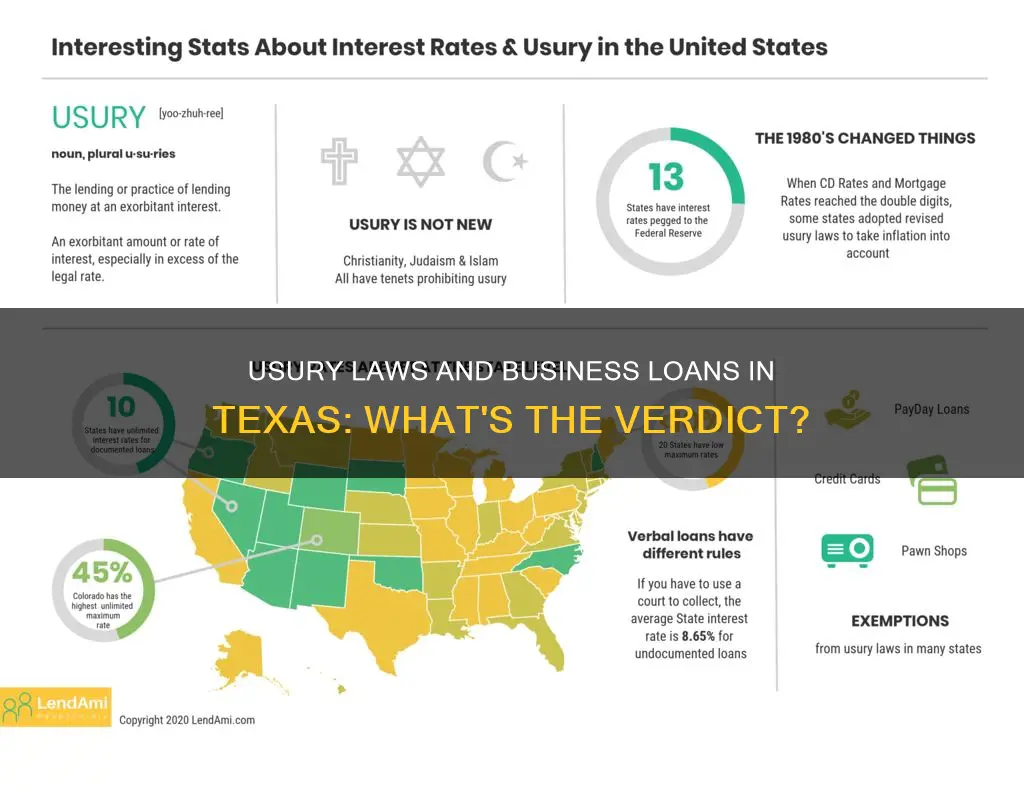

Usury laws are designed to protect consumers from predatory lending practices by setting caps on the amount of interest a lender can charge. While usury laws are typically regulated at the state level, with individual states setting their own limits on interest rates, some lenders may charge borrowers the interest rate of the state where they are headquartered. In Texas, the usury rate is 10% per year, but this does not apply to business loans, which are exempt from the usury rate rule. This means that business loans in Texas can charge interest rates above the 10% default usury rate, which is a significant consideration for borrowers and lenders alike.

| Characteristics | Values |

|---|---|

| Usury laws in Texas | Limit the interest rates a creditor may charge |

| Usury rate in Texas | 10% a year |

| Exceptions to the usury rate in Texas | Business loans, commercial loans, investments, and open-end accounts |

| Penalty for usury in Texas | The greater of 3 times the amount computed subtracting the amount of interest allowed by law from the total amount of interest contracted for, charged, or received; or $2000 or 20% of the amount of principal, whichever is less |

| Interest rates on judgments in Texas | If contract rate, then lesser of the contract rate or 18% |

| Commercial loan definition | A loan made primarily for business, commercial, investment, agricultural, or similar purposes |

| Qualified commercial loan definition | A commercial loan in which one or more persons lend, advance, borrow, or receive money or credit with an aggregate value of $3 million or more if secured by real property; or $250,000 or more if not secured by real property |

What You'll Learn

Usury laws in Texas

The usury rate in Texas is 10% per year, but this default rate is rarely applied due to various exceptions. The weekly rate ceiling, which is often substantially higher, can be found in the Texas Credit Letter published by the Texas Office of Consumer Credit Commissioner. This rate can also be found online.

Texas usury laws impose severe penalties on creditors who charge excessive interest. If a creditor charges more than the legal rate, they may be liable to pay the debtor the greater amount of three times the excessive interest charged or $2,000/20% of the principal (whichever is less). If more than twice the legal rate of interest is charged, the creditor may also lose the principal amount of the debt and be charged with a misdemeanor, resulting in a criminal fine of up to $1,000.

To avoid these penalties, creditors should obtain a written agreement from the customer to charge a higher interest rate. This agreement can take various forms, such as a work order, estimate, proposal, or memo, as long as it specifies the interest rate and is signed by the customer.

Non-Discrimination Laws: Religious Organizations' Exemptions Explored

You may want to see also

Business loans and usury rates

Usury laws regulate the amount of interest a lender can charge. They are designed to protect consumers from unreasonably high-interest rates on loans and credit cards. These laws are typically regulated by each state rather than at a federal level.

In Texas, interest rates are statutorily limited to 6% per annum, or 0.5% per month. However, this limit does not apply to business loans, commercial loans, investments, and open-ended accounts. In these cases, the legal interest rate can be up to 18% per annum, or 1.5% per month, with a written contract.

The usury rate in Texas is 10% a year, but this default rate is rarely applicable as most loans can charge the weekly ceiling, which is often substantially higher. The weekly rate can be found in the Texas Credit Letter, published by the Texas Office of Consumer Credit Commissioner.

Texas usury laws impose severe penalties on creditors who charge excessive interest rates. If a creditor charges more than 6% interest without a written agreement, they may be liable to pay the debtor the greater of three times the excessive interest charged or $2,000 or 20% of the principal amount, whichever is less. If the creditor charges more than twice the legal rate of interest, they can also lose the principal amount of the debt and be charged with a misdemeanor, resulting in a criminal fine of up to $1,000.

To avoid these penalties, businesses should ensure they have a written agreement with customers to charge interest rates above 6% per year. The agreement can be in any form, such as a work order, estimate, proposal, or memo, as long as it includes the interest rate and is signed by the customer.

Phone Laws: Exempting Tesla Drivers?

You may want to see also

Penalties for usury in Texas

Usury laws in Texas place a limit on the amount of interest a creditor can charge. In Texas, the legal maximum interest rate is 6% unless otherwise specified. However, the usury rate in Texas is 10% per year, and any interest rate above this is considered usurious unless otherwise provided by law.

Texas law outlines various penalties for charging usurious interest, which are detailed in Chapter 305 of the Finance Code. These penalties apply to both civil liability and criminal penalties.

Civil Liability

In terms of civil liability, a creditor who charges a usurious interest rate is liable to the obligor for an amount that is equal to the greater of:

- Three times the amount computed by subtracting the amount of interest allowed by law from the total amount of interest contracted for, charged, or received; or

- $2,000 or 20% of the amount of the principal, whichever is less.

If the creditor charges and receives interest greater than twice the authorised rate, they are liable for the principal amount, the interest, and all other amounts charged and received.

Additionally, a creditor who is liable under the usury laws is also liable for the obligor's reasonable attorney's fees.

Criminal Penalty

Under Texas law, charging usurious interest on a transaction for personal, family, or household use is a criminal offence. Each contract or transaction that violates this provision is considered a separate offence, and the penalty is a misdemeanour punishable by a fine of up to $1,000.

Limitations and Exceptions

It is important to note that these penalties only apply to contracts or transactions subject to the relevant subtitle of the Finance Code. Additionally, there is a four-year limitation period for bringing an action under this chapter, and the obligor must provide written notice to the creditor at least 61 days before filing a lawsuit.

In the case of an accidental and bona fide error, a creditor is not subject to penalty under the usury laws. Furthermore, a creditor who corrects a violation within 60 days of receiving notice is not liable to the obligor.

Business Loans

While Texas law exempts certain types of loans from its interest rate limits, including business loans, commercial loans, and open-ended accounts, it is important to note that these exemptions do not apply if the interest rate exceeds the rate agreed upon by both parties.

Understanding HIPAA: Employer Rights and Responsibilities

You may want to see also

How to avoid usury charges

Usury laws in Texas state that interest rates are limited to 6% unless a written contract is signed, in which case the legal interest rate can be up to 18% per annum.

To avoid usury charges, it is important to understand the applicable laws and regulations. Here are some ways to avoid usury charges:

- Have a Written Contract: If you want to charge more than 6% interest, get a written agreement with the customer that specifies the higher interest rate. This can be in the form of a work order, estimate, proposal, or memo, as long as it clearly states the interest rate and is signed by the customer.

- Stay Informed on Interest Rate Limits: The weekly rate ceiling for interest rates in Texas can vary. Check the Texas Credit Letter, published weekly by the Texas Office of Consumer Credit Commissioner, to stay informed on the current maximum allowable interest rates.

- Understand "Interest": Texas law defines "interest" as "compensation for the use, forbearance, or detention of money." This does not include "time price differentials," which refer to amounts added to the price when a buyer chooses to pay after the time of sale instead of paying in cash at the time of sale.

- Avoid Excessive Interest: Usurious interest means interest that exceeds the maximum amount allowed by law. In Texas, this is typically 10% per year, except as otherwise provided by law. Be cautious when charging interest rates above this threshold to avoid violating usury laws.

- Utilize Usury Savings Clauses Carefully: Texas law allows lenders to include usury savings clauses in contracts to avoid liability. However, these clauses must be reasonable and cannot directly contradict the explicit terms of the contract. For example, you cannot contract for 30% interest and then use a savings clause to avoid usury penalties.

- Correct Usurious Charges Promptly: If you discover that you have charged a usurious rate, take corrective action within 60 days. Refund any excess interest to the customer, notify them of the usurious charge, and make the necessary adjustments to the account.

- Seek Legal Advice: Consult with a qualified attorney who specializes in Texas interest rate laws. They can provide specific guidance based on your unique circumstances and help ensure you remain compliant with the law.

By following these steps and staying informed about Texas usury laws, you can help protect yourself and your business from costly penalties and legal consequences associated with usury charges.

HOAs and Sunshine Laws: What's the Deal in Pennsylvania?

You may want to see also

Usury laws and payday loans

Usury laws refer to the legal limits on interest rates to protect consumers from excessive interest on loans. In Texas, interest rates are statutorily limited to 6% or 18% for interest rates on judgments. However, Texas law exempts certain types of loans from these limits, including business loans, commercial loans, investments, and open-end accounts. The usury rate in Texas is 10% annually, but this is rarely applied due to exceptions in Subchapter A of Chapter 303 of the Texas Finance Code, which allows rates up to the weekly ceiling, which was 18% as of April 16, 2019.

Payday loans, also known as cash advance loans, are short-term loans meant to provide quick access to funds for emergencies. They are typically unsecured and require no collateral, making them attractive to borrowers with bad credit or none at all. However, these loans come with high-interest rates and unreasonable terms, often resulting in a cycle of debt for borrowers. Payday loans are legal in Texas, and while they are subject to state regulation, the industry has exploited loopholes to continue offering high-interest loans.

While usury laws are meant to protect consumers from excessive interest rates, payday loans often fall outside the scope of these regulations due to industry lobbying and loopholes. This results in consumers paying extremely high interest on small loans, with annual rates often exceeding 300%. In some states, such as Nebraska, Hawaii, Illinois, New Mexico, and Minnesota, there have been efforts to cap payday loan rates at 36%, demonstrating a growing awareness of the negative impact of high-interest payday loans on consumers.

To summarize, usury laws in Texas set a maximum interest rate of 10% annually, but exceptions allow for higher rates. Payday loans are a form of short-term lending that often falls outside the scope of usury laws, leading to extremely high-interest rates that can trap borrowers in a cycle of debt. While some states have taken steps to cap payday loan rates, Texas continues to allow high-interest payday lending, highlighting the need for stronger consumer protection regulations.

HIPAA Laws and the President: Who's Exempt?

You may want to see also

Frequently asked questions

Usury laws regulate the amount of interest a lender can charge. They are designed to protect consumers from unreasonably high-interest rates on loans and credit cards.

The usury rate in Texas is 10% a year, except as otherwise provided by law. However, there are exceptions to this rule, and the weekly rate ceiling is often substantially higher.

Yes, usury laws apply to business loans in Texas. However, Texas law specifically exempts business loans from its interest rate limits.