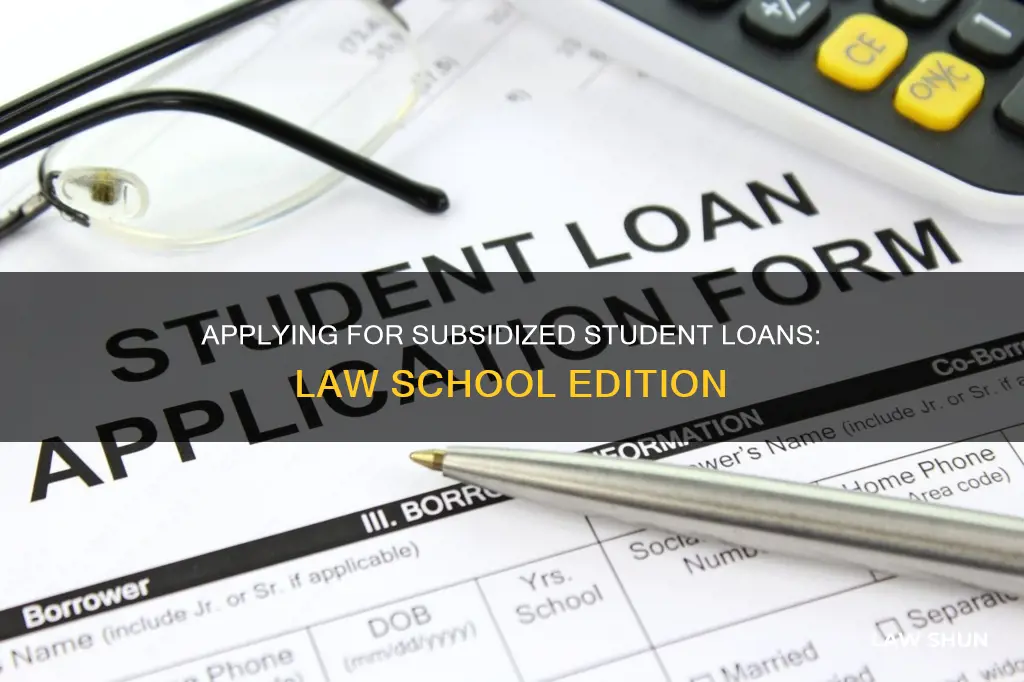

Applying for a subsidized student loan for law school can be a daunting task, but with the right information, it becomes more manageable. The first step is to understand the types of loans available: federal and private. Federal loans are offered by the government and include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans (Grad PLUS). Private loans, on the other hand, are offered by banks and lenders. It is recommended to prioritize federal loans as they offer lower interest rates and fees than private options. Additionally, federal loans provide more flexible repayment options and may be eligible for loan forgiveness or repayment programs. However, private loans may be a better choice for those with excellent credit who don't anticipate needing federal loan benefits. When applying for federal loans, individuals must complete the Free Application for Federal Student Aid (FAFSA). For private loans, applicants should apply directly through lender websites and compare interest rates and fees. It is also important to consider the repayment terms, interest rates, and any available discounts. Before making a decision, individuals should carefully weigh the advantages and disadvantages of both federal and private loans, taking into account their unique circumstances and future employment expectations.

| Characteristics | Values |

|---|---|

| Loan type | Federal or private |

| Interest rates | Variable or fixed |

| Origination fees | Yes or no |

| Prepayment penalties | Yes or no |

| Repayment term | 5, 7, 10, 12, 15, 20 or 25 years |

| Repayment plan | Immediate, interest-only, partial interest, full deferment |

| Auto-pay discount | Yes or no |

| Special discounts | Yes or no |

| Cosigner | Yes or no |

What You'll Learn

Federal vs. private loans

Federal student loans are generally considered a safer option than private loans. They are available to students regardless of their credit history and offer more flexible repayment options. Federal loans also provide access to loan forgiveness programs and income-driven repayment plans. However, they come with higher interest rates and fees than private loans.

Private loans may be a better option if you have excellent credit and don't plan on taking advantage of federal loan benefits. They often offer lower interest rates and don't require a credit check. However, private loans usually don't include the same forgiveness and hardship benefits as federal loans.

Here's a more detailed breakdown of the differences between federal and private loans:

Federal Loans:

- No credit check required

- Accessible to students with bad credit

- Offer income-driven repayment plans

- Provide access to loan forgiveness programs

- Have higher interest rates and fees than private loans

- Include an origination fee

Private Loans:

- May offer lower interest rates than federal loans

- Don't require a credit check

- Usually don't include origination fees

- May be a better option if you have excellent credit and don't need federal loan benefits

- Don't typically include loan forgiveness or hardship benefits

General Laws and the Media: Who's Exempt?

You may want to see also

Interest rates

Federal Student Loan Interest Rates:

Federal student loans currently offer fixed interest rates ranging from 6.53% to 9.08% for the 2024-2025 school year. The specific rates depend on the type of loan:

- Direct Subsidized Loans for undergraduate students: 6.53%

- Direct Unsubsidized Loans for graduate or professional students: 8.08%

- Direct PLUS Loans for graduate or professional students: 9.08%

Federal student loan interest rates are set by Congress each spring and are based on the high yield of the last 10-year Treasury note auction in May. These rates are the same for every borrower and do not depend on credit score or financial history.

Private Student Loan Interest Rates:

Private student loan interest rates vary by lender and are typically based on creditworthiness. They can range from approximately 4% to 17%. Private loans may offer either fixed or variable interest rates:

- Fixed-rate loans have a higher starting rate but provide predictability, as the rate remains the same over the life of the loan.

- Variable-rate loans tend to have lower starting rates, and the interest may increase or decrease over time depending on market conditions.

When considering private student loans, it is essential to shop around and compare interest rates from multiple lenders. Additionally, private loans may require a credit check and a co-signer for those without an established credit history.

- Federal Subsidized/Unsubsidized Loan: Undergraduate interest rate fixed at 3.73%, while graduate students get a higher rate of 5.28%.

- Federal Grad PLUS Loan: Higher interest rates and fees than unsubsidized loans, but allow you to borrow more money.

- Sallie Mae Law School Loan: Fixed rate options range from 3.49% to 14.47% APR, while variable rates range from 5.04% to 14.47% APR.

- College Ave Law Student Loan: Offers a nine-month grace period, and the interest rate depends on the applicant's creditworthiness.

- Ascent Law Student Loan: Offers a nine-month grace period and flexible payment options.

- Earnest Law School Loan: Provides a nine-month grace period and the option to skip one payment every 12 months.

- SoFi Law School Loan: Offers flexible in-school repayment options, including interest-only and flat-fee, with interest rates ranging from 3.79% to 14.83% for fixed rates and 5.79% to 15.86% for variable rates.

Recommendations:

When deciding between federal and private student loans, it is generally recommended to prioritize federal loans due to their lower and fixed interest rates, as well as more flexible repayment options. Private loans may be considered if you have excellent credit and do not anticipate needing federal loan benefits. Additionally, it is important to remember that interest rates are just one factor when evaluating loan options; other considerations include fees, repayment terms, and eligibility requirements.

Romeo and Juliet Law: Where Does It Apply?

You may want to see also

Repayment options

Federal Direct Stafford Loan

The Federal Direct Stafford Loan is a type of Direct Unsubsidized Federal Loan where students can borrow up to $20,500. It has an interest rate of 6.8% with a 1% loan fee that starts accruing as soon as the loan is distributed. Students are granted a six-month grace period before they must start repaying the loan. However, there are forbearance and deferment options available if needed.

U.S. Department of Education Loans

These loans are given to graduate students who need to supplement expenses not covered by scholarships or other financial aid. Borrowers must have a good credit history and be enrolled at least half-time at an eligible law school. The interest rate for these loans is 7.9%. Students can borrow up to the total cost of attendance, which is determined by the law school.

Private Law School Loans

There are also private loan options for law school, such as the Sallie Mae Law School Loan and the College Ave Law Student Loan. These loans often offer fixed or variable interest rates and may provide a grace period before repayment begins. It's important to carefully review the repayment terms and conditions of private loans, as they can vary widely.

Income-Driven Repayment (IDR) Plans

IDR plans are available for certain types of student loans, including some law school loans. These plans base the monthly payment on the borrower's income, usually capping the payment at a certain percentage of their monthly income. This can provide much-needed payment relief for borrowers.

Federal Perkins Loan

The Federal Perkins Loan is another option for law school students. The amount awarded is based on the student's financial need, as determined by the school using FAFSA surveys. The maximum amount awarded per student is $8,000 per year. These loans may be eligible for the Federal Public Service Loan Forgiveness program.

Antitrust Laws: Foreign Companies and US Jurisdiction

You may want to see also

Eligibility requirements

Each loan program will have a unique set of requirements for applicants. However, there are a few general criteria that students should expect to meet. Here are the eligibility requirements for some of the most common loan options for law school:

- Federal Direct Loans: Students are required to fill out the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for loan assistance. Federal Direct Loans are available to students pursuing their JD, LLM, or MSL (or any law program). Most applicants qualify, regardless of credit score. The interest rates and fees for these loans are set by Congress and remain fixed for the life of the loan.

- Direct Unsubsidized Loans: These loans are available to undergraduate students only and have the benefit of federal government-subsidized interest payments until six months after you graduate or drop below half-time enrollment. Direct Unsubsidized Loans have better interest rates and origination fees than Direct PLUS Loans. Law students can borrow up to $20,500 per year through these loans.

- Direct PLUS Loans: Direct PLUS Loans, also known as Grad PLUS Loans, are available to graduate students. These loans have higher interest rates and fees than Direct Unsubsidized Loans but allow students to borrow more money. To qualify, students must not have an adverse credit history. If they do, they can still receive the loan by enlisting a co-signer or documenting extenuating circumstances.

- Private Student Loans: Private student loans are offered by private banks and lenders. These loans often require a credit check and a co-signer if the applicant has bad credit. Private loans typically have lower interest rates than federal loans, but they also have fewer repayment protections. Applicants should carefully consider their future income and employment prospects before opting for a private loan.

- Sallie Mae Law School Loan: This loan is available to students enrolled less than half-time, making it a good option for those studying part-time or at night. It also offers 48 months of deferment during a clerkship or fellowship. Non-U.S. citizens, including DACA students, can apply with a U.S. co-signer.

- College Ave Law Student Loan: This loan is best for law students who will need extra time before starting repayment. It offers a nine-month grace period and the option to defer payments during a clerkship. Applicants must have a minimum income of $35,000 per year.

- Ascent Law Student Loan: The Ascent Law Student Loan is best for those seeking flexible payment options. It offers a nine-month grace period and the ability to see if you qualify without a hard credit check.

- Earnest Law School Loan: The Earnest Law School Loan is available to those with a minimum income of $35,000. It offers a nine-month grace period and the option to skip one payment every 12 months.

It is important to carefully review the eligibility requirements and terms of each loan program before applying. Additionally, students should exhaust all scholarship and grant options before taking out loans.

Stark Law and Commercial Insurance: What's the Verdict?

You may want to see also

Application process

The application process for subsidized student loans for law school involves several steps, and it is important to understand the different types of loans available, as well as the requirements and eligibility criteria. Here is a detailed guide on the application process:

Step 1: Understand the Types of Loans

Before starting the application process, it is crucial to understand the two main types of student loans: federal and private loans. Federal student loans are offered by the government and typically have more flexible repayment options. They include Direct Subsidized Loans (for undergraduates only), Direct Unsubsidized Loans, and Direct PLUS Loans (also known as Grad PLUS Loans for graduate students). Most applicants qualify for federal loans regardless of their credit score. Private student loans, on the other hand, are offered by private banks and lenders and often have lower interest rates, but they may have fewer repayment protections.

Step 2: Complete the FAFSA

The first step in applying for subsidized student loans for law school is to fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is required for all types of federal financial aid, including student loans. When completing the FAFSA, indicate that you are a graduate student, which increases your borrowing limits and means you don't need to include your parents' financial information.

Step 3: Explore Other Required Applications

In addition to the FAFSA, some law schools may require you to submit additional applications, such as the CSS Profile or a school-specific aid application, to be considered for non-federal financial aid. These applications may require you to provide your parents' financial information to be considered for institutional scholarships or grants. It is important to check with the financial aid office at your law school to understand their specific requirements and priority filing deadlines.

Step 4: Compare Interest Rates and Lenders

Before applying for private student loans, it is essential to compare interest rates and terms from multiple lenders. Private student loans are offered by various banks and lenders, and the eligibility requirements and interest rates can vary. Shop around and consider factors such as fixed or variable interest rates, repayment terms, fees, and the option for a co-signer.

Step 5: Apply for Private Student Loans

If you decide that a private student loan is the best option for you, the next step is to apply directly with the lender. You will need to provide information such as your identity, income, and the law school you plan to attend. Each lender has its own underwriting standards, and you may need a co-signer to get the best deal.

Step 6: Understand Repayment Options

It is crucial to understand the repayment options available for your student loans. Federal loans typically offer more flexible repayment plans, such as income-driven repayment plans, while private loans may have fewer options. Additionally, federal loans may be eligible for loan forgiveness or repayment assistance programs, such as Public Service Loan Forgiveness (PSLF). Carefully review the terms and conditions of your loan, including interest rates, fees, and repayment options, before finalizing your application.

Hawaii's TVU Law: Does It Reach Neighboring Islands?

You may want to see also

Frequently asked questions

You can take out unsubsidized federal student loans, federal PLUS loans, and private student loans to pay for law school.

To apply for subsidized student loans for law school, you will need to complete the Free Application for Federal Student Aid (FAFSA) and any other required applications, such as the CSS Profile or a school-specific aid application. You may also need to provide additional information, such as tax returns or financial statements. Once you have submitted your applications, the school's financial aid office will review your materials and determine your eligibility for subsidized student loans.

To be eligible for subsidized student loans for law school, you must be a U.S. citizen or eligible non-citizen, be enrolled in an accredited law school, and demonstrate financial need. You may also be required to maintain satisfactory academic progress and not have any outstanding student loans in default.

The interest rate for subsidized student loans for law school can vary depending on the type of loan and the current market rates. It is important to review the terms and conditions of your loan offer to understand the interest rate and any associated fees.