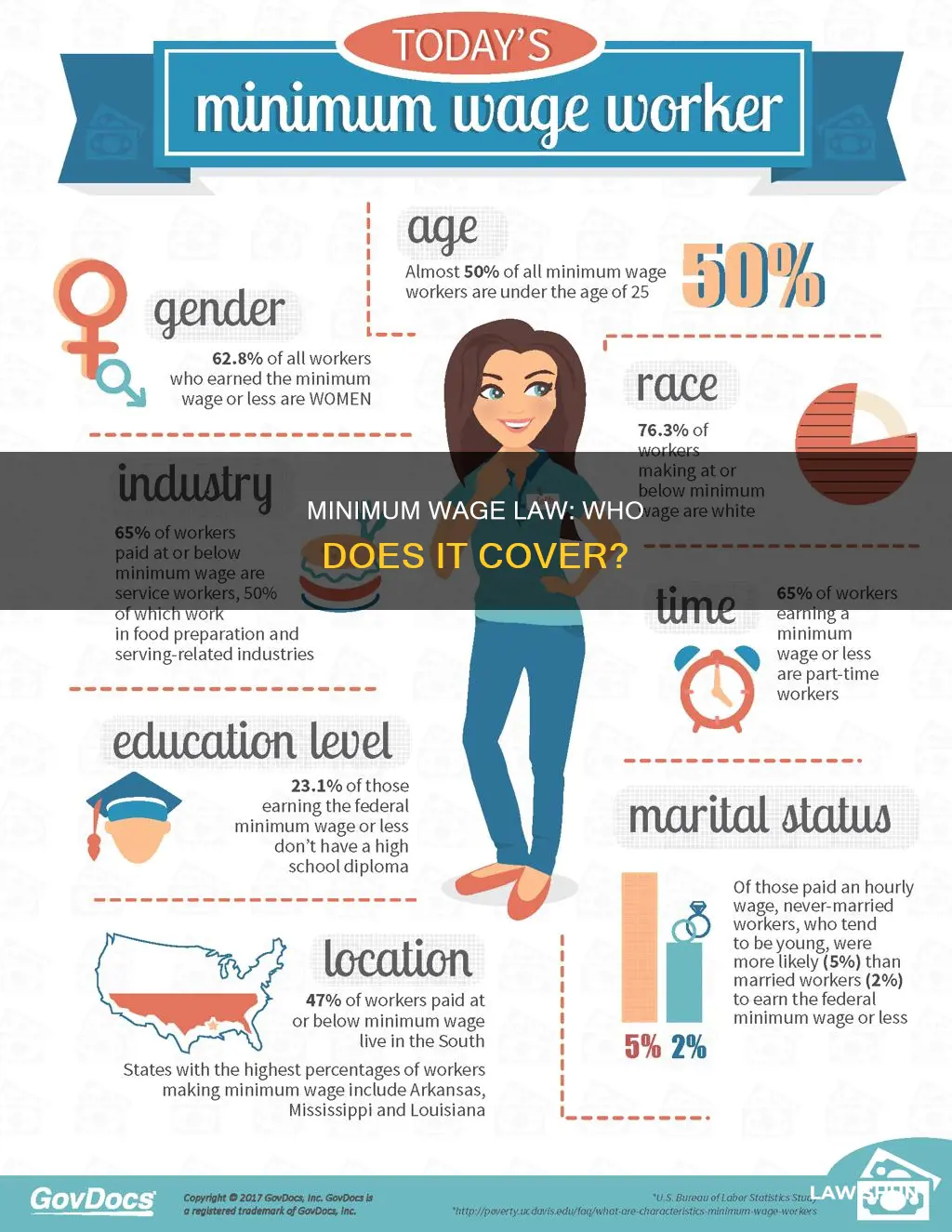

The minimum wage law is a complex topic, with federal, state, and local laws all playing a role in determining the minimum amount that employees must be paid. The Fair Labor Standards Act (FLSA) sets the federal minimum wage, currently $7.25 per hour, but many states and local governments have enacted their own minimum wage laws, which may be higher than the federal minimum. In cases where an employee is subject to multiple minimum wage laws, they are entitled to the highest of the wages.

While the minimum wage is typically discussed in terms of an hourly rate, it applies to all forms of compensation, including salary, commission, and piece rate, as long as the total compensation divided by hours worked is at least the minimum wage. Additionally, the minimum wage law does not only apply to hourly workers; it covers all employees except those who are exempt, such as independent contractors, outside salespeople, and workers on small farms.

There are also special considerations for tipped employees, who may be paid a lower base wage, with tips making up the difference to reach the minimum wage. However, employers must ensure that the total compensation, including tips, meets or exceeds the minimum wage.

| Characteristics | Values |

|---|---|

| Federal Minimum Wage | $7.25 per hour |

| Youth Minimum Wage | $4.25 per hour for the first 90 days of employment for workers under 20 |

| Tipped Employees Minimum Wage | $2.13 per hour |

| Tipped Employees Minimum Wage (if tips + hourly rate < $7.25) | Employer must pay the difference |

| Tipped Employees Minimum Wage (if tips + hourly rate > $7.25) | Employer must pay the full hourly rate of $7.25 |

| State Minimum Wage | May be higher than the federal minimum wage |

| Local Minimum Wage | May be higher than the federal or state minimum wage |

| Exemptions | Farm workers, seasonal workers, newspaper deliverers, "informal" workers (babysitters, etc.), students, apprentices, employees with disabilities, employees in American Samoa and some employees in Puerto Rico |

Farm workers

There are also specific exemptions to the minimum wage requirement, including employers who did not use more than 500 "man-days" of agricultural labor in any calendar quarter of the preceding calendar year. In this case, a "man-day" is defined as any day during which an employee performs agricultural work for at least one hour.

Other exemptions from the minimum wage and overtime provisions for agricultural employees include:

- Agricultural employees who are immediate family members of their employer

- Those principally engaged in the range production of livestock

- Local hand harvest labourers who commute daily from their permanent residence, are paid on a piece-rate basis in traditionally piece-rated occupations, and were engaged in agriculture less than 13 weeks during the preceding calendar year

- Non-local minors aged 16 or under, who are hand harvesters, paid on a piece-rate basis in traditionally piece-rated occupations, employed on the same farm as their parent, and paid the same piece rate as those over 16

It is important to note that individual states have the power to enact their own minimum wage requirements, as long as they meet the minimum requirements of the FLSA. While most states that have set their own minimum wage include agricultural workers, some do not. In these cases, agricultural workers who meet the FLSA requirements must still be paid at least the federal minimum wage.

International Copyright Laws: Global Application and Enforcement

You may want to see also

Tipped employees

In the United States, tipped employees are those who regularly receive more than $30 a month in tips. Under federal law, employers are permitted to pay tipped employees a cash wage of as little as $2.13 per hour. However, if the cash wage and the tips earned do not add up to at least the federal minimum wage of $7.25 per hour, the employer is required to make up the difference. This means that tipped employees are guaranteed to earn at least minimum wage and can earn more than minimum wage through tips.

Some states have different laws that require a higher direct wage amount for tipped employees. For example, in California, employers cannot use an employee's tips as a credit towards their obligation to pay the minimum wage. Instead, employees must receive the minimum wage plus any tips left by customers.

When it comes to tip pooling, federal law allows employers to require employees to share or "pool" tips with other eligible employees. Traditional tip pooling involves only employees who customarily receive tips, such as waiters, bellhops, and bartenders. In this case, employers must notify employees of the required tip pool contribution amount and can only take a tip credit for the tips each employee ultimately receives. On the other hand, non-traditional tip pooling includes employees who do not customarily receive tips, such as cooks and dishwashers. In this case, employers can require tipped employees to share tips with non-tipped employees, but only if all workers receive a direct cash wage of at least the federal minimum wage.

It is important to note that employers, managers, and supervisors are prohibited from keeping any portion of employees' tips, regardless of whether the employer takes a tip credit. Additionally, deductions for walkouts, breakage, or cash register shortages that reduce the employee's wages below the minimum wage are illegal.

Gift Tax and Your Child-in-Law: What You Need to Know

You may want to see also

Youth workers

In the UK, the National Minimum Wage (NMW) is the minimum amount that people classed as 'workers' must be paid per hour. This includes youth workers, as long as they are over school leaving age (usually 16). The NMW for workers varies depending on their age, with lower minimum rates for younger workers. For example, as of April 2020, the NMW for workers aged 25 and over is £8.72 per hour, while the rate for 16-17-year-olds is £4.55 per hour.

The NMW rates are set by the Low Pay Commission (LPC), an independent body that advises the government. The LPC's goal is to recommend NMW rates that are as high as possible without damaging employment. The LPC has found that younger workers are more at risk of being priced out of jobs than older workers and are more likely to experience negative long-term effects if they spend time out of work. Additionally, younger workers tend to have less experience and a weaker bargaining position when negotiating pay. As a result, the LPC sets lower minimum wages for younger workers to protect their employment prospects.

It's important to note that the NMW is a floor, not a ceiling, and employers can choose to pay above the minimum rate. Some employers pay all their employees the same rate, regardless of age, to appear fair and attract young people to work for them.

Thermodynamics Laws: Sustainability's Guiding Principles

You may want to see also

Students

The FLSA also includes a Student-Learner Program, which allows students aged 16 or older and enrolled in a vocational school to be hired for as little as 75% of the regular minimum wage. Employers must obtain a certificate from the Department of Labor to be eligible for this program.

It is important to note that the minimum wage laws can vary depending on the state and local regulations. In some cases, states may have a higher minimum wage than the federal requirement. Therefore, it is essential to refer to the specific laws and regulations in your state or locality to understand the exact minimum wage requirements for students.

Understanding Lemon Law Recall Rights and Timelines

You may want to see also

Workers with disabilities

The Fair Labor Standards Act (FLSA) permits employers to pay workers with disabilities less than the federal minimum wage. This is known as the subminimum wage. The federal minimum wage in the US is $7.25 per hour, but there is no lower limit for workers with disabilities. Some workers with disabilities have earned just pennies an hour.

To pay a worker with a disability a subminimum wage, an employer must apply for a certificate from the Department of Labor (DOL). The DOL oversees regulatory compliance to guard against exploitation. Businesses that pay subminimum wages can be private, but they are often non-profit agencies or organisations providing rehabilitation and skills training to people with disabilities.

Historically, people with disabilities performed subminimum wage work in segregated worksites known as "sheltered workshops" or "work activity centres". However, due to changes in Medicaid regulations, people with disabilities now often earn subminimum wages outside these segregated worksites through contracted employment (e.g. janitorial work).

The subminimum wage has been the subject of ethical debates for decades. Disability rights advocates argue that it implies that society values disabled workers less. They also argue that the subminimum wage is based on the assumption that disabled workers are less productive, which is not always true. On the other hand, some worry that requiring employers to pay competitive wages would increase unemployment among workers with disabilities, as some organisations providing work for disabled people rely on government funds to operate.

To address these concerns, some states have created funds to help employers transition to paying the minimum wage. As of 2024, at least 16 states have banned the practice of paying workers with disabilities less than the minimum wage.

Civil Law: Understanding Applicable Laws in a Case

You may want to see also

Frequently asked questions

The federal minimum wage in the US is $7.25 per hour. However, many states and cities have set their own minimum wages, which are higher than the federal rate. As of August 2022, 30 states and Washington, D.C., had minimum wages higher than the federal minimum.

The Fair Labor Standards Act (FLSA) sets the federal minimum wage and covers most employers and employees. Generally, a business must abide by the FLSA if it has \$500,000 or more in annual sales or if its employees work in interstate commerce, such as making calls to other states or handling goods that will be transported across state lines.

Yes, there are several exemptions to the federal minimum wage law. Employers are not required to pay the federal minimum wage to the following workers: independent contractors, outside salespeople, workers on small farms, certain switchboard operators, employees of seasonal amusement businesses, employees of small local newspapers, newspaper deliverers, and apprentices, students, and learners as defined by federal law. Additionally, tipped employees may be paid a lower minimum wage, and certain types of employees, such as those with disabilities or students working in specific industries, may be paid a sub-minimum wage with the appropriate certification.

If a business is subject to both federal and state minimum wage laws, it must abide by the law that sets the higher wage. For example, if the federal minimum wage is $7.25 and a state's minimum wage is $12, the employer must pay its employees at least $12 per hour.