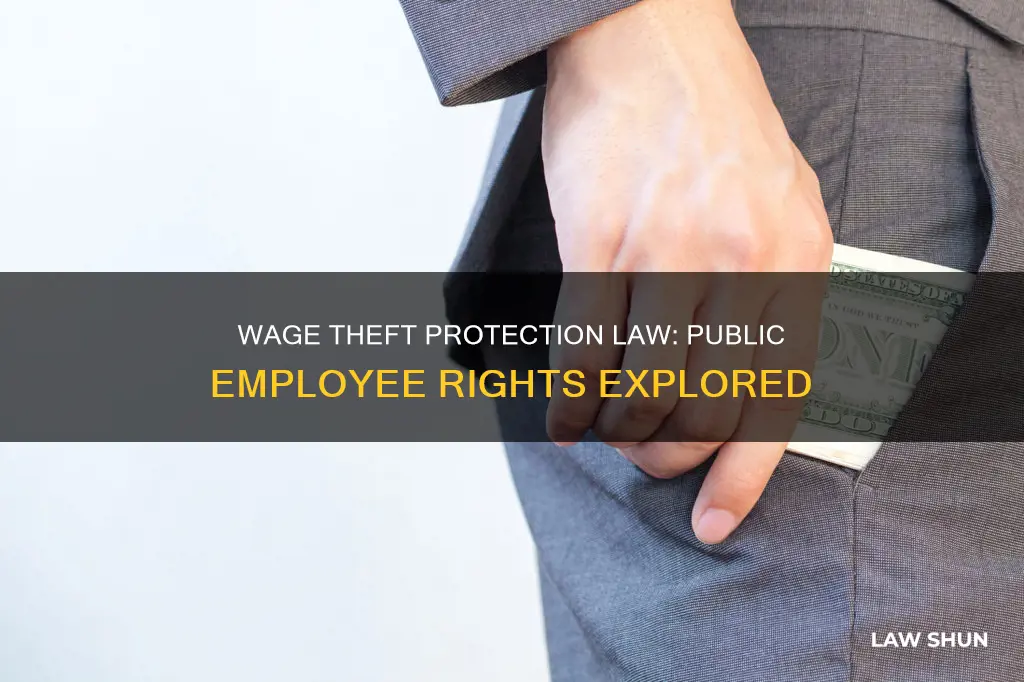

Wage theft is a serious issue in the United States, with billions of dollars in wages stolen from employees every year. While there are federal laws in place, such as the Fair Labor Standards Act, that aim to protect workers' rights and ensure they receive fair pay, wage theft still persists, particularly among low-wage and hourly workers. To address this issue, states like California have implemented their own wage theft protection laws, but the question arises: does this protection extend to public employees? The Wage Theft Protection Act of 2011 in California specifically targets private sector employers, with some exceptions for charter schools, private schools, and not-for-profit corporations. However, it is essential to examine the specific provisions and scope of the law in California to determine if public employees are included in the protections offered.

| Characteristics | Values |

|---|---|

| Year of the Wage Theft Protection Act | 2011 |

| Effective date of the Wage Theft Protection Act | January 1, 2012 |

| Amended laws | Labor Code sections 98, 226, 240, 243, 1174, and 1197.1 |

| New requirements | Labor Code sections 200.5, 1194.3, 1197.2, 1206, and 2810.5 |

| Who is covered by the law? | All private sector employers unless specified exceptions apply |

| Who is not required to receive pay notice from their employers under the law? | Employees who are considered "exempt" (don't receive overtime pay) or who are covered by collective bargaining agreements |

| Who enforces the Fair Labor Standards Act? | The U.S. Department of Labor |

What You'll Learn

Who is covered by wage theft protection laws?

Wage theft protection laws cover a wide range of employees, and the specifics may vary depending on the jurisdiction. However, in the United States, the Fair Labor Standards Act (FLSA) guarantees certain rights to all employees, regardless of citizenship status. This includes the right to a minimum wage, overtime pay, and protection from wage theft.

Wage theft occurs when an employer withholds benefits, such as breaks or compensation, that an employee has already worked for. This can take many forms, such as failing to pay overtime, violating minimum wage laws, misclassifying employees as independent contractors, making illegal deductions from pay, or simply not paying employees at all.

In terms of who is covered by wage theft protection laws, it is important to note that these laws typically apply to both direct employees and independent contractors. Additionally, undocumented immigrants are also protected from wage theft under the FLSA and can take legal action to recover unpaid wages.

In the state of California, the Wage Theft Prevention Act of 2011 specifically applies to all private-sector employers unless there is a specified exception. This means that employees who are directly employed by the state or any political subdivision, such as a city or county, are generally not covered by this particular law. However, charter schools, private schools, and not-for-profit corporations are included in the law's scope as they are not considered public entities.

It is worth noting that wage theft protection laws may have certain exemptions. For example, exempt employees who do not receive overtime pay or those covered by collective bargaining agreements may not be required to receive the same pay notice as other employees. Additionally, the specifics of wage theft protection laws can vary from state to state, and some states may have stronger protections in place than others.

Understanding Blue Sky Laws: Relevance for LLCs

You may want to see also

What constitutes wage theft?

Wage theft is the unlawful act of employers not fully compensating their employees for the work they have done. It can take many forms, including:

- Paying workers at an insufficient rate for the work they complete

- Violating the state-mandated minimum wage rate

- Making illegal deductions from a worker's paycheck

- Forcing employees to work off the clock

- Withholding overtime rates, bonuses, commissions, or other employee benefits

- Not paying for all the hours worked

- Not paying a worker at all

- Withholding any earned benefits or gratuities, like meal breaks or sick leave

- Taking an employee's tips

- Refusing an employee meal or rest breaks

- Failing to pay employees agreed-upon wages (including overtime on commissions and regular wages)

- Taking unauthorised deductions from an employee's paycheck

- Failing to pay an employee's final wages promptly

- Withholding promised benefits, including sick leave and vacation

- Refusing to reimburse employees for business expenses

- Failing to pay annual leave or holiday entitlements

In the US, wage theft is common, particularly against low-wage workers, including legal citizens and undocumented immigrants. A 2014 report by the Economic Policy Institute suggested that wage theft costs US workers billions of dollars a year.

In California, wage theft is a serious offence. Under Assembly Bill 1003, passed in 2021, instances of wage theft exceeding $950 are prosecuted as grand theft.

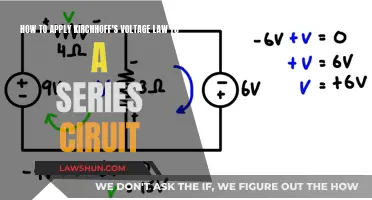

The Wage Theft Protection Act of 2011 requires all employers to provide each employee with a written notice containing specified information at the time of hire. This includes:

- The employee's rate or rates of pay

- The employee's designated payday

- The employer's intent to claim allowances (e.g. meal or lodging allowances) as part of the minimum wage

- The basis of wage payment (e.g. whether paying by the hour, shift, day, week, piece, etc.), including any applicable overtime rates

- Any alternate names the company might use as part of their business

Employment Laws: Non-Profits and At-Will Rules Explained

You may want to see also

What are the penalties for wage theft?

Wage theft is a serious offense, and the penalties for those who engage in it can be severe. Here are some of the main consequences:

Financial Penalties and Fines

Employers who commit wage theft may be subject to financial penalties and fines, which can include back pay, interest on unpaid wages, and additional damages. These penalties can be substantial and have a significant impact on the financial health of the business. In California, for example, the Wage Theft Protection Act of 2011 established minimum penalties for failure to comply with wage-related statutes.

Lawsuits and Legal Fees

Employees who experience wage theft can file lawsuits against their employers. If successful, the employee recovers their unpaid wages, as well as damages for any harm caused by the wage theft, such as emotional distress or financial hardship. Defending against wage theft claims can be costly for employers, with litigation, legal fees, and settlements potentially having long-lasting financial implications.

Criminal Charges

In some cases, wage theft may rise to the level of a criminal offense. Employers who engage in wage theft may be charged with criminal offenses such as theft, fraud, or embezzlement. If convicted, they may face fines, jail time, or both. For instance, in California, instances of wage theft exceeding $950 are prosecuted as grand theft, which is a felony offense.

Reputational Damage

Employers who engage in wage theft may suffer negative publicity and damage to their reputation, making it more difficult to attract and retain employees and customers. Rebuilding a reputation after a scandal can be challenging and time-consuming.

Loss of Investors, Customers, and Employees

When companies lose investors, customers, and employees due to wage theft scandals, it affects their ability to make a profit and maintain a competitive advantage. This can have long-term financial implications and even lead to company closure.

Increased Loan Requests and Layoffs

The financial strain of penalties and lawsuits may result in companies taking out more loans and laying off employees to stay afloat.

To avoid these penalties, it is crucial for employers to understand the laws and regulations regarding wage and hour requirements and to ensure they are complying with them. Clear communication of pay rates and policies, accurate record-keeping, and training for managers and supervisors on wage and hour laws are also essential steps in preventing wage theft.

Security Laws: Do They Apply to Small Private Companies?

You may want to see also

How can employees report wage theft?

Employees can report wage theft in several ways, depending on their location and the specifics of their case. Here are some general steps and avenues to consider when reporting wage theft:

- Understand wage theft and its signs: Wage theft occurs when an employer fails to provide an employee with the compensation they are legally owed for their work. This can include withholding earned benefits, such as meal breaks or sick leave, paying less than minimum wage, refusing meal or rest breaks, failing to pay agreed-upon wages, unauthorised paycheck deductions, and more.

- Document and record-keeping: Employees should keep detailed records of their work hours, breaks taken, and pay stubs or wage statements. This documentation will be crucial when filing a claim, as it helps determine if an employee has been paid correctly and supports their case.

- Gather relevant information and documents: When filing a claim, employees should provide as much information as possible, including documentation such as timesheets, paychecks/stubs, records of unpaid commissions, notices from the employer regarding employment information (rate of pay, overtime rate, etc.), and other relevant details.

- Know the deadlines for filing: In California, for instance, the deadlines for filing a wage claim vary depending on the type of violation. These deadlines include one year for issues like bounced paychecks or withheld payroll records, two years for oral promises to pay more than minimum wage, three years for violations of minimum wage, overtime, unpaid breaks, and illegal deductions, and four years for breaches of written employment contracts.

- Contact the appropriate authorities: In California, employees can file a wage claim with the Labor Commissioner's Office, also known as the Division of Labor Standards Enforcement (DLSE). This can be done online, by mail, or in person. The DLSE investigates the claim and works to resolve the issues between the employee and employer, potentially scheduling a hearing if necessary. Additionally, employees can contact the Wage and Hour Division (WHD) operated by the U.S. Department of Labor, which handles federal labor law violations.

- Seek legal assistance: Employees can also consult with an employment lawyer or attorney who specialises in labour disputes. They can provide guidance, answer questions, and help employees navigate the wage claim process to ensure they receive the compensation they are owed.

Sharia Law in Malaysia: Foreigners and Legal Exemptions

You may want to see also

What are the time limits for filing a wage claim?

The time limit for filing a wage claim, also known as a wage lawsuit, varies depending on the jurisdiction in which you live or work. These limits are typically set by labor laws, state or federal wage laws, and other wage and hour rules. In the United States, the Fair Labor Standards Act (FLSA) establishes a statute of limitations of two years from the date the wages were due. If the violation is considered willful, this can be extended to three years.

In California, the time limit for filing a claim for unpaid wages depends on the type of violation:

- Bounded paycheck or withheld payroll/personnel records: one year to file.

- Breach of oral promise to pay wages higher than minimum wage: two years to file.

- Violations of minimum wage, overtime, unpaid rest and meal breaks, sick leave, illegal deductions from pay, or unpaid reimbursements: three years to file.

- Breach of written employment contract: four years to file.

In Texas, the deadline for filing a wage claim is no later than 180 days after the date the wages were originally due to be paid.

Labor Laws and Churches: California's Unique Religious Exemption

You may want to see also

Frequently asked questions

No, the Wage Theft Protection Act only applies to private sector employers. Public employees are directly employed by the state or any political subdivision, including any city, county, city and county, or special district.

The Wage Theft Protection Act is a law that went into effect on January 1, 2012, in California, that gives greater protection to workers and makes changes in the way workers are notified of basic employment information.

The Act requires that all employers provide each employee with a written notice containing specific information at the time of hire, including the rate(s) of pay, designated pay day, the employer’s intent to claim allowances (e.g. meal or lodging allowances) as part of the minimum wage, and the basis of wage payment (e.g. whether paying by the hour, shift, day, week, piece, etc.), including any applicable rates for overtime.

Wage theft is when an employer withholds benefits, such as breaks or compensation, that an employee has already worked for. It can take many forms, such as not paying overtime, violating minimum wage laws, misclassifying employees as independent contractors, or simply not paying an employee at all.

If you believe your employer is committing wage theft, you can file a complaint with the Department of Labor or the labor or employment department in your state. You may also be able to file a lawsuit in federal court, depending on the specifics of your case.