Filial responsibility laws are statutes that place a legal obligation on adult children to provide financial support for their parents who cannot afford to pay their bills. These laws are holdovers from decades ago when there were no governmental programs like Social Security, Medicare, and Medicaid to support people based on age and need. While these laws still exist in over half of the US states, they are rarely enforced. Wisconsin is not one of the states with filial responsibility laws.

| Characteristics | Values |

|---|---|

| Does Wisconsin have a filial responsibility law? | No |

| Number of states with a filial responsibility law | 29 or 30 |

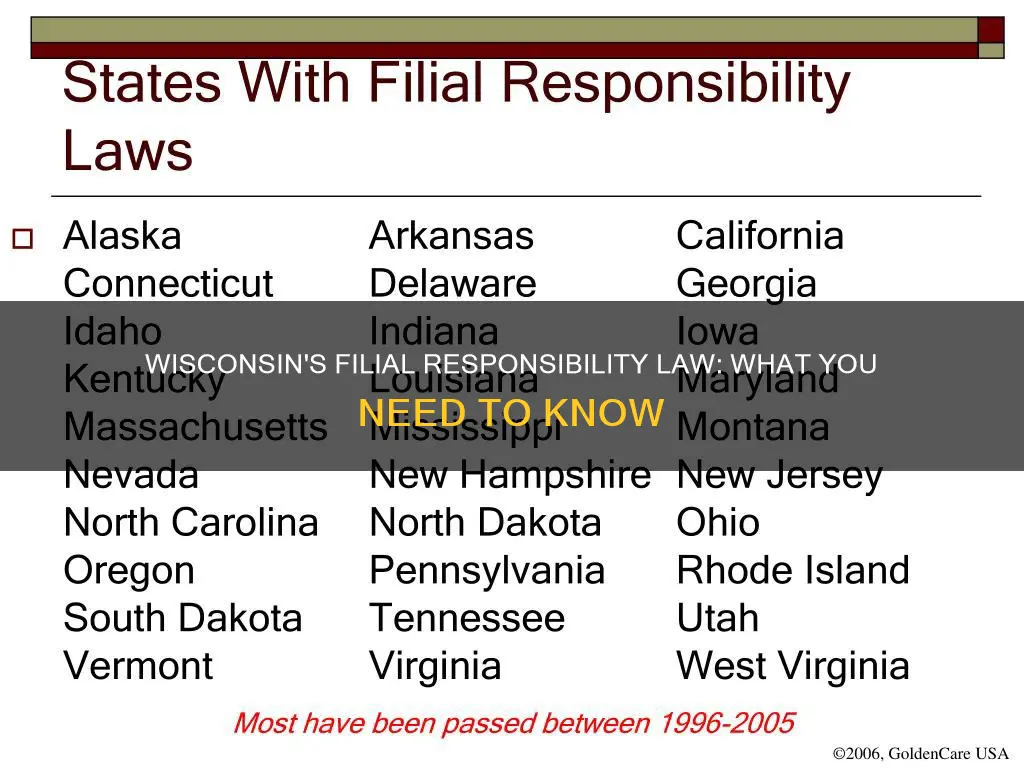

| States with a filial responsibility law | Alaska, Arkansas, California, Connecticut, Delaware, Georgia, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Montana, Nevada, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Virginia, West Virginia |

What You'll Learn

Filial responsibility laws in Wisconsin

Close to half of the states in the US have filial responsibility laws, which can create a legal obligation for adult children to pay for their parents' care. However, Wisconsin is not one of these states.

Filial responsibility laws are a set of laws that mandate adult children to be financially responsible for their parents' unpaid healthcare costs and other necessities when their parents cannot afford to pay themselves. These laws are a holdover from the era before governmental programs like Social Security, Medicare, and Medicaid were implemented to provide financial support for people based on age and need.

Today, filial responsibility laws are rarely used, and even when they are, it is usually when someone is attempting to game the system. For example, if a parent sells their property for a very low price to give money to their children and then expects the government to pay for their healthcare, these laws can be invoked. Another example is when a child uses a financial power of attorney to access their parent's money, and the state pulls out these laws to prevent that.

If your parents live in a state with filial responsibility laws, you could potentially be held financially responsible for their expenses. If you are concerned about having to pay a large bill for your parents, consult a local legal expert to understand your state's specific laws and how they might apply to your situation.

Labor Laws: Do They Apply to Hospital Work?

You may want to see also

Wisconsin's filial responsibility laws vs. California's

Wisconsin does not have a filial responsibility law, whereas California does. This means that in Wisconsin, adult children are not legally obligated to pay for their parents' unpaid healthcare costs or other basic needs. In California, however, adult children are responsible for supporting their parents if they are in need and unable to maintain themselves, unless otherwise provided by law.

Filial responsibility laws are laws that impose a duty on adult children to financially support their impoverished parents or other relatives. These laws may be enforced by governmental or private entities and may result in civil or criminal penalties for non-compliance. While most states with filial responsibility laws have not actively enforced them, there have been cases where nursing homes and government agencies have pursued legal action to recover the cost of caring for parents whose children failed to provide adequate support.

The laws vary from state to state in terms of who can be held liable, the extent of liability, and the penalties for non-compliance. For example, in California, adult children are responsible for supporting their parents if they are in need and unable to maintain themselves, unless otherwise provided by law. On the other hand, in Connecticut, the law only applies if the parents are younger than 65, and in Nevada, filial liability only applies if there is a written agreement to pay for care.

It is important to note that even if an individual lives in a state without filial responsibility laws, they may still be held responsible for their parents' care if their parents move to a state with such laws. However, this is not a common occurrence, and it depends on the specific state laws and the circumstances of the case.

Given the potential legal and financial implications, it is crucial for adult children to be aware of the filial responsibility laws in their state and to have transparent conversations with their loved ones regarding retirement and estate planning.

US Sports: Segregation and Professional Leagues

You may want to see also

Wisconsin's filial responsibility laws and Medicaid

Wisconsin does not have a filial responsibility law. However, close to half of the states in the US do have such laws, which can create a legal obligation for adult children to support their parents. These laws are rarely enforced, as most elderly parents who cannot pay for their care receive federal assistance through Medicaid, and federal law prohibits Medicaid from pursuing adult children for payments.

However, in some rare cases, adult children have been sued by private institutions for their parents' care costs. In one such case, a Pennsylvania appeals court ruled that an adult son had to pay his mother's $93,000 nursing home bill.

Medicaid Estate Recovery can also impact the inheritances of adult children whose parents received federal assistance for long-term care. After a parent's death, Medicaid can take money owed to it for long-term care from the parent's estate, including the sale of their home, money in a trust, or other property.

IP Law: Internet's Wild West?

You may want to see also

Wisconsin's filial responsibility laws and long-term care

Wisconsin does not have any filial responsibility laws, which means that adult children are not legally obligated to pay for their parents' unpaid healthcare costs or long-term care. However, it is important to note that some states with filial responsibility laws may attempt to apply these laws to out-of-state children of their residents. In most cases, these laws go unenforced, and courts will typically apply the filial-support law of the state where the parent lives.

If you are a resident of Wisconsin with aging parents, it is essential to have critical discussions with them about their ability to afford long-term care, including nursing home costs. Find out if they have long-term care insurance or Medicaid, which can help cover these expenses. It is also crucial to have transparent conversations with your loved ones about their retirement and estate planning to avoid any financial surprises in the future.

UK Laws in Ireland: Applicable or Not?

You may want to see also

Wisconsin's filial responsibility laws and financial planning

Wisconsin is not one of the US states with filial responsibility laws. This means that adult children in Wisconsin are not legally obligated to pay for their parents' care or cover their debts. However, it is still important for adult children to be aware of their parents' financial situation and to plan for their own financial future.

Filial responsibility laws are legal concepts that hold adult children financially responsible for their parents' unpaid healthcare costs and other necessities when their parents cannot afford to pay. These laws are in place in about half of US states, though they are rarely enforced. The laws vary from state to state, with some limiting responsibility to medical bills and others including food, shelter, and other costs.

Wisconsin's Position

Wisconsin does not have filial responsibility laws, so adult children in the state cannot be legally forced to pay their parents' nursing home bills or other expenses. However, it is still important for adult children in Wisconsin to discuss their parents' ability to afford long-term care and to help them plan financially. This may include finding out if their parents have long-term care insurance or Medicaid, which can help cover nursing home expenses.

Planning for the Future

To avoid potential issues with filial responsibility laws in other states and to ensure their parents' financial security, adult children in Wisconsin can get involved in their parents' financial planning. This may include working with a financial advisor or estate planning attorney to develop a strategy for their parents' assets to last as long as they need. It is also important to ensure that any cash gifts from parents are within their means and will not affect their eligibility for need-based programs like Medicaid.

In conclusion, while Wisconsin does not have filial responsibility laws, adult children in the state should still be proactive in discussing and planning for their parents' long-term care needs to ensure their financial security and peace of mind.

EEOC Laws: Who's Covered and Who's Exempt?

You may want to see also

Frequently asked questions

No, Wisconsin does not have a filial responsibility law.

A filial responsibility law is a law that makes children financially responsible for their parents' unpaid healthcare costs and other necessities when the parents cannot afford to pay themselves.

There are currently 29 states that have filial responsibility laws, including California, Pennsylvania, and North Carolina.

If your parents live in a state with a filial responsibility law, it is important to get involved in their financial planning to ensure they can cover their costs. You should also make sure they are not giving away cash gifts that they cannot afford, as this could affect their eligibility for need-based programs like Medicaid.