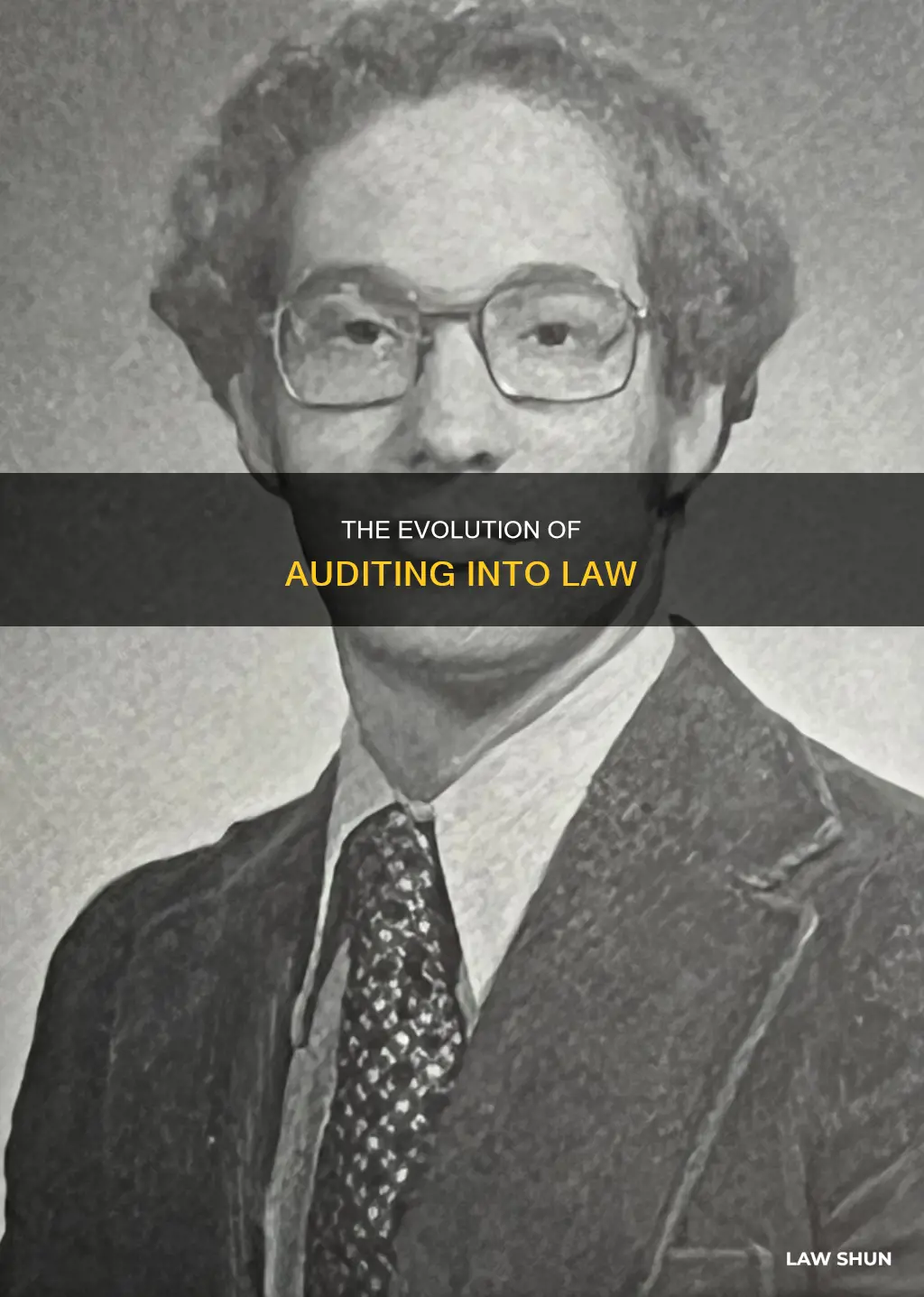

Auditing has been a safeguard measure since ancient times, with people double-checking public spending in Ancient Egypt and the Roman Empire. However, the modern concept of auditing is closely linked to the growth of industry during the Industrial Revolution. During this time, the number of joint-stock companies, owned by multiple investors, exploded. As these investors were liable for the company's debts, they were keen to know the state of company accounts.

In 1844, the British Parliament passed the Joint Stock Companies Act, which required companies to give shareholders audited financial statements. However, companies were not legally required to appoint an independent auditor for this until 1900. In the US, auditing became law following the stock market crash of 1929 and the Great Depression, with the US government passing laws in the 1930s to regulate the stock market. These laws inspired similar legislation in other countries, with all companies listed on a stock exchange now required to have audited accounts.

| Characteristics | Values |

|---|---|

| Earliest known auditing practices | Ancient Egypt and the Roman Empire |

| Modern auditing | Began during the Industrial Revolution (mid-18th century) |

| First auditing standards | Established in the 1930s |

| First authoritative auditing standard | Statement on Auditing Procedure (SAP) 1, issued in 1939 |

| UK Joint Stock Companies Act | Passed in 1844, requiring companies to give shareholders audited financial statements |

| US Securities Acts | Passed in 1933 and 1934, requiring companies listed on a stock exchange to have audited accounts |

| US Sarbanes-Oxley Act | Passed in 2002, introduced new auditor independence rules and established the Public Company Accounting Oversight Board (PCAOB) |

What You'll Learn

The Industrial Revolution and the growth of modern industry

The Industrial Revolution was a period of global transition from the 18th to the 19th century, marking a shift from hand production methods to machines and new chemical manufacturing processes. This period witnessed the emergence of groundbreaking innovations in textiles, iron-making, and other industries, transforming largely rural, agrarian societies into industrialized, urban ones.

The Industrial Revolution had its origins in Great Britain, which had become the world's leading commercial nation by the mid-18th century. The country's dominance was bolstered by its vast colonial empire and military-political hegemony over the Indian subcontinent. The development of trade and the rise of business, along with advancements in law, such as courts ruling in favour of property rights, played a pivotal role in catalysing the Industrial Revolution.

The textile industry was at the forefront of this revolution, becoming the dominant industry in terms of employment, output value, and capital investment. Innovations like the spinning jenny, the flying shuttle, the water frame, and the power loom revolutionised cloth production, making it faster, more efficient, and less reliant on manual labour. This mechanisation, coupled with the increasing use of water and steam power, led to a significant increase in output, resulting in an unprecedented rise in population and population growth rates.

The Industrial Revolution also witnessed the widespread adoption of steam power, with Scottish engineer James Watt improving upon Thomas Newcomen's atmospheric steam engine. This breakthrough technology found applications in various industries, including flour, paper, cotton mills, ironworks, distilleries, waterworks, and canals. The utilisation of steam engines further fuelled the demand for coal, as it enabled miners to extract this energy source more efficiently and go deeper into mines.

The impact of the Industrial Revolution extended beyond technological advancements. It brought about a shift from a predominantly agrarian society to an urbanised one, with people migrating from rural areas to burgeoning industrial cities in search of employment opportunities. This rapid urbanisation, however, presented significant challenges, including pollution, inadequate sanitation, deplorable living conditions, and a lack of safe drinking water.

The Industrial Revolution also had far-reaching social implications, giving rise to the emergence of a middle class of industrialists and businessmen, who thrived under the new economic system. In contrast, working-class people often faced harsh working conditions, with long hours and low wages. The mechanisation of labour, while increasing productivity, also led to the exploitation of child labour and hazardous working environments.

In conclusion, the Industrial Revolution was a pivotal era in world history, marking a transition to widespread, efficient, and stable manufacturing processes. It transformed societies, economies, and daily lives, paving the way for modern industrial capitalism and shaping the world we know today.

Royal Assent: The Law-Making Process Simplified

You may want to see also

The South Sea Bubble and the 1929 stock market crash

The history of auditing law can be traced back to the early 1900s, with the first comprehensive auditing guidance published in the US in 1912. However, it was the stock market crashes of 1929 and the subsequent Great Depression that led to landmark changes in auditing legislation.

The South Sea Bubble

The South Sea Bubble was a speculation mania that peaked in 1720 and ruined many British investors. The bubble centred on the South Sea Company, founded in 1711 to trade with Spanish America, assuming that the War of the Spanish Succession would end with a favourable treaty. The company's stock sold well, and King George I of Great Britain became its governor in 1718, creating confidence in the enterprise.

In 1720, there was an incredible boom in South Sea stock as the company proposed to take over the national debt. This proposal was accepted by Parliament. The company's shares rose dramatically from 128 1/2 in January 1720 to over 1,000 in August. However, by September, the market had collapsed, and many investors were ruined. The scandal brought Robert Walpole to power, and he is generally considered to be Britain's first prime minister.

The 1929 Stock Market Crash

The Wall Street crash of 1929, also known as the Great Crash, was a rapid and steep decline in US stock prices in late October. Over four business days, from Black Thursday (October 24) to Black Tuesday (October 29), the Dow Jones Industrial Average dropped from 305.85 points to 230.07 points, a 25% decrease in stock prices.

The main cause of the crash was the long period of speculation that preceded it, with millions of people investing their savings or borrowing money to buy stocks, pushing prices to unsustainable levels. Other factors included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, which contributed to a gradual decline in stock prices.

The stock market crash of 1929 had far-reaching consequences, contributing to the Great Depression of the 1930s, which lasted about ten years and affected both industrialised and non-industrialised countries worldwide. In response to the crash, Congress passed two landmark acts of federal legislation: the Securities Act of 1933 and the Securities Exchange Act of 1934. These acts required all SEC registrants to have their financial statements audited by independent CPAs, highlighting the importance of the auditing profession and increasing the demand for its services.

The 1929 stock market crash and the ensuing Great Depression had a significant impact on the world of auditing, leading to the establishment of public company auditing and the evolution of auditing standards and the standard audit report.

The Storyboard: Bill to Law, Explained

You may want to see also

The Securities Act of 1933 and the Securities Exchange Act of 1934

The Securities Act of 1933 was the first federal legislation to regulate the stock market. It was signed into law by President Franklin D. Roosevelt and is considered part of the New Deal. The Act had two main goals: to ensure more transparency in financial statements so investors could make informed decisions, and to establish laws against misrepresentation and fraudulent activities in the securities markets. It also took power away from the states, putting it into the hands of the federal government, and created a uniform set of rules to protect investors against fraud.

The Securities Exchange Act of 1934 was enacted by Franklin D. Roosevelt's administration to govern securities transactions on the secondary market. Its goal was to ensure greater financial transparency and accuracy and to reduce fraud or manipulation. All companies listed on a stock exchange must follow the requirements outlined in the Act, which include registration of securities, company financial disclosure, and margin and audit requirements. The Act also authorized the formation of the Securities and Exchange Commission (SEC), which has broad authority to regulate all aspects of the securities industry.

The two Acts together introduced national disclosure requirements for companies selling stocks or other securities, requiring them to reveal key information about their property, financial health, and executives. They also highlighted the importance of the auditing profession and substantially increased the demand for its services.

Homebuyer Tax Credit: A Law to Help First-Timers

You may want to see also

The establishment of the Securities and Exchange Commission (SEC)

The U.S. Senate Banking Committee held hearings in 1932, known as the Pecora hearings, to determine the cause of the Great Depression and prevent a future stock market crash. These hearings found that numerous financial institutions had misled investors, acted irresponsibly, and participated in widespread insider trading.

In response, Congress passed the Securities Act of 1933, which required the registration of most securities sales in the United States and gave the Federal Trade Commission the power to block securities sales. This was followed by the creation of the SEC with the Securities Exchange Act of 1934.

The SEC is an independent federal regulatory agency tasked with protecting investors and capital, overseeing the stock market, and proposing and enforcing federal securities laws. The SEC has five divisions: the Division of Corporation Finance, the Division of Trading and Markets, the Division of Investment Management, the Division of Enforcement, and the Division of Economic and Risk Analysis.

The establishment of the SEC was a significant development in the history of financial regulation in the United States, giving the government extensive powers to regulate the securities industry and bring civil charges against individuals and companies who violated securities laws.

Texas House Bills: Laws in the Making

You may want to see also

The Sarbanes-Oxley Act of 2002

The Act contains eleven sections that place requirements on US public company boards of directors, management, and public accounting firms. It also applies to privately held companies in certain instances, such as the willful destruction of evidence to impede a federal investigation.

- Registration of accounting firms that audit public companies in US securities markets

- Inspections of registered accounting firms

- Establishment of auditing, quality control, and ethics standards for registered accounting firms

- Investigation and discipline of registered accounting firms for violations of law or professional standards

The Sarbanes-Oxley Act introduced several new auditor independence rules, increased oversight by boards of directors, and enhanced the independence of outside auditors reviewing corporate financial statements. It also created a new quasi-public agency, the PCAOB, charged with overseeing, regulating, inspecting, and disciplining accounting firms in their roles as auditors of public companies.

The Act has been praised for improving investor confidence and the accuracy and reliability of financial statements. It has also been credited with nurturing an ethical culture, forcing top management to be transparent, and protecting whistleblowers. However, critics argue that it has introduced an overly complex regulatory environment, placing US corporations at a competitive disadvantage.

Brainstorming to Legislation: The Law-Making Process

You may want to see also

Frequently asked questions

Auditing has been a safeguard measure since ancient times. However, the first modern auditing laws were passed in the 1930s following the 1929 stock market crash. These laws, passed in the US, required all companies listed on a stock exchange to have audited accounts.

The first auditing law was the 1933 Securities Act, followed by the Securities Exchange Act of 1934. These laws established the Securities and Exchange Commission (SEC) and required public companies to file audited financial reports.

Auditing laws aim to protect investors and other stakeholders by ensuring that financial statements are accurate and reliable. They also promote transparency and help regulate stock markets.

Auditing laws have evolved to keep up with the increasing complexity of businesses and the rise of globalisation. Today, auditing laws often focus on standardising practices and reducing the potential for bias.