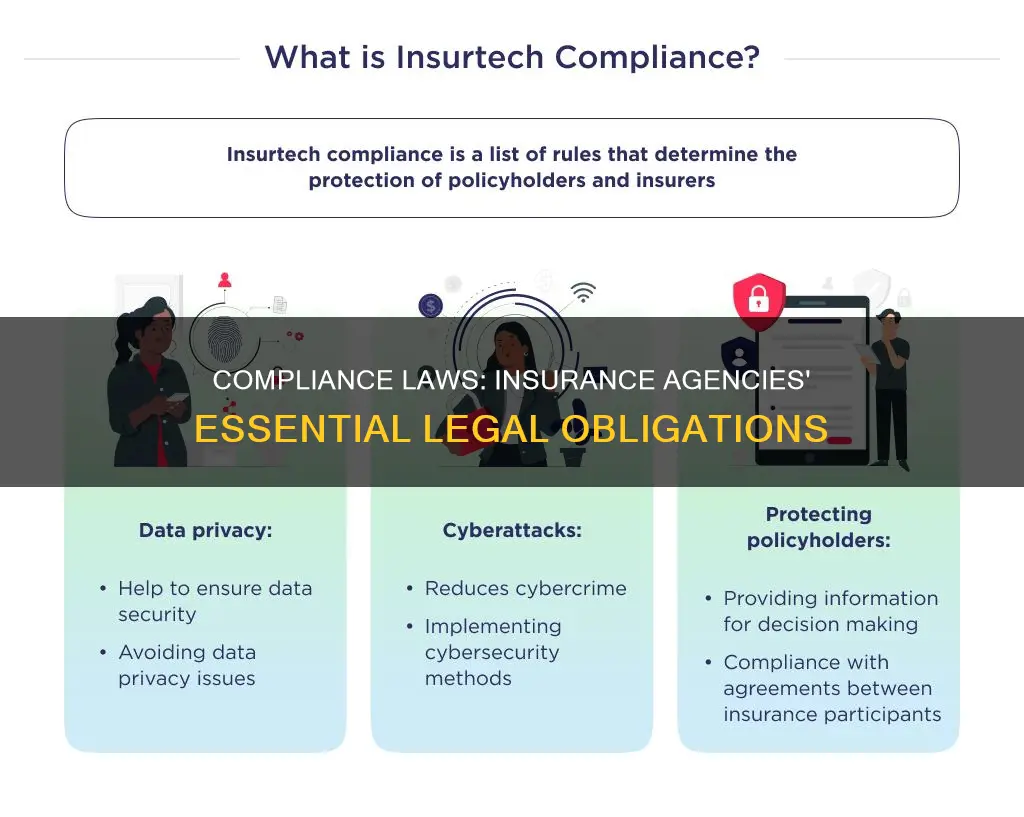

Insurance agencies must navigate a complex web of laws and regulations to uphold the highest standards of conduct. Compliance is a cornerstone of operational integrity for any insurance agency, but the intricate world of finance and insurance can make it challenging to keep up with the requirements of the relevant regulatory bodies. These requirements are designed to protect consumers and the overall insurance market, providing guidelines on how insurance companies should operate and setting standards to keep customer information secure.

| Characteristics | Values |

|---|---|

| Number of Regulatory Bodies | 57 (including state, territory, and federal agencies) |

| Regulatory Focus | Consumer data protection, anti-money laundering, and health insurance |

| Regulatory Bodies | National Association of Insurance Commissioners (NAIC), International Association of Insurance Supervisors (IAIS), Center for Consumer Insurance Information and Oversight (CCIIO), Centers for Medicare & Medicaid Services (CMS) |

| Compliance Requirements | Licensing, data security, anti-money laundering measures, compliance training, regular audits |

| Compliance Challenges | Data security, cross-border compliance, cost, keeping up with regulatory changes |

| Compliance Solutions | Agile compliance management system, state-of-the-art cybersecurity, automation, shared service models, digital tools |

What You'll Learn

Consumer data protection

Insurance companies are entrusted with vast amounts of sensitive customer data, including personal information, financial records, and health details. As such, they must comply with strict data protection requirements to maintain consumer trust and regulatory compliance. Failure to do so can result in severe penalties, reputational damage, and loss of customer trust. Here are some key aspects of consumer data protection for insurance agencies:

Regulatory Intelligence and Updates

Insurance providers must stay informed about the latest regulatory changes and updates in data protection laws and standards. This proactive approach enables them to adjust their compliance strategies and stay ahead of the evolving cyber threats.

Compliance Risk Assessment

Identifying and evaluating potential compliance risks is essential. By conducting regular risk assessments, insurers can focus their resources on areas with the highest risk of non-compliance and strengthen their data protection measures.

Robust Security Measures

Insurance companies must implement robust security measures to safeguard customer data. This includes encrypting data during transmission and storage, implementing strong access controls, regularly auditing systems for vulnerabilities, and monitoring user activity.

Data Minimization and Purpose Limitation

Insurance companies should collect and process only the minimum amount of personal data necessary for a specific, legitimate purpose. They must ensure that data is not retained for longer than needed and is used solely for the purposes for which it was collected.

Data Breach Response

Despite preventive measures, data breaches can still occur. Insurance agencies should have effective incident response plans to mitigate the impact on affected individuals and the organization. Prompt detection and response to data breaches are crucial for minimizing potential legal and reputational consequences.

Compliance with Specialized Legislation

In the US, insurance companies must comply with specialized legislation such as the Health Insurance Portability and Accountability Act (HIPAA), the Graham-Leach-Bliley Act (GLBA), and the Sarbanes-Oxley Act (SOX). These laws impose stringent requirements on the protection of personal data, particularly in the insurance and healthcare sectors.

International Standards

Insurance agencies should also adhere to international standards, such as the Payment Card Industry Data Security Standard (PCI DSS), which safeguards the security of credit card processing. If they accept credit cards or store cardholder information, a PCI DSS compliance system is essential.

The Domination's Power Over Law's End

You may want to see also

Anti-money laundering regulations

Insurance agencies are subject to a range of compliance laws and regulations, including those related to anti-money laundering (AML). AML regulations are particularly important in the insurance industry as insurance companies are prime targets for money laundering due to the nature of their products.

In the United States, the Financial Crimes Enforcement Network (FinCEN) has issued final rules requiring certain insurance companies to establish AML programs and file Suspicious Activity Reports. These rules apply to insurance companies that issue or underwrite products with a high degree of risk for money laundering, terrorist financing, or other illicit activities. This includes permanent life insurance policies, annuity contracts, and any other insurance products with cash value or investment features.

To comply with FinCEN's rules, insurance companies must establish a program with the following four basic elements:

- A compliance officer: This individual is responsible for ensuring the effective implementation of the AML program. They should have sufficient authority and be familiar with the company's operations, the AML program, and relevant laws and regulations.

- Written policies, procedures, and internal controls: These should be designed to control the risks of money laundering, terrorist financing, and financial crime associated with the company's business. They should be based on an assessment of the company's specific risks and vulnerabilities.

- Ongoing training: Appropriate persons within the company, including employees, agents, and brokers, should receive ongoing training on their responsibilities under the AML program. The training should be tailored to the individual's duties and clearly understood.

- Independent testing: The company should conduct independent testing to monitor and maintain the adequacy of the AML program. This involves evaluating the success of the program and its compliance with the relevant rules.

It is important to note that insurance agents and brokers are not required to establish separate AML programs. However, they are an integral part of the insurance industry and play a critical role in assisting the insurance company in preventing money laundering. Therefore, insurance companies must integrate their agents and brokers into their AML programs and monitor their compliance.

By adhering to these AML regulations, insurance companies can protect themselves and their customers from financial crimes and maintain the integrity of the financial system.

Title IX Law: Does It Extend to Elementary Education?

You may want to see also

Compliance risk assessment

Regulatory Intelligence and Updates:

Staying vigilant about the latest regulatory changes is essential. Insurance agencies must proactively stay informed about legislative updates and adjust their compliance strategies accordingly. This proactive approach enables them to allocate resources effectively and focus on areas with the highest risk of non-compliance.

Identifying and Assessing Compliance Risks:

Insurance agencies need to identify and evaluate potential compliance risks. This involves understanding the full spectrum of compliance risks within their organization, including consumer protection laws, anti-money laundering regulations, and data security measures. By conducting a thorough internal gap analysis, insurance agencies can pinpoint specific risks related to compliance and allocate resources to mitigate those risks effectively.

Compliance Training and Education:

Regular and comprehensive training programs are crucial for instilling a culture of compliance among employees. These programs should cover a range of topics specific to the insurance industry, including consumer data protection, anti-money laundering measures, and ethical practices. By investing in staff training, insurance agencies can raise awareness about compliance risks and promote a culture of compliance throughout the organization.

Robust Data Security Measures:

In today's digital age, protecting consumer data is of paramount importance. Insurance agencies must implement robust data security measures and privacy policies to safeguard sensitive customer information. This includes investing in state-of-the-art cybersecurity technologies and regularly training staff on data protection protocols to prevent data breaches and mitigate the risk of non-compliance.

Monitoring and Reporting:

Ongoing monitoring of compliance processes is essential to ensure they are functioning as intended. Insurance agencies should establish transparent reporting systems to document compliance efforts, identify areas for improvement, and demonstrate regulatory compliance. Additionally, monitoring can help identify weaknesses in controls and enhance them to meet the institution's risk appetite and regulatory requirements.

Collaboration with Regulators and Compliance Professionals:

Cultivating partnerships with regulators and compliance professionals is beneficial. By collaborating with experts, insurance agencies can gain valuable insights into best practices, stay aligned with regulatory expectations, and navigate the complex world of finance and insurance more effectively. These partnerships contribute to a dynamic compliance program that adapts to the ever-evolving regulatory landscape.

Sharia Law and Non-Muslims: Who Does It Affect?

You may want to see also

Regulatory intelligence and updates

Insurance providers must remain vigilant and informed about the latest regulatory changes. They need to be proactive in adjusting their compliance strategies to stay ahead of legislative updates. This is particularly challenging due to the complex web of laws and regulations that insurance agencies must navigate to uphold the highest standards of conduct. Compliance requirements vary depending on the jurisdiction, product offerings, and other factors.

In the United States, insurance compliance is governed at both the state and federal levels. State laws take precedence, with each state having its own insurance regulatory agency. The McCarran-Ferguson Act establishes that Congressional regulations for the insurance industry do not override state laws or regulations. This means that insurance companies must first comply with state regulations and then adhere to federal laws where state laws do not apply.

The National Association of Insurance Commissioners (NAIC) is a U.S. body that sets regulatory standards and provides support and guidance to insurance companies. It is composed of chief insurance regulators from all 50 states, the District of Columbia, and the five U.S. territories. While the NAIC sets standards, each state has the autonomy to adopt and adapt these rules based on their specific requirements.

At the international level, the insurance sector is guided by standards set by the International Association of Insurance Supervisors (IAIS). The IAIS is a non-profit, voluntary membership organisation with members from over 200 jurisdictions, covering 97% of the world's insurance premiums. Their objective is to maintain fair and secure insurance markets through effective supervision of the industry.

To manage the dynamic nature of compliance, insurance agencies should implement agile compliance management systems that can quickly adapt to regulatory changes. This includes staying informed about updates to data protection laws, consumer privacy rights, and industry-specific regulations such as those related to health insurance and financial data.

Additionally, insurance agencies should engage with leadership and stakeholders to establish a strong culture of compliance throughout the organisation. Regular training programs are essential to instil a sense of compliance among employees, covering the spectrum of compliance obligations specific to the insurance industry.

Stop and Frisk: Does It Extend to Motor Vehicles?

You may want to see also

Compliance training and education

Training should cover the latest regulatory changes, enabling employees to adjust their strategies proactively. It should also cover compliance risk assessments, helping employees identify and evaluate potential compliance risks, and focus their attention on areas with the highest risk of non-compliance.

Compliance training should also cover policies and procedures, ensuring that employees understand the importance of thorough, accessible, and regularly reviewed policies and procedures that meet regulatory requirements.

Additionally, training on monitoring and reporting can help employees understand the importance of ongoing monitoring of compliance processes and transparent reporting systems for documenting compliance efforts and identifying areas for improvement.

With the constant evolution of technology and the increasing sophistication of cyber threats, compliance training should also cover data security measures and privacy policies. This includes educating employees about the latest cyber threats, such as phishing, system intrusion, and human error, as well as training on data encryption, secure access control measures, and incident response plans.

Furthermore, as insurance companies often partner with third-party vendors, compliance training should address the risks associated with third-party security. Employees should be trained to monitor and audit third-party vendors, ensuring they comply with cybersecurity standards and contractual security arrangements.

Overall, compliance training and education empower employees to navigate the complex web of laws and regulations in the insurance industry, fostering a culture of compliance and helping to protect consumers and the reputation of the insurance organisation.

Left Lane Laws: Texas Toll Roads Explained

You may want to see also

Frequently asked questions

A successful compliance program is a dynamic system that adapts to the ever-evolving regulatory landscape. The critical components for robust compliance in the insurance sector include:

- Regulatory Intelligence and Updates: Staying informed about the latest regulatory changes and making proactive compliance strategy adjustments.

- Compliance Risk Assessment: Identifying and evaluating potential compliance risks to focus resources on areas with the highest risk of non-compliance.

- Policies and Procedures: Developing thorough, accessible, and regularly reviewed policies and procedures that meet regulatory requirements.

- Compliance Training and Education: Conducting regular training programs to instill a culture of compliance among employees.

- Monitoring and Reporting: Ongoing monitoring of compliance processes and transparent reporting to document compliance efforts and identify areas for improvement.

- Consumer Data Protection: Implementing robust data security measures and privacy policies to maintain consumer trust and regulatory compliance.

Insurance agencies must comply with various laws and regulations depending on their jurisdiction and the type of insurance services they provide. Some key compliance requirements include:

- Data Protection Requirements: Insurance agencies handle sensitive customer data and must comply with regulations such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Gramm–Leach–Bliley Act (GLBA).

- Anti-Money Laundering (AML) Regulations: Insurance agencies must have controls, processes, and procedures in place to manage the risk of money laundering.

- Licensing Requirements: Insurance agencies and individual agents must be licensed to sell insurance, and licenses must be renewed periodically.

- Health Insurance Compliance: Health insurance carriers must comply with laws and regulations specific to the healthcare industry, such as the Affordable Care Act (ACA) or "Obamacare."

Non-compliance with insurance regulations can result in several negative consequences, including:

- Financial Penalties: Fines and punitive damages can impact the finances of insurance providers.

- Restrictions on Business Operations: Non-compliance can lead to sanctions and restrictions on conducting business, including license suspensions.

- Reputational Damage: Failure to comply with regulations can result in loss of consumer trust and damage to the reputation of the insurance agency.

- Legal Accountability: State regulations impose severe penalties and legal consequences for non-compliance to safeguard customers from fraudulent insurance practices.