The Stark Law is a federally mandated set of civil regulations enacted in 1992 to protect patients from biased referrals. It is a federal anti-fraud law that seeks to put patients over profits. Under the Stark Law, physicians can be held liable if they refer patients to anyone with whom they have a financial relationship. An ambulatory surgery center (ASC) is a facility performing same-day operations for patients who do not need to be admitted for an overnight stay. ASCs are not covered by the Stark Law as they are not one of the named designated health services (DHS). However, if an ASC treats patients who are covered under public healthcare funds like Medicaid or Medicare, then compliance with the Anti-Kickback Statute, a criminal anti-corruption statute, becomes crucial.

| Characteristics | Values |

|---|---|

| What is an ASC? | A facility performing same-day operations for those who have already seen a medical professional and determined surgery as the formal treatment option. |

| Examples of ASCs | Out-patient facilities owned by a hospital, single specialty centers, etc. |

| Procedures ASCs perform | Colonoscopies, tonsillectomies, cosmetic procedures, cataracts, and other similar non-urgent procedures. |

| Stark Law | A federally mandated set of civil regulations enacted in 1992 to protect patients from biased referrals. |

| Does Stark Law apply to ASCS? | No, as a surgical center is not covered as it is not one of the named designated health services (DHS). |

| Anti-Kickback Statute (AKS) | A criminal anti-corruption statute that prohibits financial transactions in return for referrals. |

| Safe Harbors | Allow medical providers to circumvent anti-kickback laws and ensure physicians can offer the best medical care. |

| Common red flags for Stark Law violations at ASCs | Buying or selling shares in an ASC at a steep discount, leasing equipment below fair market value, sham directorships, etc. |

What You'll Learn

ASCs are exempt from Stark Law

Ambulatory Surgery Centers (ASCs) are exempt from the Stark Law because they are not one of the named designated health services (DHS). The Stark Law is a federally mandated set of civil regulations enacted in 1989 and updated in 1992 to protect patients from biased referrals. The law prohibits physicians from referring patients to clinical laboratory services that they have a financial relationship with when the services are payable by Medicare. Over the years, the scope of the federal Anti-Kickback Statute has expanded to include the following DHS payable by Medicare:

- Physical therapy services

- Occupational therapy services

- Outpatient speech-language pathology services

- Radiology, MRI, and imaging services

- Medical devices, equipment, and supplies

- Prosthetics and orthotics

- Home health care and home health services

- Outpatient prescription drugs

- Inpatient and outpatient hospital services

ASCs are a type of facility that performs same-day operations for patients who have already seen a medical professional and determined surgery as the formal treatment option. Examples of ASCs include outpatient facilities owned by a hospital, single specialty centers, and doctors' offices. ASCs may perform procedures such as colonoscopies, tonsillectomies, cosmetic procedures, and cataract surgeries.

While ASCs are exempt from the Stark Law, they are still legally bound by the Anti-Kickback Statute (AKS). The AKS is a criminal anti-corruption statute that prohibits financial transactions in return for referrals. It prohibits monetary compensation as well as kickbacks in the form of free equipment, shares, and similar bribes. Financial relationships with ASCs may fall under the exceptions outlined in 42 CFR § 1001.952 as "Safe Harbors."

Safe harbors allow medical providers to circumvent anti-kickback laws and ensure that physicians can offer the best medical care possible, even in situations that may seem in violation of the Stark Law or the AKS. For example, safe harbor regulations permit financial relationships between a physician and another medical organization, such as rental space or equipment at fair market value and discounts on purchases made within the fiscal year.

To summarize, ASCs are exempt from the Stark Law because they are not a designated health service under the law. However, ASCs must still comply with the AKS and other relevant regulations to ensure ethical and legal operations.

Understanding Hooke's Law: Stretching Springs and Limits

You may want to see also

ASCs must comply with the Anti-Kickback Statute

Ambulatory Surgery Centers (ASCs) are vulnerable to violations of the Stark Law and the Anti-Kickback Statute (AKS). The AKS is a federal criminal law prohibiting the offering or accepting of kickbacks intended to generate healthcare business. It applies to a broad range of participants in the healthcare system, including doctors, patients, procurement staff, and marketing/sales staff.

ASCs must comply with the AKS, which prohibits financial transactions in return for referrals. This includes kickbacks in the form of monetary compensation, free equipment, shares, and other bribes. Violation of the AKS is a felony, punishable by up to ten years in jail and fines of $100,000 per violation.

ASCs should be particularly mindful of the AKS when dealing with designated health services (DHS) that are payable by Medicare. These DHS include physical therapy services, radiology, medical devices, and prescription drugs.

To ensure compliance with the AKS, ASCs should be aware of the following key points:

- The AKS prohibits anyone from requesting, receiving, offering, or paying kickbacks intended to generate healthcare business.

- The term "remuneration" is used in the AKS and is defined as anything of value, including discounts.

- Referrals under the AKS include any required authorizations and certifications that permit a patient to access an item or service, even if the provider had no role in selecting the item or provider.

- The AKS prohibits remuneration whenever one purpose is to reward or induce healthcare business. This includes situations where remuneration is provided for multiple reasons.

- The AKS applies to a broad range of participants in the healthcare system, including doctors who refer patients for items or services paid for by health insurance, and patients who choose to purchase these items or services.

- There are safe harbors that protect certain payment and business practices that could otherwise implicate the AKS. These include bona fide employment, personal services and management contracts, discounts and rebates, space rental, and copay and deductible waivers.

In summary, ASCs must comply with the AKS, which prohibits kickbacks and financial transactions in return for referrals. Violation of the AKS can result in serious penalties, including felony charges, fines, and jail time. To ensure compliance, ASCs should understand the key terms, prohibitions, and safe harbors of the AKS.

Employee Laws: Reservations' Rights and Exemptions

You may want to see also

Safe Harbors for Anti-Kickback Statute

Safe harbors allow medical providers to circumvent anti-kickback laws and ensure that physicians can offer the best medical care possible. Safe harbor regulations describe various payment and business practices that, although they potentially implicate the Federal anti-kickback statute, are not treated as offenses under the statute.

The safe harbor regulations define payment and business practices that will not be considered kickbacks, bribes, or rebates that unlawfully induce payment by Medicare or Medicaid programs. They specify allowable financial and referral relationships between physicians or other providers and suppliers.

- Rental space or equipment at fair market value: The lease agreement must be set out in writing, signed by both parties, cover all the premises or equipment, and be for a term of at least one year. The rental charge must be set in advance, consistent with fair market value, and not determined by the volume or value of referrals.

- Discounts on purchases made previously within the fiscal year: Discounts must be earned based on purchases of the same good or service bought within a single fiscal year, and the buyer must claim the benefit of the discount in the fiscal year in which it is earned or the following year.

- Remuneration to employees: Employees of physicians are exempt from anti-kickback laws.

- Group purchasing organizations: The practitioner or provider cannot pay more than a 3% fee to the group purchasing organization (based on the purchase price of goods or services).

- Waiver of beneficiary coinsurance and deductible amounts: Hospitals offering to waive cost-sharing amounts must not claim the amount reduced or waived as a bad debt for payment purposes and must offer to reduce or waive the cost-sharing amounts without regard to the reason for admission, length of stay, or diagnostic-related group.

- Increased coverage, reduced cost-sharing, or reduced premium amounts offered by health plans: The health plan must offer the same increased coverage or reduced cost-sharing or premium amounts to all Medicare or State health care program enrollees covered by the contract unless otherwise approved.

- Price reductions offered to health plans: The contract health care provider cannot seek payment directly from Medicare or Medicaid, and the payment amount must remain in effect throughout the term of the agreement with the plan.

- Practitioner recruitment: The arrangement must be set forth in a written agreement that specifies the benefits, terms, and obligations of each party. There must be no requirement that the practitioner make referrals to or generate business for the entity as a condition for receiving benefits. The amount or value of the benefits provided may not vary based on the volume or value of any expected referrals.

- Obstetrical malpractice insurance subsidies: The payment must be made in accordance with a written agreement between the entity paying the premiums and the practitioner, which sets out the terms of the payments. The practitioner must certify that they have a reasonable basis for believing that at least 75% of their obstetrical patients treated will reside in a Health Professional Shortage Area (HPSA) or be part of a Medically Underserved Population (MUP).

- Investments in group practices: The equity interests in the practice or group must be held by licensed health care professionals who practice in the practice or group. The equity interests must be in the practice or group itself, not a subdivision. The practice must meet the definition of "group practice" and be a unified business with centralized decision-making, pooling of expenses and revenues, and a compensation/profit distribution system that is not based on satellite offices operating as separate enterprises.

- Ambulatory surgical centers: All investors must be physicians who are in a position to refer patients directly to the entity and perform procedures on those patients. The terms on which an investment interest is offered must not be related to the previous or expected volume of referrals, services furnished, or business generated. At least one-third of each physician investor's medical practice income from all sources for the previous fiscal year or 12-month period must be derived from the performance of procedures. The amount of payment to an investor must be directly proportional to the amount of their capital investment. All ancillary services for federal health care program beneficiaries must be directly and integrally related to primary procedures and may not be separately billed to Medicare or other federal health care programs. The entity and investors must treat patients receiving medical benefits or assistance under any federal health care program in a nondiscriminatory manner.

Murphy's Law: Wisconsin's Exception or Rule?

You may want to see also

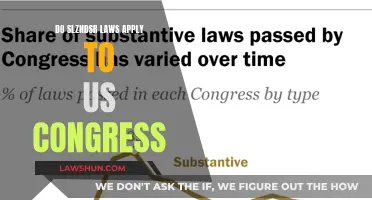

Stark Law and Anti-Kickback penalties

The Stark Law and Anti-Kickback Statute are two of the most frequently referenced and important Federal healthcare laws. The Stark Law is a strict liability statute, meaning that a violation does not have to be intentional to be actionable. It prohibits physicians from referring patients to entities in which they or their immediate family members have a financial relationship (including compensation and ownership relationships) for "designated health services" (DHS) payable by Medicare or Medicaid. Violations of the Stark Law can result in denied payments for services, refunds of existing payments, and civil penalties of up to $15,000 for each service provided in violation of the law. Physicians may also be liable for up to three times the total amount of improper payments received from Medicare/Medicaid, plus additional civil penalties of up to $100,000.

The Anti-Kickback Statute (AKS) is a criminal law that prohibits the payment or solicitation of remuneration to induce or reward patient referrals or the generation of business involving any item or service payable by Federal healthcare programs. Remuneration can include cash, gifts, expensive hotel stays, meals, and excessive compensation for medical directorships. Violations of the AKS can result in criminal penalties of up to $25,000 per violation and up to a five-year prison term per violation. Civil/administrative penalties can include False Claims Act liability, civil monetary penalties of up to $50,000 per violation, plus three times the amount of the remuneration, as well as exclusion from participation in Federal healthcare programs.

To avoid penalties under the Stark Law and AKS, healthcare organizations should implement compliance programs that include processes and systems for auditing, monitoring, and assessing risk. Organizations should also regularly survey and identify potential conflicts of interest, monitor provider compensation arrangements, and electronically track provider time and activities.

Logarithmic Laws: Do They Apply to Natural Logs?

You may want to see also

Stark Law whistleblower rewards

The Stark Law, or the Physician Self-Referral Law, prohibits physicians from referring patients to "designated health services" (DHS) with which they or their immediate family members have a financial relationship. This includes ownership interests, investments, or any form of compensation for referrals. The law was enacted to prevent unnecessary medical testing and reduce the government's overall healthcare costs.

Ambulatory Surgery Centers (ASCs) are a type of healthcare facility that performs same-day operations for patients who have already consulted a medical professional and decided on surgery as their treatment option. Examples of ASCs include outpatient facilities owned by hospitals, single-specialty centers, and cosmetic procedure centers.

ASCs are not specifically named in the Stark Law as one of the designated health services (DHS). Therefore, a referral to an ASC that the physician is financially tied to would not typically fall under the Stark Law. However, this does not exempt ASCs from ethical considerations and regulatory compliance.

The Anti-Kickback Statute (AKS) is another important piece of legislation in this context. It is a criminal anti-corruption statute that prohibits monetary compensation and other forms of kickbacks in exchange for referrals. AKS applies to ASCs and seeks to prevent financial transactions that could influence referrals.

Whistleblowers play a crucial role in enforcing both the Stark Law and the AKS. Qui tam cases brought by whistleblowers have been highly effective in helping the government recover losses resulting from Stark Law violations. Whistleblowers may be rewarded with a percentage of the total amount recovered by the government, which can reach millions of dollars in some cases.

To be eligible for a whistleblower reward, individuals must work with an attorney to file a qui tam suit under the False Claims Act. The reward amount can range from 15% to 30% of the recovered sum. It is important to note that the Department of Justice rejects 75% of reward claims, so seeking legal advice from an experienced attorney is crucial.

Whistleblowers can report Stark Law violations or kickbacks offered by employers in the medical field. By doing so, they may qualify for protections against retaliation and receive substantial financial rewards.

Lemon Laws: Do Tractors Qualify for Protection?

You may want to see also

Frequently asked questions

The Stark Law is a federally mandated set of civil regulations enacted in 1992 to protect patients from biased referrals. It is also referred to as the "physician self-referral law".

No, a surgical centre is not covered under the Stark Law as it is not one of the named designated health services (DHS).

An ambulatory surgery centre (ASC) is a facility that performs same-day operations for those who have already seen a medical professional and determined surgery as the formal treatment option.

Examples of ASCs include outpatient facilities owned by a hospital, single specialty centres, doctors' offices, and specialty or cosmetic procedure centres.

Penalties for violations include denied payments for services, refunds for existing payments, fines of up to $15,000 per service provided in violation, and additional civil penalties.