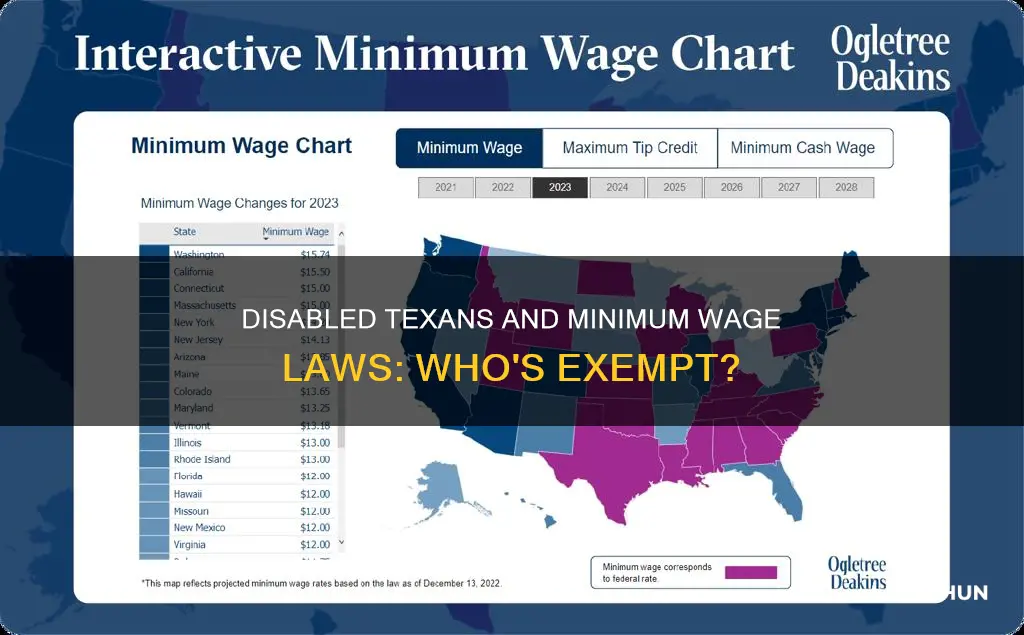

Texas has a complex set of laws regarding minimum wage requirements, and these laws can vary depending on the city or region within the state. While the federal minimum wage in the US is $7.25 per hour, Texas does not have a state-mandated minimum wage, and instead, employers must follow the federal guidelines. This means that the minimum wage in Texas is currently $7.25 per hour for non-exempt employees, and $2.13 per hour for tipped employees, who must make a combined total of at least $7.25 per hour including tips.

There are several exemptions to the Texas minimum wage law, including federal workers, small business employees, agricultural workers, domestic service workers, students, and trainee workers. Additionally, employers can pay employees under the age of 16 or with disabilities less than the minimum wage in certain circumstances.

The Texas Workforce Commission (TWC) is responsible for enforcing the state's minimum wage law and investigating complaints about employers who may be paying less than the minimum wage. Employees who believe they are not being paid fairly can file a wage claim with the TWC or file a lawsuit in civil court.

This raises the question: do minimum wage laws apply to disabled individuals in Texas, and if so, how do these laws differ from those for non-disabled individuals?

| Characteristics | Values |

|---|---|

| Minimum wage in Texas | $7.25 per hour |

| Minimum wage for tipped employees in Texas | $2.13 per hour |

| Texas Minimum Wage Act exemptions | Federal workers, small business employees, agricultural workers, domestic service workers, students, trainee workers, employees under the age of 16, employees with disabilities |

| Texas labor laws exclusion | Employees with disabilities who are not more than 21 years old, are clients of vocational rehabilitation, and are participating in a cooperative school-work program |

What You'll Learn

- Texas minimum wage law exempts disabled people under 21 in vocational rehabilitation

- Employees can file a claim with TWC or a lawsuit if they believe they've been underpaid

- Texas employers must provide written earnings statements to employees

- The Texas Workforce Commission enforces the state's minimum wage law

- Texas law does not mandate overtime pay provisions

Texas minimum wage law exempts disabled people under 21 in vocational rehabilitation

Texas has a complex set of laws regarding minimum wage, and there are a number of exemptions to the standard minimum wage laws. The Texas Minimum Wage Act sets a minimum wage for non-exempt employees. The current minimum wage in Texas is $7.25 per hour, which is the same as the federal minimum wage. Texas has not raised its minimum wage since 2009.

The Texas Minimum Wage Act does not apply to employees covered by the Fair Labor Standards Act (FLSA). For most employers and employees, minimum wage obligations are governed by the FLSA. The FLSA also governs the lowest minimum wage for employees with disabilities.

The Texas Minimum Wage Act also exempts from its coverage nonprofit charitable organizations that engage in evaluating, training, and employment services for disabled individuals. This only applies if the organization complies with federal regulations covering those activities.

Texas labor laws also exclude employees with disabilities from minimum wage requirements if the employee is:

- Not more than 21 years old

- A client of vocational rehabilitation

- Participating in a cooperative school-work program

Animal Cruelty Laws: Do Farms Have Exemptions?

You may want to see also

Employees can file a claim with TWC or a lawsuit if they believe they've been underpaid

Employees who believe they have been underpaid have several options for recourse in Texas. The first step is to talk to their employer, as most issues can be resolved this way. If this does not work, or is not an option, employees can file a wage claim with the Texas Workforce Commission (TWC) or file a lawsuit in court.

Filing a Wage Claim with the TWC

The TWC handles various wage violations, including minimum wage violations, overtime violations, unauthorized deductions, unpaid bonuses, and unpaid commissions. Employees must complete and mail or fax a Wage Claim to the TWC within 180 days after their wages became due. The TWC will then investigate the claim, make a decision, and help the employee recover any wages that are owed.

Filing a Lawsuit

Employees can also file a lawsuit in court to collect unpaid wages. This process is more complicated, so it is recommended that employees hire an employment lawyer, especially if they are claiming a large amount in unpaid wages. A lawyer can also represent employees before the TWC, although this is not a requirement.

Other Options

If the TWC cannot accept an employee's wage claim, there are other alternatives to seek owed wages. Employees can contact the US Department of Labor, Wage and Hour Division (USDOL), which can assist with minimum wage and overtime claims if the employee is covered by the Fair Labor Standards Act. Employees can also file a suit in their county's Civil or Small Claims Court, although there is a small filing fee and a limit on the amount of owed wages that can be awarded.

RV Lemon Law: What's the Deal?

You may want to see also

Texas employers must provide written earnings statements to employees

For employees not covered by the FLSA, Texas law requires employers to pay wages in full and on time, adhering to designated paydays as stipulated by the employer. These paydays must occur at regular intervals, and if not specified, the default paydays are the 1st and 15th of each month. Employers can pay wages in person, by mail, via direct deposit, to a third party authorized by the employee in writing, or by any other method agreed upon in writing by the employee.

In the case of deceased employees, final wages are paid to the legal representative of the deceased employee's estate. The employer should confirm the identity of the representative, obtain a signed receipt for the wages, and keep a copy for the payroll records. If the deceased employee was married, payment may be made to the surviving spouse if no executor or administrator has been appointed for the estate.

Unclaimed wages are held by the employer for one year, after which they are turned over to the Unclaimed Property Division of the Texas State Comptroller's Office.

Understanding ADA Laws During Company Sales and Acquisitions

You may want to see also

The Texas Workforce Commission enforces the state's minimum wage law

The Texas Workforce Commission (TWC) is responsible for enforcing the state's minimum wage law. Employees who believe their employer is paying them less than the minimum wage can file a complaint with the TWC. Upon receiving a complaint regarding minimum wage violations, the TWC conducts a thorough investigation into the matter. If the investigation reveals non-compliance, the TWC will take appropriate action against the employer. This may include requiring the employer to pay back wages to affected employees, imposing liquidated damages as compensation for violating the law, and potentially pursuing legal action in severe cases.

The TWC's role in enforcing the minimum wage law is crucial for ensuring that employees in Texas are paid fairly and that their rights are protected. The TWC has the authority to investigate complaints and take necessary actions to resolve issues related to non-compliance with the state's minimum wage requirements.

In addition to enforcing the minimum wage law, the TWC also provides information and guidance to employers and employees about their rights and responsibilities under the Texas Minimum Wage Act. The TWC's website offers resources and educational materials to help businesses and individuals understand their obligations and ensure compliance with the law.

Furthermore, the TWC plays a vital role in promoting fair and equitable workplace practices in Texas. By enforcing the minimum wage law, the TWC helps to ensure that employees receive at least the minimum wage for their work. This contributes to a more stable and just economy, as workers are guaranteed a basic level of compensation for their labor.

It's important to note that while the TWC enforces the state's minimum wage law, Texas has adopted the federal minimum wage rate set by the Fair Labor Standards Act (FLSA). This means that the current minimum wage in Texas is $7.25 per hour, which is the same as the federal minimum wage. However, the TWC still plays a crucial role in ensuring that employers comply with this minimum wage rate and addressing any violations or complaints that arise.

Labor Laws for 17-Year-Olds in Missouri: What You Need Know

You may want to see also

Texas law does not mandate overtime pay provisions

Texas labor laws are complex, and the state's minimum wage laws do not address certain considerations, such as whether employers can require employees to participate in tip-pooling or tip-sharing arrangements. Notably, Texas law does not mandate overtime pay provisions. Instead, overtime pay in Texas is governed by the federal Fair Labor Standards Act (FLSA). This means that, while overtime pay is guaranteed by state and federal law for many Texas workers, the specific provisions are outlined in federal legislation.

The FLSA establishes that employers must compensate their employees at a rate of 1.5 times their regular hourly wage for all hours worked beyond 40 in a single workweek. This overtime pay requirement applies to most non-exempt employees in Texas, ensuring they receive additional compensation for working extended hours. However, it is important to note that certain professions, such as teachers, outside sales employees, lawyers, and physicians, are exempt from receiving overtime pay.

In Texas, the current minimum wage is $7.25 per hour for non-exempt employees, which is in line with the federal minimum wage. This rate applies to tipped and non-tipped employees differently. Employers must pay non-tipped employees at least $7.25 per hour, while tipped employees must receive a minimum of $2.13 per hour in cash wages, excluding tips. Employers can take a tip credit of up to $5.12 per hour for tipped employees, ensuring their total earnings, including tips, amount to at least $7.25 per hour.

Texas law allows for several exemptions to its minimum wage requirements. For example, federal workers, small business employees, agricultural workers, domestic service workers, students, and trainee workers are all exempt from the Texas minimum wage law under specific conditions. Additionally, employers can pay employees below the minimum wage if they are under 16 years of age or if they are disabled and meet certain criteria.

While Texas law does not mandate overtime pay provisions, employees in the state are protected by the FLSA, which ensures they receive overtime compensation for working more than 40 hours in a workweek.

Understanding Lemon Laws: Do They Cover Computers?

You may want to see also

Frequently asked questions

The current minimum wage in Texas is $7.25 per hour.

Texas labour laws exclude disabled employees from minimum wage requirements if they are not more than 21 years old, are a client of vocational rehabilitation, and are participating in a cooperative school-work program.

If you believe your employer is paying you less than the minimum wage, you can file a wage claim with the Texas Workforce Commission (TWC) or file a lawsuit in civil court.

The TWC is the agency responsible for enforcing the state's minimum wage law and investigating complaints about minimum wage violations.

Exemptions to the Texas minimum wage law include federal workers, small business employees, agricultural workers, domestic service workers, students, and trainee workers.