The law of demand is a fundamental economic principle that states that demand for a product or resource will decrease as its price increases and vice versa. This is derived from the law of diminishing marginal utility, which states that consumers use goods to satisfy their most urgent needs first, and that each additional unit consumed provides less utility. Consumers are therefore willing to pay less for a good as their utility decreases. This is reflected in a downward-sloping demand curve. The law of demand is critical in helping market players understand and predict future conditions, and in setting prices.

| Characteristics | Values |

|---|---|

| Relationship between price and quantity demanded | As the price increases, the quantity demanded decreases and vice versa |

| Relationship between utility and price | As utility increases, consumers are willing to pay more and vice versa |

| Consumer behaviour | Consumers will buy more of a good when its price falls and less when its price rises |

| Consumer priorities | Consumers prioritise their most urgent needs and wants |

| Consumer spending | Consumers have finite resources, so their spending on a given product is limited |

| Consumer choices | Consumers handle the law of diminishing marginal utility by consuming numerous different goods |

What You'll Learn

The law of demand and pricing

The law of demand is a fundamental principle of economics that describes the inverse relationship between the price of a good or service and the quantity demanded by consumers. According to the law of demand, as the price of a product increases, the demand for it decreases, and vice versa. This relationship is influenced by the law of diminishing marginal utility, which states that consumers derive less utility or satisfaction from each additional unit of a product as they consume more.

The law of demand plays a crucial role in pricing decisions for businesses. Companies use this law when setting prices for their products, understanding that consumers' willingness to pay decreases as their utility declines. For instance, during Black Friday sales, retailers offer discounted prices to stimulate demand. However, as the holiday approaches, larger markdowns are necessary to entice consumers, as their needs have already been met and their utility has diminished.

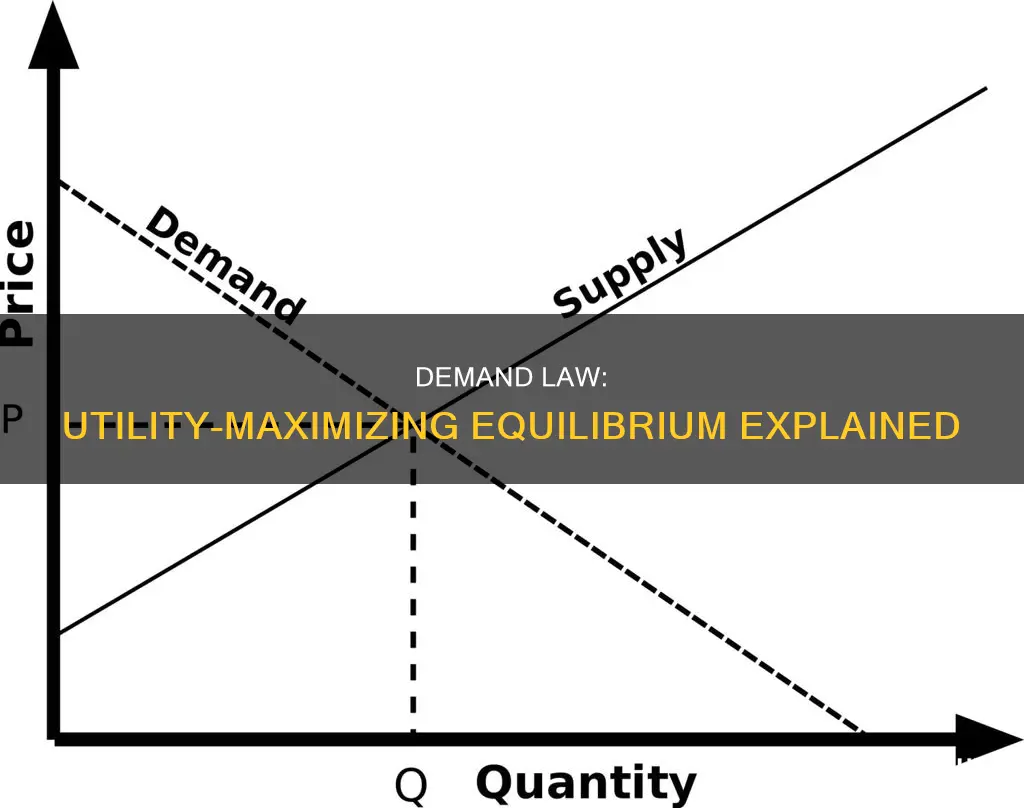

The law of demand also comes into play when determining the market-clearing price or equilibrium price. This is the point at which the quantity supplied equals the quantity demanded, creating a balance between supply and demand. At this price, buyers and sellers are satisfied, and there is no surplus or shortage in the market.

The law of demand is not absolute, and there are exceptions, such as Giffen goods and Veblen goods. Giffen goods are typically low-priced staples that exhibit an increase in demand when their price rises. This unusual behaviour is attributed to the income effect, where consumers' purchasing power is reduced, and they cannot afford higher-quality substitutes. On the other hand, Veblen goods are luxury items that gain in value as their price increases, signalling the owner's status and leading to higher demand.

In conclusion, the law of demand is a fundamental concept in economics that guides pricing strategies for businesses. It is influenced by the law of diminishing marginal utility, which reflects consumers' decreasing satisfaction with each additional unit of a product. By understanding the law of demand, companies can set prices that align with consumers' willingness to pay, maximising their profits and ensuring market equilibrium.

Vagrancy Laws: Whites Exempt or Included?

You may want to see also

Utility maximization and demand

The law of demand is a fundamental principle of economics that describes the inverse relationship between the price of a good or service and the quantity demanded by consumers. According to this law, as the price of a product increases, consumer demand decreases, and vice versa. This relationship is influenced by the law of diminishing marginal utility, which states that consumers derive less utility or satisfaction from each additional unit of consumption.

Utility maximization is the concept that individuals will make choices that provide them with the highest level of utility, given their budget and preferences. In the context of demand, this means that consumers will seek to purchase goods and services that maximise their utility within the constraints of their budget. As the price of a good increases, the marginal utility derived from each additional unit decreases, leading to a decrease in demand.

To illustrate this, let's consider an example. Suppose Mary Andrews consumes only apples, priced at $2 per pound, and oranges, priced at $1 per pound, and her budget allows her to spend $20 per month on fruit. To maximise her utility, she would adjust her consumption so that the ratio of marginal utility to price is the same for both apples and oranges. Initially, she might buy 5 pounds of apples and 10 pounds of oranges. However, if the price of apples decreases to $1 per pound due to a large harvest, the marginal utility of each dollar spent on apples increases. As a result, she will purchase more apples and may also buy fewer oranges to maintain the equilibrium.

This example demonstrates how changes in price can lead to adjustments in an individual's demand curve. The market demand curve is then derived by aggregating the individual demand curves of all consumers in the market. The law of demand asserts that demand curves are downward-sloping, reflecting the inverse relationship between price and quantity demanded.

The substitution and income effects also play a role in understanding utility maximisation and demand. When the price of a good decreases, consumers may substitute it for other goods, leading to an increase in demand for the cheaper good. Additionally, a decrease in price can increase consumers' purchasing power, allowing them to buy more goods and further influencing demand.

In summary, the law of demand describes the inverse relationship between price and quantity demanded, and it is influenced by the law of diminishing marginal utility. Consumers seek to maximise their utility within their budget constraints, leading to adjustments in individual demand curves. By aggregating these individual curves, we obtain the market demand curve. The substitution and income effects also impact demand, with lower prices leading to substitution of cheaper goods and increased purchasing power.

Right to Work Laws: Lockheed Martin's Legal Obligations

You may want to see also

The substitution and income effects of a price change

The Substitution Effect

The substitution effect refers to how consumers respond to a change in the relative prices of two goods. When the price of one good decreases, consumers may choose to buy more of it and less of the other good, assuming they are substitutes. Conversely, when the price of a good increases, consumers may substitute it with a cheaper alternative, leading to a decrease in demand for the good. This effect is particularly relevant when there are multiple substitutes available in the market.

For example, let's consider a scenario where the price of coffee increases. The substitution effect would predict that consumers of hot drinks may switch to drinking tea, leading to an increase in demand for tea. Conversely, if the price of coffee decreases, tea drinkers may substitute their daily tea with coffee, causing a decrease in demand for tea.

The Income Effect

The income effect, on the other hand, focuses on how a change in the price of a good affects a consumer's purchasing power or real income. When the price of a good decreases, it effectively increases the consumer's purchasing power, as they now have more money left to spend on other goods. This can lead to an increase in demand for complementary goods or normal goods. Conversely, when the price of a good increases, it reduces the consumer's disposable income, which may result in a decrease in demand for the good, especially if it is a normal good.

To illustrate the income effect, let's revisit the previous example. If the price of coffee increases, it may reduce the disposable income of consumers, leading to a decrease in the demand for coffee. Similarly, if the price of coffee decreases, consumers may now have more money left to spend on other goods, potentially increasing their demand for complementary products, such as milk or sugar.

Interaction of the Two Effects

It is important to note that the substitution and income effects often interact and influence each other. In the case of normal goods, the income effect reinforces the substitution effect. When the price of a normal good decreases, consumers not only substitute other goods with the now relatively cheaper good (substitution effect) but also have more money to spend on it (income effect). Conversely, when the price of a normal good increases, both effects work in the opposite direction, leading to a decrease in demand.

However, in the case of inferior goods, the income and substitution effects work against each other. When the price of an inferior good decreases, consumers may substitute other goods with it due to its lower price (substitution effect). At the same time, the lower price effectively makes them richer, reducing their demand for the inferior good (income effect).

Impact on Demand Elasticity

The magnitude of the substitution and income effects depends on various factors, including the availability of substitutes, the consumer's income, and the importance of the good in their budget. These effects play a crucial role in determining the price elasticity of demand. A larger substitution effect generally leads to a greater absolute value of price elasticity. Additionally, when the income effect moves in the same direction as the substitution effect, it contributes to a greater price elasticity of demand.

Do Frost Laws Apply to Dirt Roads?

You may want to see also

The income effect

However, for "inferior goods", the relationship is reversed: as income rises, demand for inferior goods falls. Inferior goods are typically low-priced, and as consumers become wealthier, they may opt for higher-quality, more expensive alternatives. An example could be store-brand items, which consumers may substitute for more expensive name brands as their income increases.

For normal goods, the income and substitution effects work in the same direction. A decrease in the price of a normal good will increase the quantity demanded because it is now cheaper than substitute goods, and because consumers can increase their overall consumption due to increased purchasing power.

For inferior goods, the income and substitution effects work in opposite directions. An increase in the price of an inferior good will cause consumers to seek substitute goods, but they will also want to consume less of any substitute normal goods because of their lower real income.

Copyright Law: Digital Songs and Legal Protection

You may want to see also

The law of diminishing marginal utility

The law of demand is a fundamental concept in economics, stating that the quantity demanded of a good or service varies inversely with its price. In simpler terms, when the price of a product increases, consumers will demand less of it, and vice versa. This law is derived from the law of diminishing marginal utility, which states that as consumption of a product increases, the marginal utility or satisfaction from each additional unit decreases.

Marginal utility refers to the incremental increase in utility or satisfaction that comes from consuming one more unit of a good or service. "Utility" is an economic term for the satisfaction or happiness a consumer gets from an economic act, such as buying a sandwich when hungry. The law of diminishing marginal utility suggests that the more of an item a person consumes, the less satisfaction they will get from each additional unit. For example, eating the first slice of pizza when hungry will be very satisfying, but as you eat more slices, the satisfaction from each additional slice will decrease. The same principle applies to various goods and services.

Additionally, the law influences businesses' workforce structure. For instance, a company may benefit from having three accountants, but if there is no real need for a third, hiring another may result in diminished utility due to minimal added benefit. In such cases, hiring an administrative assistant instead may provide higher utility.

The law also impacts the range of goods and services businesses offer. By diversifying their product lines, companies can avoid diminished marginal utility and encourage consumers to purchase more. For example, a pizza shop may offer salads to cater to customers who no longer want more pizza, thus maintaining high marginal utility for their products.

Lemon Law and Audio Equipment: What's Covered?

You may want to see also

Frequently asked questions

The law of demand is a fundamental economic principle that states that consumer demand for a product or resource will increase when prices fall, and decrease when prices rise. This is derived from the law of diminishing marginal utility, which states that consumers use or buy goods to satisfy their most urgent needs first. As a result, the first good or unit typically has the highest utility or benefit, and with each additional unit consumed, utility decreases.

The law of demand is used by companies when setting prices and determining the level of demand for their products. Consumers also use the law of demand when deciding how many goods to buy. For example, during Black Friday sales, consumers rush to buy products at deep discounts. As the holidays approach, however, the discounts must be greater to entice consumers to buy more products as their utility or satisfaction has declined.

The law of demand can impact companies as they can only lower their prices to a certain point before it has little to no impact on consumer demand. This is because, as consumers' urgent needs are met, their utility declines and they will demand lower prices.