally have to comply with employment laws, including those regarding minimum wage. In California, the minimum wage is currently $16.00 per hour for all employers, though some cities and counties have higher minimum wages. For example, San Francisco's minimum wage is $12.25 an hour.

Certain employees are exempt from minimum wage laws, including outside salespersons and apprentices. Additionally, learners (employees with no similar or related experience) can be paid 85% of the minimum wage during their first 160 hours of employment.

Some non-profit organisations, such as sheltered workshops or rehabilitation facilities that employ disabled workers, can apply for a special license to pay their employees less than the minimum wage. However, this exception is only valid until January 1, 2025.

While volunteers are not paid, it's important to note that they cannot be coerced or pressured into volunteering, and they must not be compensated with lodging, meals, transportation, or nominal awards.

Biometric Privacy Laws: Who Are They Targeting?

You may want to see also

Non-profits and overtime pay

Non-profits in California must comply with state and federal wage and hour laws, including those pertaining to overtime pay. The federal Fair Labor Standards Act (FLSA) sets the minimum wage, overtime, recordkeeping, and child labor standards. Non-profits are generally subject to the FLSA if they have an annual gross revenue of at least $500,000 from commercial activities such as operating a gift shop or providing veterinary services for a fee. Employees of non-profits that are not covered by the FLSA on an enterprise basis may still be entitled to its protections if they are individually engaged in interstate commerce or the production of goods for interstate commerce.

In California, employees who are not exempt from overtime requirements under state and federal laws must be paid overtime (1.5 times their regular rate of pay) for all hours worked over 8 hours in a day and 40 hours in a week. Additionally, employees must receive double overtime (2 times their regular rate of pay) for hours worked over 12 hours in a day. The overtime policy should state that overtime-eligible employees must receive advance permission to work overtime, take meal and rest breaks as required by law, and report all hours worked. Employers can be subject to strict penalties for failing to pay overtime, so this is an essential policy for non-profits to have and enforce.

To determine whether a non-profit organisation is required to pay overtime, it is necessary to first establish whether the FLSA applies to the organisation or any of its employees. This can be done by considering whether the non-profit is an enterprise covered by the FLSA, and whether any employees are covered by the FLSA due to the nature of their job responsibilities. Once it has been determined that the FLSA applies, the next step is to classify employees as either volunteers, employees, or independent contractors. Employees can be further classified as exempt or non-exempt from overtime requirements. Finally, it is necessary to identify which non-exempt positions are likely to require overtime pay, taking into account work patterns throughout the year.

It is important to note that California's overtime rules are based on California Labor Code 510 and are more stringent than federal laws. California requires overtime pay for any hours worked beyond 8 in a single day, whereas federal law requires overtime pay for hours worked beyond 40 in a workweek. Additionally, California requires double overtime pay for any hours worked beyond 12 in a single day.

Animal Cruelty Laws: Do Farms Have Exemptions?

You may want to see also

Non-profits and workplace investigations

Non-profits, like all organisations and corporations, are run by employees and must comply with employment laws. In California, employees have specific rights, and employers are required to notify their employees of these rights, as well as their responsibilities and benefits. This is often done through an employee handbook, which should reflect the non-profit's philosophy, values, and culture.

Workplace Investigations

Workplace investigations are a crucial aspect of addressing employee complaints and ensuring compliance with the law and company policies. In California, employers are mandated by law to conduct a "prompt, impartial, and thorough" investigation into employee complaints involving harassment, discrimination, or retaliation. These investigations must be initiated promptly, conducted by a trained and unbiased investigator, and meticulously planned to gather and analyse all relevant evidence.

Employee Handbook

The employee handbook is an important document that outlines the policies and procedures to be followed during an internal workplace investigation. It should include information on the employee's rights during the investigation process, such as the right to be heard, access to information being used against them, and protection from retaliatory actions.

Common Scenarios for Workplace Investigations

Workplace investigations can be triggered by various scenarios, including allegations of sexual harassment or abuse, claims of discrimination based on protected characteristics, reports of a hostile work environment, allegations of fraud, or violations of company policy.

Rights During a Workplace Investigation

Employees have several legal rights during a workplace investigation, including protection from retaliation, discrimination, or termination. Employers are prohibited from taking adverse employment actions, such as demotion or pay cuts, against employees who have filed a discrimination or harassment claim or reported a violation of the law. Employees also have the right to privacy, and employers who violate this right may face legal consequences.

Choosing an Investigator

There are several options for conducting workplace investigations in California. Internal investigations can be performed by the non-profit's internal staff, but questions of neutrality and legal knowledge may arise. Alternatively, non-profits can seek assistance from external investigators, such as human resources professionals, private investigators, or licensed attorneys, who can provide independent and thorough investigations.

Benefits of External Investigators

External investigators offer several benefits, including expertise, credentials, and impartiality, ensuring accurate and legally compliant investigations. They work closely with HR teams to provide comprehensive investigation reports and strategic solutions to address any vulnerabilities.

In summary, workplace investigations are a critical aspect of maintaining a compliant and ethical work environment in non-profits. By understanding the legal requirements, policies, and procedures, non-profits can effectively address employee complaints and protect the rights of their employees.

Animal Cruelty Laws: Do They Protect Domesticated Rats?

You may want to see also

Non-profits and workplace safety

Non-profits in California must comply with many employment laws, and employees have specific rights that employers are required to notify them of. A good way to do this is through an employee handbook, which should reflect the nonprofit's philosophy, values, and culture, as well as outline key employment policies.

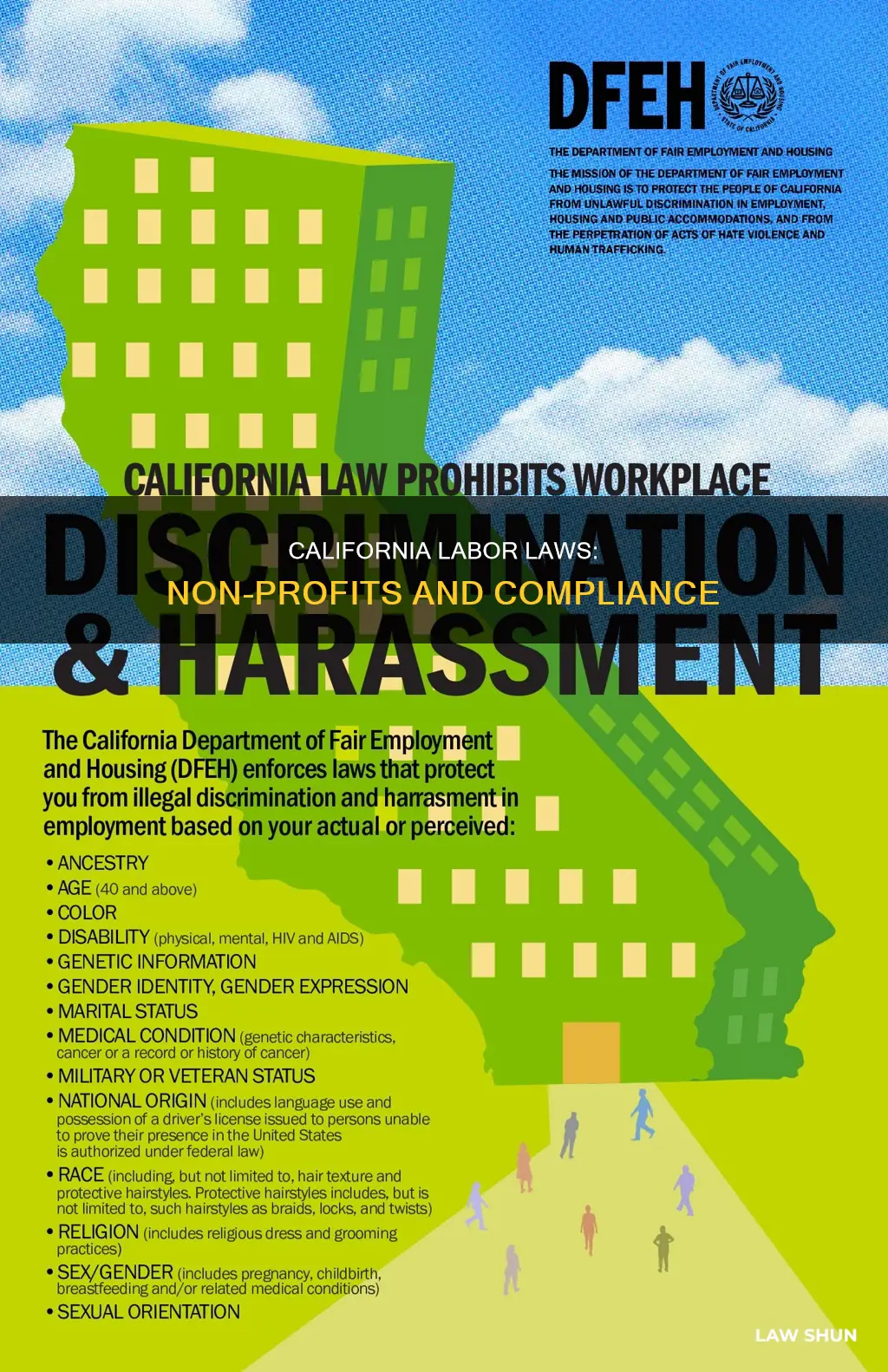

Equal Employment Opportunity Statement

An equal employment opportunity policy should be in place, which makes a clear statement against all forms of discrimination based on protected classifications. In California, these classifications include race, religious creed, colour, national origin, ancestry, physical or mental disability, medical condition, genetic information, marital status, sex, gender, gender identity, gender expression, age, sexual orientation, and the veteran or military status of any person. The policy should also state that employment decisions are based on merit, qualifications, and competence.

Policy Prohibiting Harassment, Discrimination, and Retaliation

California nonprofits are required to develop and enforce policies that prevent harassment, discrimination, and retaliation under the Fair Employment and Housing Act (FEHA) and Title VII. These policies must explain prohibited conduct, provide a procedure for complaints, and mandate that complaints are investigated. Employers must also provide training on these policies and ensure employees receive them.

Reasonable Accommodations

Under the Americans with Disabilities Act and FEHA, California nonprofits must provide reasonable accommodations to disabled employees. The policy should explain how employees can request accommodations, describe the employer's right to request documentation, and outline how the employer will respond to the request with an interactive process.

Leave Policies

California employees have rights to various types of leave, including Family Medical Leave, Pregnancy Disability Leave, Jury Duty/Witness Leave, Military Leave, Time off for Voting, School Activities Leave, and several others. Employers must keep these policies up to date and ensure employees are aware of their rights.

Lactation Accommodation

California Labor Code 1034 requires employers to implement and distribute a policy on lactation accommodations. This policy must explain the procedure for employees to request break time to express breast milk and the employer's obligation to provide a private room that is not a bathroom.

Wage and Hour Laws

Employers, including nonprofits, must comply with state and federal wage and hour laws. Employees who are not exempt from overtime requirements must be paid overtime (1.5 times the regular rate of pay) for hours worked over 8 hours a day or 40 hours a week. Employees must also receive double overtime for hours worked over 12 hours a day. The policy should outline that overtime-eligible employees must receive advance permission to work overtime, take meals and breaks as required by law, and report all hours worked.

Workplace Safety

California nonprofits, like all employers in the state, are required to provide a safe and healthy workplace for their employees. This includes complying with the California Occupational Safety and Health Act (Cal/OSHA) regulations. Employers must identify and correct any workplace hazards, provide training and instruction on safe work procedures, and maintain a written Injury and Illness Prevention Program (IIPP) that outlines their health and safety procedures. Nonprofits must also comply with the California Safe Drinking Water and Toxic Enforcement Act, which requires them to warn employees about potential exposure to toxic chemicals.

Conflict Resolution

Nonprofits should have a clear process for resolving conflicts and handling complaints. This includes investigating and addressing any issues related to harassment, discrimination, or retaliation. Employees should know how to report concerns and the steps that will be taken to resolve them.

Employee Training

Nonprofits should provide regular training to employees on relevant health and safety topics, including emergency response procedures, hazard communication, ergonomic practices, and violence prevention. Training should also cover the organisation's specific policies and procedures, such as those related to harassment, discrimination, and the use of technology.

Record-Keeping

California nonprofits must maintain accurate records related to workplace safety, including injury and illness reports, safety data sheets for hazardous chemicals, and documentation of safety meetings and training. These records are essential for compliance with Cal/OSHA regulations and may be required during inspections or investigations.

Regular Reviews and Updates

It is important for nonprofits to regularly review and update their workplace safety policies and procedures to ensure ongoing compliance with changing laws and regulations. They should also conduct periodic safety audits to identify and address any potential hazards or areas for improvement.

By adhering to these guidelines, California nonprofits can maintain a safe and healthy work environment for their employees, which is essential for any organisation striving to make a positive impact in its community.

Jim Crow Laws: Racist History of Oppression

You may want to see also

Frequently asked questions

California labor laws apply to anyone working within the state, irrespective of their residency or employer location.

Non-profits in California must comply with several labor laws, including:

- Equal Employment Opportunity policies

- Anti-harassment, discrimination, and retaliation policies

- Reasonable accommodations for disabled employees

- Lactation accommodations

- Compliance with state and federal wage and hour laws, including overtime

- Technology and facilities use policies

- Conflict of interest policies

Volunteers in California non-profits must meet specific criteria to be considered volunteers and not employees. They must work without the promise, expectation, or receipt of compensation. There should be no coercion or pressure to volunteer, and any benefits provided should be appropriate to the situation and not a substitute for compensation.

Volunteers in California are protected by the 1997 Volunteer Protection Act and the state's labor laws. They are generally not liable for harm caused by their actions unless it involves willful or criminal misconduct, gross negligence, reckless misconduct, or indifference to the rights or safety of others.

While most labor laws apply to non-profits, there are some exceptions. For example, the Occupational Safety and Health Administration (OSHA) can enforce actions such as fines and citations on work performed by employees but not on volunteers. Additionally, non-profits that qualify as "tax-exempt" are not required to pay income taxes on their revenues but are still subject to payroll taxes and Social Security payments for employees.