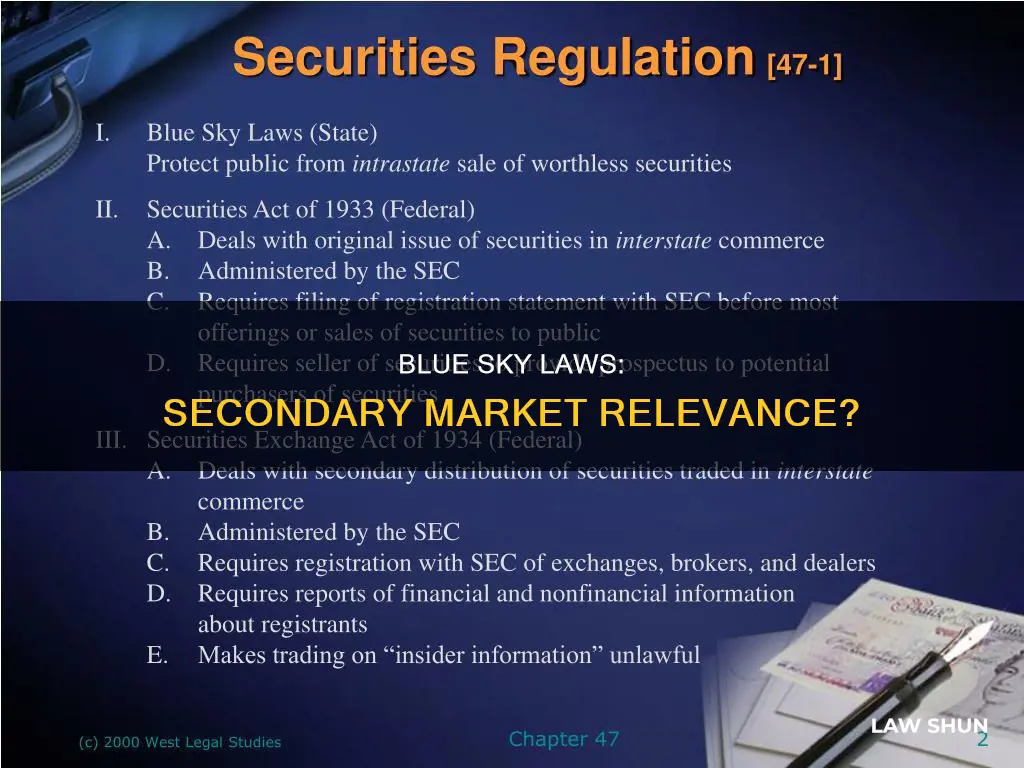

Blue sky laws are state-level regulations designed to protect investors from securities fraud. They require the registration of securities and the disclosure of details about the offering, such as financial details of the deal and the entities involved. While blue sky laws do not supersede federal securities statutes, they act as an additional layer of protection for investors. The trading of securities of issuers listed on National Securities Exchanges, such as the NASDAQ Stock Market and the New York Stock Exchange, are exempt from state blue sky laws. However, companies on the OTC Markets must comply with state blue sky laws for both their offerings and resales. This compliance can be challenging and costly for companies, especially those in the early stages of growth. Therefore, the applicability of blue sky laws to secondary markets is an important consideration for companies looking to raise capital and provide liquidity to investors.

| Characteristics | Values |

|---|---|

| Purpose | To protect investors from securities fraud |

| Registration requirements | Sellers of new issues must register their offerings and provide financial details of the deal and the entities involved |

| Disclosure requirements | Issuers of securities must disclose details of their offerings, including material information that may affect the security |

| Liability | Issuers of securities are held liable for any incorrect or missing information they give to investors |

| State-level laws | Each state has its own blue sky laws, which may vary but generally require the registration of securities offerings |

| Federal preemption | Blue sky laws are superseded by federal securities laws in cases of duplication |

| Exemptions | Securities listed on national stock exchanges are exempt from blue sky laws; offerings that fall under Rule 506 of Regulation D of the Securities Act of 1933 are also exempt |

| Regulation | The Uniform Securities Act of 1956 set the framework for blue sky laws, and each state has its own regulatory agency (typically the Securities Commissioner) |

| Enforcement | State securities commissioners can suspend securities offerings or revoke the ability of a firm to operate in the state if blue sky laws are violated |

What You'll Learn

National Securities Exchanges are exempt from Blue Sky Laws

National Securities Exchanges are exempt from state Blue Sky Laws.

Blue Sky Laws are state-level regulations designed to protect investors from securities fraud. They require the registration of securities offerings and the disclosure of the specifics of the offering, including financial details. These laws are anti-fraud regulations that create liability for issuers, allowing legal action to be brought against them for failing to live up to the laws' provisions.

The trading of securities of issuers listed on National Securities Exchanges, such as the NASDAQ Stock Market and the New York Stock Exchange (NYSE), are exempt from state Blue Sky Laws that govern secondary trading. This is because securities listed on national stock exchanges are considered “covered securities” under the National Securities Markets Improvement Act of 1996 (NSMIA). This Act created a class of securities that are exempt from state Blue Sky Law registration requirements.

While National Securities Exchanges are exempt from Blue Sky Laws, companies on the OTC Markets must comply with these laws for both their offerings and resales by purchasers. This includes compliance with state rules that apply to secondary trading, so that purchasers can resell their shares if they wish to.

It is important to note that even though National Securities Exchanges are exempt from Blue Sky Laws, they are still subject to federal securities laws and regulations. Blue Sky Laws do not supersede federal securities statutes but rather act as an additional safeguard for investors.

Antitrust Laws: Microsoft's Friend or Foe?

You may want to see also

Companies on the OTC Markets must comply with Blue Sky Laws

Companies listed on National Securities Exchanges such as the NASDAQ Stock Market and the New York Stock Exchange (NYSE) are exempt from state blue sky laws that govern secondary trading. However, companies on the OTC Markets must comply with state blue sky laws for both their Regulation A+ offering and resales by the purchasers in the offering.

Blue sky laws are state-level anti-fraud regulations that require the registration of securities offerings and the disclosure of details about the offering. These laws are designed to protect investors from fraud and ensure they have access to a wealth of verifiable information on which to base their investment decisions.

State blue sky laws typically require sellers of new issues to register their offerings and provide financial details of the deal and the entities involved. They also create liability for issuers, allowing legal authorities and investors to take action against them for failing to comply with the laws' provisions.

The North American Securities Administrators Association (NASAA) offers a coordinated review program for companies on the OTC Markets to facilitate compliance with state blue sky laws. Under this program, companies can submit their Regulation A offering materials to the administrator of the review program by email. Once approved, the offering will be compliant with the state blue sky laws in the states that participate in the program.

Medical Privacy Laws: Do They Apply in Churches?

You may want to see also

Blue Sky Laws and the two tiers of Regulation A

Blue sky laws are state-level regulations that aim to protect investors from securities fraud. They require the registration of new issues and the provision of financial details about the deal and the entities involved. These laws apply to both the offer and sale of securities by the issuer and the resale by investors.

Regulation A also known as Regulation A+ includes two tiers, each treated differently under state blue sky laws.

Tier 1 of Regulation A+

Tier 1 of Regulation A+ provides an exemption for securities offerings of up to $20 million in a 12-month period. Companies making offerings under this tier must comply with the specific rules and regulations of each state where they plan to offer and sell securities. They can use the North American Securities Administrators Association (NASAA) review program, which allows them to send their offering materials to the administrator of the program by email. Upon approval, the offering will be compliant with the state blue sky laws in the states participating in the program.

Tier 2 of Regulation A+

Securities offered under Tier 2 of Regulation A+ are "covered securities" under the National Securities Markets Improvement Act of 1996 (NSMIA) and are exempt from state registration and qualification requirements. However, states may require the issuer to provide a copy of the Form D filed with the Securities and Exchange Commission (SEC) and pay filing fees.

Compliance for Both Tiers

Even if an issuer is compliant with state blue sky laws for their Regulation A+ offering, they must still comply with state laws that regulate secondary trading so that purchasers can resell their shares. Compliance can become more complicated for issuers conducting both Tier 1 and Tier 2 offerings when shareholders seek to sell their shares.

America's Jewish Population: Miscegenation Law Effects

You may want to see also

The Manual Exemption for secondary trading

To be eligible for the Manual Exemption, the issuer and the security must be listed in a securities manual recognised by the specific state. The securities manual must include the names of the issuer and its officers and directors, the issuer's balance sheet, and a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations.

The Manual Exemption is a disclosure-based exemption from individual state Blue Sky Laws. As each state's Blue Sky Laws may differ, it can be challenging for companies to qualify in all jurisdictions. Regulators and brokers across the country rely on the Manual Exemption to facilitate secondary trading while ensuring investor protection.

The Manual Exemption is particularly relevant for companies traded on OTC Markets, as these companies must comply with individual state Blue Sky Laws. Traditionally, manuals have been printed publications that investors could find in their local library or broker's office. However, with the increasing availability of information online, electronic equivalents of securities manuals are now also recognised for the purposes of the Manual Exemption.

OTC Markets Group has been working with the North American Securities Administrators Association (NASAA) and individual state regulators to have their OTCQX and OTCQB Markets recognised as electronic equivalents of securities manuals. This recognition is based on the easily accessible, robust disclosure that OTCQX and OTCQB companies provide, which fulfils the company disclosure requirements of each state's Manual Exemption.

By granting this exemption, state regulators are supporting more informed and efficient trading that benefits OTCQX and OTCQB companies, brokers, and investors.

Understanding ADA Laws: Do They Apply to Churches?

You may want to see also

The impact of Blue Sky Laws on liquidity

Blue sky laws are state-level regulations designed to protect investors from securities fraud. They require the registration of securities offerings and the disclosure of financial details, providing investors with verifiable information to base their decisions on. These laws apply to both the primary and secondary markets, impacting liquidity in several ways.

Firstly, blue sky laws can affect the liquidity of secondary markets by imposing additional costs and delays on companies, particularly those in the early stages of growth. Compliance with these laws can be debilitating for smaller companies, impacting their ability to raise capital and provide liquidity to investors.

Secondly, blue sky laws vary from state to state, creating a complex landscape for companies operating across multiple states. This lack of uniformity adds to the cost and complexity of compliance, further impacting liquidity.

Thirdly, while NASDAQ and NYSE-listed securities are generally exempt from blue sky registration, Over-the-Counter (OTC) listed securities are typically not exempt. This distinction can affect the liquidity of secondary markets, particularly for smaller companies that rely on OTC markets for capital raising.

Furthermore, blue sky laws impose restrictions on broker-dealers and investment advisors, limiting their ability to provide advice or distribute research on securities that are not blue sky eligible in a given state. This restriction can reduce investor interest and liquidity in the secondary market for such securities.

To address these challenges, companies can utilise exemptions such as the Manual Exemption, which is recognised in 38 states, or the unsolicited brokerage transaction exemption. These exemptions can alleviate the burden of blue sky compliance and facilitate secondary trading.

In conclusion, blue sky laws impact the liquidity of secondary markets by imposing registration, disclosure, and compliance requirements on companies and securities. While these laws are essential for investor protection, they can hinder liquidity by increasing costs and complexity, particularly for smaller companies and those operating across multiple states. The availability of certain exemptions can help ease the burden, but the overall impact of blue sky laws on liquidity in the secondary market is significant.

Volunteer Rights: Anti-Discrimination Laws and Their Applicability

You may want to see also

Frequently asked questions

Blue sky laws are state-level regulations that protect investors from securities fraud. They require the registration of securities and the disclosure of details about the offering.

Yes, blue sky laws apply to secondary trading. However, there are exemptions. For example, the secondary trading of securities traded on a national securities exchange is automatically exempt from state blue sky laws.

Securities listed on national stock exchanges are exempt from blue sky registration. Additionally, securities that fall under Rule 506 of Regulation D of the Securities Act of 1933 are also exempt.

Violating blue sky laws can result in a state securities commissioner suspending the securities offering. In more severe cases, they may revoke the ability to operate in the state.

Blue sky laws aim to protect investors from fraudulent or speculative investments. They ensure that investors have access to verifiable information and that offerings are fair and equitable.