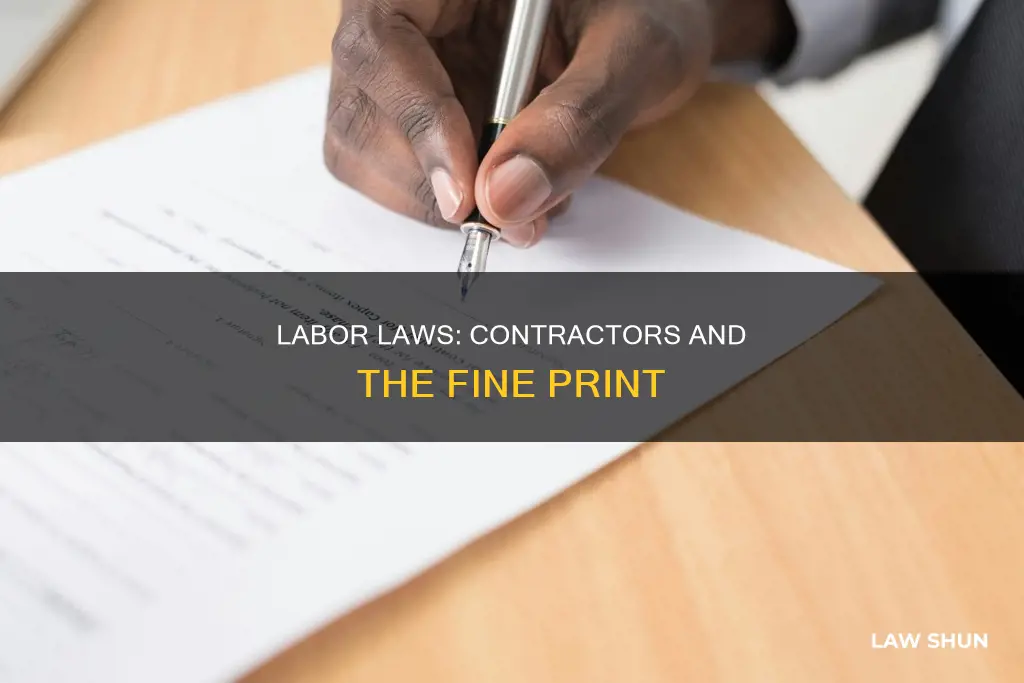

The application of US labor laws to independent contractors is a complex issue that has been frequently litigated over the years. Independent contractors are typically treated as self-employed under US labor laws, which means they may not have the same protections and benefits as employees. This includes exemptions from minimum wage and overtime laws, eligibility for unemployment and healthcare benefits, and protection under employment laws such as the Fair Labor Standards Act and the Family and Medical Leave Act. However, it's important to note that courts use a variety of factors to determine whether an individual is an independent contractor or an employee, and the distinction is not always clear-cut. With the evolving nature of work and the rise of new business models, the application of labor laws to independent contractors is an ongoing discussion.

Do US Labor Laws Apply to Independent Contractors?

| Characteristics | Values |

|---|---|

| Treatment under US labor law | Independent contractors are treated as self-employed |

| Minimum wage | Not covered by minimum wage laws |

| Overtime pay | Not covered by overtime pay laws |

| Payroll taxes | Pay both employer and employee payroll taxes |

| Unemployment benefits | Not eligible for unemployment benefits |

| Healthcare | Not eligible for healthcare benefits |

| Retirement | Not eligible for retirement benefits |

| Sick time | Not eligible for sick time |

| Family leave | Not eligible for family leave |

| Union formation | Cannot form a union with other workers |

| Employment laws | Not protected by employment laws |

What You'll Learn

Independent contractors are treated as self-employed

Independent contractors are considered self-employed under US labor law and are therefore not entitled to the same benefits and protections as employees. This means that they are responsible for both employer and employee payroll taxes, and are not covered by minimum wage or overtime laws. They are also not eligible for unemployment, healthcare, retirement, sick time, or family leave benefits.

The distinction between employees and independent contractors has been a frequently litigated issue for decades. Courts use a variety of factors to determine whether a worker is an employee or an independent contractor, including the level of control exerted by the employer, the worker's opportunity for profit or loss, the worker's investment in the job, the skill level required, the permanence of the work arrangement, and whether the service provided is integral to the business.

The Fair Labor Standards Act (FLSA), which provides benefits such as minimum wage and overtime pay, does not apply to independent contractors. This is because independent contractors are seen as separate from employees, using their "freedom and talents" to operate their own businesses. They are therefore not considered to be in an employer-employee relationship, and the obligations imposed on employers regarding their employees under the FLSA do not apply to independent contractors.

While independent contractors have more autonomy than employees, they also lack many of the protections and benefits afforded to employees. This has led to criticism of companies that rely on low-wage independent contractors, such as Uber, as they can deny their contractors the pay and benefits they would be entitled to as employees.

Understanding ADA Laws: Private Property Exemptions and Compliance

You may want to see also

They are not covered by minimum wage laws

In the United States, labor laws do not apply to independent contractors in the same way they do to employees. Independent contractors are not entitled to the minimum wage because they are not legally considered employees of the company they are working for. Instead, they are self-employed and work for hire. This means that they are generally not paid a salary, and are responsible for withholding and depositing their own income taxes, social security taxes, and Medicare taxes.

The distinction between an employee and an independent contractor is a complex and frequently litigated issue. The Fair Labor Standards Act (FLSA) provides benefits to employees, including a minimum wage and overtime pay for hourly employees, but does not apply to independent contractors. To determine whether a worker is an employee or an independent contractor, courts use a variety of factors that relate to the "economic reality" of the working relationship. These factors include the employer's control over the work, the worker's opportunity for profit or loss, the worker's investment in the job, the permanence of the work relationship, and the nature and degree of control exercised by the employer.

The classification of a worker as an independent contractor or an employee is important because it determines their entitlement to certain rights and protections, such as minimum wage and overtime pay. Misclassification of employees as independent contractors is a serious problem, as it can result in workers not receiving the wages and benefits they are entitled to under the FLSA. Employers are responsible for correctly determining the classification of their workers, and there can be consequences for misclassifying employees as independent contractors.

The U.S. Department of Labor (DOL) has recognized the complexity of this issue and has published guidance to help employers and workers understand how to analyze a worker's status as an employee or independent contractor under the FLSA. This guidance is intended to provide clarity and ensure that workers are correctly classified, receiving the wages and protections they are entitled to.

Driving Laws: Private Property Exemptions and Confusions

You may want to see also

They are not eligible for benefits

In the United States, independent contractors are treated as self-employed, and as such, they are not entitled to the same benefits as employees. This means that they are not covered by minimum wage or overtime laws, and they are not eligible for unemployment benefits, healthcare, retirement, sick pay, or family leave. They also cannot form unions with other workers and are not protected by employment laws such as the Fair Labor Standards Act, the Family and Medical Leave Act, or the Employment Non-Discrimination Act.

The distinction between employees and independent contractors has been a frequently litigated issue for decades, with courts using a variety of factors to determine a worker's status. These factors include the employer's control over the worker, the worker's opportunity for profit or loss, their investment in the job, the skill level required, the permanence of the work arrangement, and whether the service is integral to the business. Despite this, independent contractors are often at a disadvantage when it comes to wages and benefits, with companies like Uber using their independent contractor status to pay workers less than they would be entitled to as employees.

As independent contractors are considered self-employed, they are responsible for both employer and employee payroll taxes. This can result in a significant financial burden, especially for low-wage independent contractors who may already struggle with reduced wages and a lack of benefits. This group of workers is particularly vulnerable to exploitation, with little to no increase in autonomy to justify their lack of benefits.

While independent contractors may enjoy the freedom to operate their own businesses and use their talents as they see fit, they do so without the security of benefits such as healthcare, retirement plans, or sick leave. This means that they are solely responsible for their own well-being and must navigate the challenges of unpredictable income and a lack of safety nets alone. This can lead to financial instability and a higher risk of negative outcomes in the event of unforeseen circumstances, such as illness or injury.

Understanding HIPAA: Employer Rights and Responsibilities

You may want to see also

They cannot unionise

In the United States, independent contractors are not considered "employees" and are therefore not covered by the same wage and hour provisions as employees. This means that independent contractors are not protected by the Fair Labor Standards Act (FLSA) and are not entitled to benefits such as a minimum wage, overtime pay, and leave under the Family Medical Leave Act.

While independent contractors can join a union, they do not have the same privileges and protections as a regular union bargaining unit. For example, an employer is not obliged to bargain with a union regarding contract terms for an independent contractor in the same way they would for a regular employee. Additionally, an independent contractor who went on strike would not be protected from employer reprisals under the National Labor Relations Act.

The National Labor Relations Board (NLRB) has eased the ability of independent contractors to unionize by returning to an Obama-era test that determines when workers considered independent contractors may organize a union. This decision has been criticized for creating legal confusion and destabilizing industries.

Despite the limitations, joining a union as an independent contractor can provide benefits such as access to health and equipment insurance, contract advice, and job support.

Employment Laws: Independent Contractors' Rights and Responsibilities

You may want to see also

They are not protected by employment laws

Independent contractors are not protected by employment laws in the same way that employees are. This is because independent contractors are treated as self-employed under US labor law. As such, they are not covered by the Fair Labor Standards Act (FLSA), which includes provisions for a minimum wage and overtime pay for hourly employees. This means that independent contractors can be paid less than the minimum wage, and they are not entitled to overtime pay.

Additionally, independent contractors are not covered by the Family and Medical Leave Act, which guarantees unpaid time off and continued health insurance coverage for employees around the birth of a child or other circumstances. They are also not protected by the Employment Non-Discrimination Act, which protects employees from discrimination and harassment. This lack of protection means that independent contractors can be discriminated against or harassed without legal recourse.

Furthermore, independent contractors are not eligible for unemployment, healthcare, retirement, sick time, or family leave benefits. They are also not able to form unions with other workers, which limits their collective bargaining power and ability to advocate for better working conditions. This lack of protection under employment laws can leave independent contractors vulnerable to exploitation and unfair treatment by employers.

The distinction between employees and independent contractors has been a frequently litigated issue for decades, and courts use a variety of factors to determine a worker's status. These factors include the employer's control over the worker, the worker's opportunity for profit or loss, the worker's investment in the job, the skill required, the permanence of the work arrangement, and whether the service is integral to the business. However, despite these considerations, independent contractors generally fall outside the coverage of employment laws, leaving them with fewer protections and benefits than traditional employees.

Understanding California Employment Laws: Statutory Employees

You may want to see also

Frequently asked questions

Yes, independent contractors are considered self-employed under US labor law. This means they are not covered by minimum wage or overtime laws, are not eligible for unemployment benefits, and are responsible for both employer and employee payroll taxes.

No, independent contractors are not generally protected by employment laws. They are not eligible for benefits such as healthcare, retirement, sick time, or family leave, and they cannot form unions with other workers.

Yes, some companies may use the independent contracting status to pay workers less than they would be entitled to as employees. This is often seen with low-wage independent contractors, where wages and benefits can be stripped away without a corresponding increase in autonomy.

The US Department of Labor has proposed a rule that considers the "opportunity for profit or loss depending on managerial skill." Factors include the ability to set pay, negotiate, accept or decline jobs, choose the order and time of performance, engage in marketing, and hire others.

No, independent contractors must resolve disputes or enforce their rights through means other than state agencies, unlike employees who can go to agencies such as the Labor Commissioner's Office.