Gasoline prices are determined by the laws of supply and demand. The law of demand states that demand for a product changes inversely to its price, i.e., demand for a product will decline as its price rises and vice versa. Gasoline is an inelastic product, meaning changes in its price have little influence on demand. However, there is evidence that periods of rising gasoline prices are associated with reduced gasoline consumption. This is particularly true in the long run, as consumers may trade in their cars for more fuel-efficient models or move closer to work.

| Characteristics | Values |

|---|---|

| Law of Supply and Demand | Applies to gasoline |

| Gasoline prices | Affected by supply and demand |

| Gas prices | Rise in response to geopolitical events that impact the oil market |

| Gas prices | Can move rapidly to balance supply and demand |

| Crude oil | Most important factor in setting gasoline prices |

| Crude oil | Widely traded global commodity |

| Crude oil | Among the most widely used global commodities |

| Crude oil | Market power of groups like OPEC has diminished over time |

| Crude oil | Development of alternative sources and growth in demand from developing countries |

| Gasoline grades | Third law of demand applies |

| Gasoline demand | More responsive to price changes than previously thought |

| Gasoline demand | Reduced when prices rise |

| Gasoline demand | Relatively inelastic |

What You'll Learn

Gasoline is a relatively inelastic product

Gasoline is considered a relatively inelastic product, meaning that changes in its price have little influence on demand. In other words, when the price of gasoline increases, consumers are likely to continue purchasing the same amount because they need it for their daily commutes, to get to work, or to travel to other important destinations. This is especially true in the United States, where most people rely on automobiles as their primary mode of transportation.

The inelastic nature of gasoline demand can be attributed to several factors. Firstly, gasoline is a necessity for many people, and reducing its consumption can be challenging even when the cost becomes high. Secondly, there are few substitute goods for gasoline. While individuals may consider public transportation, carpooling, or alternative energy vehicles, these options are often not feasible or widely available. For example, electric cars are more expensive than gas-fueled vehicles, and the infrastructure for charging these vehicles is not yet established in many places.

The law of demand states that as the price of a product increases, the demand for it will decrease, and vice versa. However, this law does not seem to apply to gasoline in the short term. Data suggests that even when the price of gasoline fluctuates, the consumption of gasoline remains relatively constant. For example, during the 2007-2009 economic recession in the United States, income and consumption generally decreased. Yet, despite the economic climate and changes in gasoline prices, households continued to consume the same amount of gasoline.

The price elasticity of gasoline demand measures how responsive consumers are to changes in gasoline prices. While most price elasticities are negative, indicating that an increase in price leads to lower demand, the price elasticity of gasoline is estimated to be in the range of 0.02 to 0.04 in the short term. This means that it would take a significant decrease in gasoline prices (25-50%) to see even a small increase (1%) in automobile travel.

In summary, gasoline is considered a relatively inelastic product due to its necessity in daily life and the lack of widely available substitute goods. Consumers tend to continue purchasing the same amount of gasoline despite price increases, making the demand for gasoline relatively insensitive to changes in price.

Prostitution Laws: Do They Hold Water at Sea?

You may want to see also

Demand for gasoline is comparatively inelastic

The law of demand states that demand for a product or resource will decline as its price rises and rise as the price drops. However, there are exceptions to this rule, and gasoline is one of them.

Demand for gasoline is considered comparatively inelastic, meaning that changes in price have little influence on demand. This is because gasoline is a necessity for many people's daily lives, especially in car-dependent countries like the United States. While people may be able to reduce their discretionary driving, they are less likely to be able to reduce their overall gasoline consumption.

This is reflected in data from the Consumer Expenditure Survey (CE), which suggests that individual households buy as many gallons of gas and travel as many or more miles regardless of the price of gasoline. For example, despite a 28% drop in the average retail price of gasoline in the United States from 2014 to December 2014, there was no significant change in automobile travel and gasoline consumption.

Some economists have argued that the demand for gasoline is not completely inelastic, and that over time, it can become more elastic as consumers may switch to more fuel-efficient cars or move closer to work. However, the general consensus is that the demand for gasoline is relatively inelastic in the short run.

Understanding Spring Laws: Regular vs Ideal Springs

You may want to see also

Gasoline prices are controlled by market forces of supply and demand

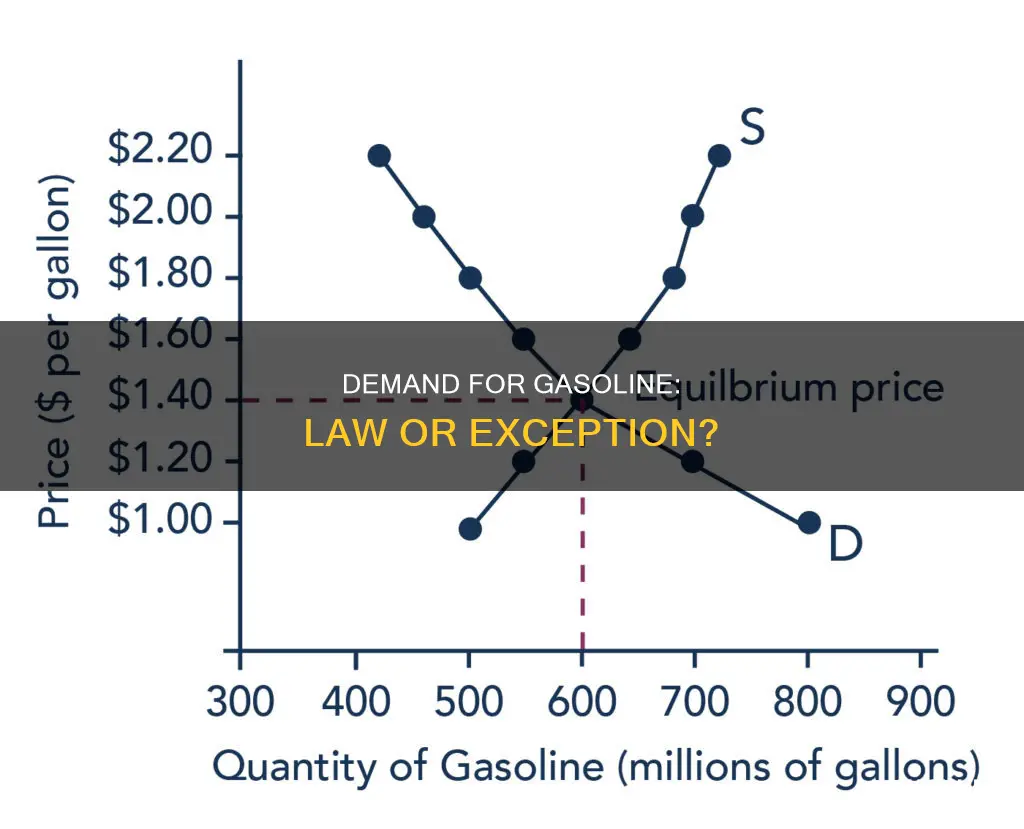

Gasoline prices are influenced by various factors, but ultimately, they are controlled by the market forces of supply and demand. The law of demand states that demand for a product decreases when prices rise and increases when prices fall. Conversely, the law of supply states that producers supply more of a product as prices rise and less as prices fall.

In the case of gasoline, the laws of supply and demand are at play, but there are also other factors at work. The price of crude oil is the most significant factor in determining gasoline prices, as it is the raw material used to make gasoline. In the decade up to 2020, the price of crude oil accounted for 56% of the price of gasoline on average. However, this percentage can vary widely, as seen in 2020 when crude oil prices dropped due to the COVID-19 pandemic, and in 2022 when they rose sharply due to the Russian invasion of Ukraine.

Refining costs and profits also play a role, as gasoline must be distilled from crude oil, which incurs costs for refiners. Additionally, gasoline production costs can vary due to seasonal and regional blending requirements and the cost of additives. Distribution and marketing costs, as well as taxes, also contribute to the final price of gasoline.

Consumer demand for gasoline is relatively inelastic, meaning that changes in price have a limited impact on demand. This is because most consumers rely on gasoline for their daily commutes and find it challenging to reduce their gasoline consumption significantly when faced with higher prices. However, over time, demand for gasoline can become more elastic as consumers may switch to more fuel-efficient vehicles or move closer to work.

Geopolitical events can also impact the oil market and, consequently, gasoline prices. For example, the COVID-19 pandemic caused a plunge in gasoline consumption, leading to a quick drop in prices. In contrast, the Russian invasion of Ukraine in 2022 led to a sharp increase in oil and gasoline prices.

In summary, gasoline prices are indeed controlled by the market forces of supply and demand, but they are also influenced by various other factors, including crude oil prices, refining costs, distribution and marketing costs, taxes, consumer behaviour, and geopolitical events. These factors interact with the laws of supply and demand to determine the price of gasoline in the market.

EEOC Laws: Who's Covered and Who's Exempt?

You may want to see also

Crude oil prices play a major role in setting gasoline prices

Gasoline prices are determined by market forces of supply and demand, and the price of crude oil is the primary determinant of the price at the pump. Crude oil is the raw commodity used to make gasoline, so crude oil prices play a major role in setting gasoline prices. According to the U.S. Energy Information Administration, the price of crude oil accounted for 56% of the price of gasoline in the decade through 2020, on average. However, this average masks significant fluctuations. For example, in 2020, with crude prices down sharply due to the COVID-19 pandemic, crude oil accounted for just 43% of gasoline costs. In contrast, in 2022, the Russian invasion of Ukraine caused both oil and gas prices to surge.

Crude oil prices are influenced by various factors, including geopolitics, global market fundamentals, supply and demand, inventories, seasonality, and financial market considerations. For instance, the 2008 financial crisis, the 2015 drop in oil prices, and the 2020 oil price war and pandemic significantly impacted oil prices. Additionally, the actions of organizations like OPEC (Organization of Petroleum Exporting Countries) can affect oil prices by manipulating the supply of oil in the world market.

The cost of refining crude oil into gasoline also contributes to the retail price of gasoline. Refining costs vary seasonally and by region due to different gasoline formulations required to reduce air emissions. Distribution and marketing costs, as well as federal, state, and local taxes, further add to the final price of gasoline.

Understanding the factors influencing crude oil prices and the subsequent impact on gasoline prices is crucial for investors, policymakers, and consumers. It helps predict market conditions, make economic decisions, and comprehend the broader economic landscape.

Space Laws: Do Legal Boundaries Extend Beyond Earth?

You may want to see also

Demand for gasoline is influenced by consumer income

The law of demand states that demand for a product or resource will decrease as its price increases, and vice versa. In the case of gasoline, this law holds true. When gasoline prices rise, consumers tend to reduce their consumption by driving less, adopting a more fuel-efficient driving style, or even trading in their cars for more fuel-efficient models.

Consumer income is a crucial factor influencing gasoline demand. Gasoline is considered a normal good, meaning that when consumer income rises, demand for gasoline increases, and when income falls, demand for gasoline decreases. This relationship is known as the income effect.

For example, during the COVID-19 pandemic in 2020, gasoline consumption plummeted due to reduced travel and economic activity, leading to a decrease in demand and a subsequent drop in prices. As the economy started to recover in 2021, gasoline consumption rebounded, driving up prices.

Additionally, expectations of future price changes can impact current demand. If consumers anticipate higher gasoline prices in the future, they may fill up their tanks more frequently or consider purchasing fuel-efficient vehicles to avoid higher costs down the line. On the other hand, if they expect prices to decrease, they may postpone their purchases, leading to a reduction in current demand.

It is worth noting that demand for gasoline is also influenced by other factors, such as the availability of substitute goods (e.g., public transportation or electric cars) and consumer preferences for fuel-efficient vehicles.

In summary, consumer income plays a significant role in shaping the demand for gasoline. As income levels rise, consumers are more likely to purchase and consume gasoline, contributing to an overall increase in demand. Conversely, during economic downturns or when income levels fall, demand for gasoline tends to decrease as consumers adjust their spending habits and driving behaviors.

Slander Laws: US Congress' Freedom or Restraint?

You may want to see also

Frequently asked questions

Yes, the law of demand applies to gasoline. The law of demand states that demand for a product changes inversely to its price when all else is equal. That is, the higher the price, the lower the level of demand. Gasoline prices are determined by market forces of supply and demand.

The law of demand holds that demand for a product changes inversely to its price. When the price of gasoline increases, demand for it decreases, and vice versa. Gasoline is considered a relatively inelastic product, meaning changes in prices have little influence on demand.

Consumer income, preferences, and willingness to substitute one product for another are among the most important determinants of demand for gasoline. For example, consumers may be willing to substitute gasoline with more fuel-efficient models or move closer to work in response to higher gasoline prices.

The equilibrium price is where the demand for gasoline matches its supply. The law of demand helps all players in the market, including investors, entrepreneurs, and economists, understand and forecast future market conditions. For instance, a company may decide to increase the price of gasoline, expecting a decrease in demand.