401(k) plans are a popular way for both employers and employees to save money for retirement. These plans are regulated by a variety of federal and state laws, with the primary legislation being the Employee Retirement Income Security Act (ERISA) of 1974 and the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. ERISA outlines the rights of consumers with assets in retirement accounts, while the SECURE Act aims to make 401(k) plans more flexible and accessible. With a 401(k) plan, employees can contribute a portion of their wages to individual accounts, and employers can also contribute. These contributions are typically invested in a portfolio of stocks, bonds, mutual funds, and other investment options. While 401(k) plans offer tax benefits, there are also rules and requirements that businesses must follow to set up and maintain these plans, ensuring compliance with ERISA and the Internal Revenue Code.

| Characteristics | Values |

|---|---|

| Type of plan | Retirement plan |

| Regulation | Regulated by federal and state laws, primarily the Employee Retirement Income Security Act (ERISA) and the Setting Every Community Up for Retirement Enhancement (SECURE) Act |

| Contributions | Employees can contribute a percentage of their salary before tax; employers can also contribute |

| Taxation | Contributions are tax-free until withdrawal; taxable income upon withdrawal |

| Eligibility | Must have at least one year of service (1,000 hours in a 12-month period) |

| Vesting | Employees own 100% of their contributions immediately; employer contributions vest over time according to a vesting schedule |

| Distribution | Distributions can be made at age 59 1/2 or in certain circumstances, such as financial hardship or disability; withdrawals before this age are subject to a 10% penalty |

| Administration | Plan administrators must regularly inform participants about features and funding; must follow ERISA and Internal Revenue Code regulations |

What You'll Learn

The Employee Retirement Income Security Act (ERISA)

ERISA ensures minimum standards are set for most private industry pension and health plans, as well as other benefit plans such as life insurance. The law also covers other forms of employee benefits, including health insurance plans and retirement accounts.

Under ERISA, employees must be notified of benefit plan terms, including funding, coverage, and costs. The law also offers protections against fiduciary wrongdoing. Employees are granted the right to sue for benefits and breaches of fiduciary duty.

ERISA is enforced by the Employee Benefits Security Administration (EBSA), a unit of the Department of Labor (DOL). The law was passed in response to growing concerns over the mismanagement of pension plans, and it provides protection to individuals enrolled in these plans.

ERISA's vesting rules ensure that employees have the opportunity to accrue benefits within a specified time frame. Vesting refers to the ownership of benefits accrued through employment. The law sets forth guidelines that require employers to establish reasonable vesting requirements, allowing employees to gradually become entitled to their earned benefits.

ERISA also covers defined contribution plans, such as 401(k) plans, which are based on contributions made by the employee or employer. The future benefits of defined contribution plans vary based on investment performance.

Faraday's Law: Non-Uniform Magnetic Fields Explained

You may want to see also

Setting Every Community Up for Retirement Enhancement (SECURE) Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law by President Donald Trump on December 20, 2019, as part of the Further Consolidated Appropriations Act, 2020. The SECURE Act was designed to address the retirement savings shortfall that many Americans face. It encourages more employers to offer retirement plans and incentivizes employees to participate in them.

The SECURE Act makes it easier for small businesses to offer their employees 401(k) plans and provides tax credits and protections for collective Multiple Employer Plans (MEPs). MEPs allow unrelated small employers to join together to establish a shared 401(k) plan. This enables small businesses to pool resources and mitigate the administrative expenses of establishing a plan. The SECURE Act also shields employers who join an MEP from liability for potential misconduct by other employers in the same plan.

The Act also removes the maximum age limit on retirement contributions, previously capped at 70.5 years, and raises the required minimum distribution (RMD) age to 72 (as of January 1, 2023, this was raised to 73). It allows workers to contribute to traditional Individual Retirement Accounts (IRAs) after turning 70.5 years old.

The SECURE Act also permits penalty-free withdrawals of up to $5,000 from retirement plans for the birth or adoption of a child. It relaxes rules on employers offering annuities through sponsored retirement plans and shields employers from liability if the insurance company selling the annuity commits fraud or collapses, provided they meet specific regulatory requirements.

The Act also allows individuals to use up to $10,000 from 529 education savings plans to repay student loans. It revises components of the Tax Cuts and Jobs Act that raised taxes on benefits received by family members of students, some Native Americans, and deceased veterans. It also eliminates the "stretch IRA" estate planning strategy, which permitted non-spouse beneficiaries of IRAs to spread disbursements from the inherited money over their lifetimes. The new limit is within 10 years of the death of the original account holder.

International Law: Domestic Legal Systems and Their Applications

You may want to see also

Qualification requirements

To qualify for the tax benefits available to 401(k) plans, the plan must meet certain requirements (qualification rules) of the tax law and be operated in accordance with the plan's provisions. Here are some of the key qualification rules:

- Plan assets must not be diverted: The plan must ensure that its assets are only used for the benefit of employees and their beneficiaries, and not diverted to the employer or other purposes.

- Contributions or benefits must not discriminate: The plan must not favour highly compensated employees. In 2024, employees with compensation of $155,000 or more from the prior year are considered highly compensated.

- Contributions and allocations are limited: Contributions to a 401(k) plan must not exceed certain limits set by the IRC. These limits apply to the total amount of employer contributions, employee elective deferrals, and forfeitures credited to the participant's account during the year.

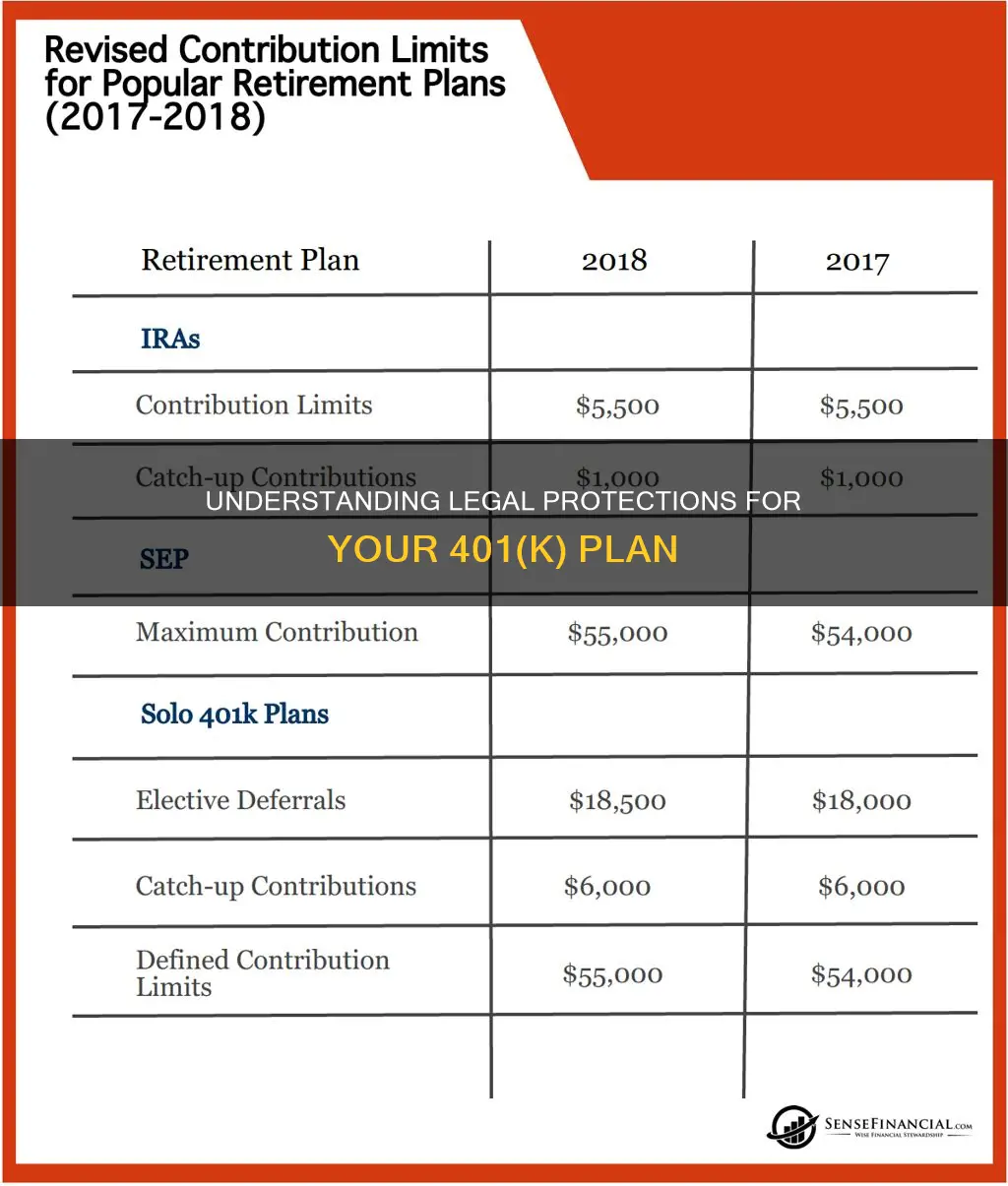

- Elective deferrals must be limited: Plans must limit 401(k) elective deferrals to the amount specified in IRC section 402(g) for that year. The elective deferral limit is $23,000 in 2024. A 401(k) plan may also allow participants aged 50 and older to make additional catch-up contributions.

- Minimum vesting standards must be met: A 401(k) plan must satisfy certain requirements regarding when benefits vest, i.e., when participants acquire ownership of their account. All participants must be fully (100%) vested in their 401(k) elective deferrals. A traditional 401(k) plan may require a specific number of years of service for vesting in employer discretionary or matching contributions.

- Employee participation standards must be met: In general, an employee must be allowed to participate in a qualified retirement plan if they have at least one year of service. A plan cannot exclude an employee based on age.

- Distribution rules must be followed: Distributions cannot be made until a "distributable event" occurs, such as the employee's death, disability, or severance from employment; the plan ending; or the employee reaching age 59½ or suffering a financial hardship.

- Benefits must not be assigned or alienated: The plan must provide that its benefits cannot be assigned or alienated. Loans from the plan to participants or beneficiaries are generally treated as assignments or alienations unless they meet certain requirements, such as being available to all participants on a reasonably equivalent basis and bearing a reasonable rate of interest.

- Top-heavy plan requirements must be met: A plan is top-heavy if the total value of accrued benefits or account balances of key employees is more than 60% of the total value of all employees' benefits or balances. Additional requirements apply to top-heavy plans, such as the requirement that non-key employees receive a minimum contribution.

The Levitical Laws: Did Jewish Kings Obey?

You may want to see also

Distribution rules

Timing of Distributions

Generally, distributions from 401(k) plans are restricted until an individual reaches the age of 59 and a half. Early withdrawals often attract a 10% additional tax penalty unless certain exceptions are met, such as emergency withdrawals or specific circumstances like disability or adoption. Once an individual reaches the age of 72, they are required to start making withdrawals, known as Required Minimum Distributions (RMDs). The SECURE Act of 2019 pushed back this age to 73 for those born between 1951 and 1959, and 75 for those born in 1960 or later.

Distributable Events

According to the Internal Revenue Service, distributions cannot be made until a "distributable event" occurs. These events include the death of the employee, disability, or severance from employment. Additionally, reaching the age of 59 and a half or experiencing a financial hardship are also considered distributable events.

Consent Requirements

In certain situations, the plan administrator must obtain consent from the individual before making a distribution. If the account balance exceeds $5,000, consent is typically required. Additionally, depending on the type of benefit distribution, spousal consent may also be necessary.

Distribution Amounts

The amount that can be distributed from a 401(k) plan is subject to limits. For 2024, the elective deferral limit is $23,000, with a catch-up contribution of $6,500 allowed for those aged 50 and over. These limits are subject to cost-of-living adjustments and may vary from year to year.

Distribution Forms

Distributions from 401(k) plans can take different forms, including nonperiodic distributions such as lump-sum payments, or periodic distributions like annuity or installment payments.

Taxation of Distributions

Distributions from 401(k) plans are typically taxable unless rolled over into another qualified retirement plan or traditional Individual Retirement Account (IRA). If an individual receives a lump-sum distribution, they may be able to elect different methods of figuring the tax on the distribution. The tax rate for distributions depends on the federal tax bracket at the time of withdrawal.

Hardship Distributions

Hardship distributions are allowed in certain circumstances, such as immediate and heavy financial needs. These include medical expenses, costs related to the purchase of a principal residence, educational expenses, preventing eviction or foreclosure, funeral expenses, and certain expenses related to disasters or repairs to the primary residence.

Rollovers

A rollover occurs when funds are transferred from one qualified retirement plan to another or to a traditional IRA. This transaction is not taxable, but it must be reported. If a distribution is made and not rolled over, any taxable amount must be included in income for the year.

Loans from 401(k) Plans

Some 401(k) plans permit participants to borrow from their vested account balance, usually up to a maximum of $50,000 or 50% of the balance. These loans must be repaid within a specified timeframe and are subject to specific criteria and tax considerations.

In summary, the distribution rules for 401(k) plans are comprehensive and aim to provide flexibility while also ensuring the preservation of retirement funds. These rules are governed by federal laws and are designed to balance access to funds with the long-term goal of retirement savings.

Usury Laws: Do They Apply to Business Loans?

You may want to see also

Compliance considerations

Another important piece of legislation is the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, which aims to make 401(k) plans more flexible and encourage both employers and employees to sign up. The SECURE Act allows small employers to set up 401(k)s more easily, enables businesses to sign up part-time employees, pushes back the age for required minimum distributions, permits penalty-free withdrawals for the costs of having or adopting a child, and encourages plan sponsors to include annuities as an option.

To qualify for the tax benefits of a 401(k) plan, the plan must meet certain requirements, including that plan assets must not be diverted for purposes other than the benefit of employees and their beneficiaries, contributions and benefits must not discriminate in favour of highly compensated employees, contributions and allocations are limited, elective deferrals must be limited, a minimum vesting standard must be met, employee participation standards must be met, distribution rules must be followed, benefits must not be assigned or alienated, and top-heavy plan requirements must be met.

Additionally, 401(k) plans must comply with government filings, such as Form 5500, which provides plan details to the IRS and the Department of Labor. ERISA fidelity bonds are also required to protect plan assets from theft or wrongdoing. 401(k) nondiscrimination testing is performed annually to ensure that highly compensated employees are not benefiting disproportionately.

Sovereign Citizenship: Lawful or Lawless?

You may want to see also

Frequently asked questions

The two primary laws that affect 401k plans are the Employee Retirement Income Security Act (ERISA) of 1974 and the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019.

ERISA is a federal law that protects the retirement assets of American workers. The law outlines the rights of consumers whose assets are invested in retirement accounts, including 401(k) plans. It also sets minimum standards for participation, vesting, benefit accrual, and funding.

The SECURE Act was passed in 2019 to make 401(k) plans more flexible and encourage both employers and employees to sign up. It provides tax credits and makes the 401(k) provisions more flexible.

Yes, 401(k) plans are regulated by a variety of federal and state laws. In addition to ERISA and the SECURE Act, there are also specific rules and requirements that must be followed for a plan to qualify for tax benefits, such as the Internal Revenue Code Section 401(a) and 401(k).

Different aspects of 401(k) plans are regulated by different federal agencies. ERISA, for example, is enforced by the Employee Benefits Security Administration (EBSA), a unit of the Department of Labor (DOL).