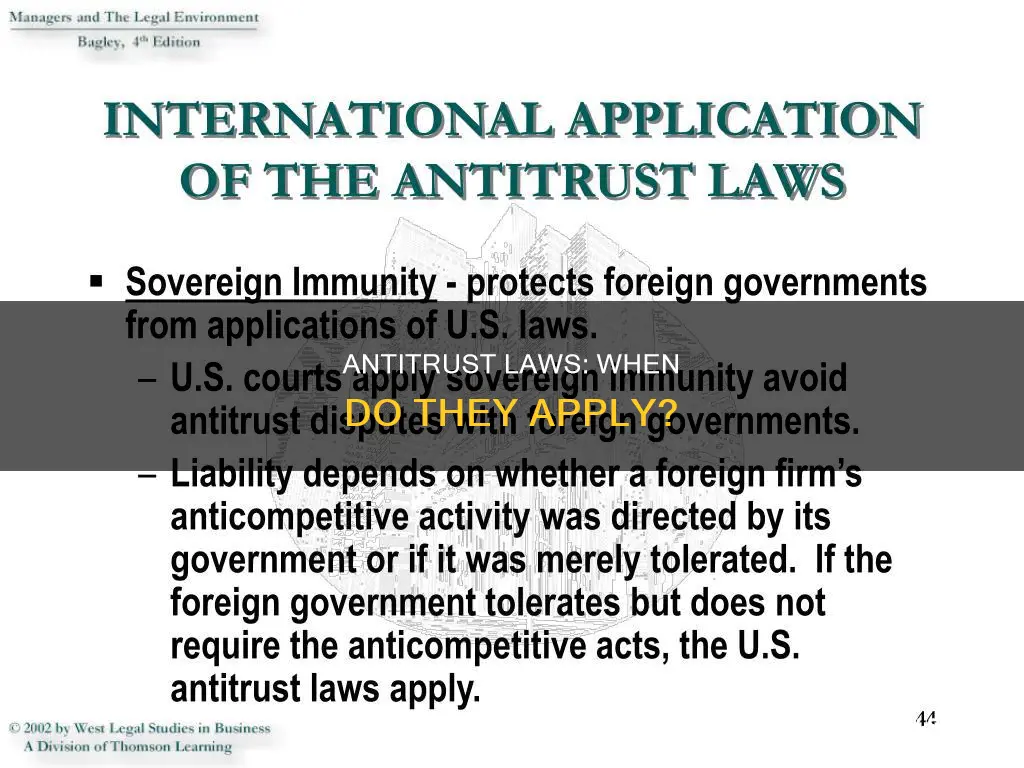

Antitrust laws are regulations that encourage competition by limiting the market power of any particular firm. They are designed to protect consumers from predatory business practices and ensure fair competition. Antitrust laws are applied to a wide range of questionable business activities, including market allocation, bid rigging, price fixing, and monopolies.

The core of US antitrust legislation is formed of three pieces of legislation: the Sherman Antitrust Act of 1890, the Federal Trade Commission Act, and the Clayton Antitrust Act. These laws serve three major functions: prohibiting price fixing and the operation of cartels, restricting mergers and acquisitions that may substantially lessen competition or create a monopoly, and prohibiting monopolization.

Bid rigging

Antitrust laws are a set of regulations designed to encourage competition and prevent anti-competitive practices that harm consumers. These laws are enforced by the Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ).

One such anti-competitive practice is bid rigging, which involves collusion among competitors to manipulate the competitive bidding process and effectively raise prices. Bid rigging is a criminal offence under the Sherman Antitrust Act and can result in significant fines and imprisonment.

The detection of bid rigging can be challenging as collusive agreements are often made in secret. However, unusual bidding patterns, such as the same company always winning or bids being much higher than expected, can arouse suspicion. Additionally, suspicious statements or behaviour by bidders, such as references to industry-wide pricing or advance knowledge of competitors' pricing, may indicate the presence of collusion.

To maintain a fair and competitive marketplace, bid rigging is closely monitored and prosecuted by the Antitrust Division of the DOJ, with the support of public reporting.

Moore's Law: Still Relevant or an Outdated Concept?

You may want to see also

Price fixing

Antitrust laws are regulations that promote competition by limiting the market power of individual firms. They are designed to prevent companies from forming monopolies and to break up those that have. Antitrust laws also prevent multiple firms from colluding to limit competition through practices such as price fixing.

Most types of price-fixing agreements are illegal under antitrust laws, particularly Section 1 of the Sherman Act. Horizontal price-fixing agreements are the stereotypical example of price fixing, where competitors agree to raise, lower, or stabilize prices, creating a cartel agreement. For example, when two competing fast-food chains agree on the retail price of cheeseburgers, that horizontal agreement is illegal under the Sherman Act as it undermines market pricing. Vertical price fixing involves members of the supply chain agreeing to raise, lower, or stabilize prices. For instance, when manufacturers force retailers to sell a product at a predetermined retail price or require them to follow "suggested" retail price policies that do not allow for discounts. These types of vertical agreements are also illegal under antitrust laws.

The boundaries of what constitutes illegal price fixing can be unclear, and proving price fixing can be challenging. Illegal price fixing can occur even when the parties have not directly communicated, as was the case in *Interstate Circuit v. United States*, where the Supreme Court found a conspiracy to exist among film distributors in Texas, despite no evidence of direct communication. Instead, each distributor changed their prices after receiving the same demands from two primary movie theater companies in the state.

The Federal Trade Commission (FTC) has the authority to prevent "unfair competition" under 15 U.S.C. § 45, which includes actions beyond price fixing and potentially without the proof requirements of Section 1 of the Sherman Act. However, the Second Circuit has indicated that the FTC must still show "evidence of anticompetitive intent or purpose" or "the absence of an independent legitimate business reason" for a company's conduct to act on price fixing under this section.

While almost all agreements among competitors to control prices or the volume of a product are per se illegal, price fixing is allowed in some limited circumstances, such as in the case of joint ventures, where it can actually lead to better pricing or more competition in the market. Additionally, entities covered by trade agreements, such as government-operated businesses like OPEC, may be exempted from traditional price-fixing rules.

Understanding Hooke's Law and Its Application to Elastics

You may want to see also

Monopolies

Antitrust laws are designed to prevent anticompetitive conduct and mergers that could harm consumers, workers, and the economy. They do this by regulating the concentration of economic power and ensuring fair competition. In the US, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are responsible for enforcing antitrust laws, with the FTC focusing on consumer-related segments and the DOJ on infrastructure areas like telecommunications and banking.

The Sherman Antitrust Act of 1890, the Federal Trade Commission Act of 1914, and the Clayton Antitrust Act of 1914 form the core of US antitrust legislation. These laws prohibit anticompetitive practices such as price-fixing, bid-rigging, market allocation, and monopolies.

The Sherman Act outlaws "every contract, combination, or conspiracy in restraint of trade," as well as any "monopolization, attempted monopolization, or conspiracy or combination to monopolize." It imposes severe penalties, including criminal fines of up to $100 million for corporations and $1 million for individuals, as well as potential prison terms of up to 10 years.

The Clayton Act addresses specific practices that the Sherman Act does not clearly prohibit, such as mergers and interlocking directorates (where the same person sits on the boards of competing companies). It prohibits mergers and acquisitions that may "substantially lessen competition or tend to create a monopoly."

The Federal Trade Commission Act bans "unfair methods of competition" and "unfair or deceptive acts or practices." While the FTC does not directly enforce the Sherman Act, it can bring cases under the FTC Act against activities that violate the Sherman Act.

Antitrust laws are applied to a wide range of monopolistic behaviors, including exclusive supply agreements, tying the sale of two products, predatory pricing, and refusal to deal.

Exclusive supply agreements occur when a supplier is prevented from selling to different buyers, allowing the monopolist to buy supplies at lower costs and stifling competition. Tying the sale of two products involves forcing customers to buy a second, unrelated product to obtain the desired product. This is a violation of antitrust laws. Predatory pricing occurs when a company sets prices very low to drive out competitors and then raises prices once competition is eliminated. Refusal to deal refers to monopolies using their market dominance to prevent competition, such as by refusing to conduct business with certain companies.

While antitrust laws aim to prevent monopolies and protect consumers, critics argue that they can also hinder business success and efficiency by intervening in the free market.

When Do Courts Apply Foreign Laws?

You may want to see also

Mergers and acquisitions

The Sherman Act outlaws "every contract, combination, or conspiracy in restraint of trade", and any monopolization, attempted monopolization, or conspiracy to monopolize. The Act also prohibits agreements between competitors to fix prices or wages, rig bids, or allocate customers, workers, or markets.

The Federal Trade Commission Act bans "unfair methods of competition" and "unfair or deceptive acts or practices". The Act gives the Federal Trade Commission (FTC) the power to bring cases against companies engaging in these practices.

The Clayton Act addresses specific practices that the Sherman Act does not clearly prohibit, such as mergers and acquisitions. Section 7 of the Act prohibits mergers and acquisitions where the effect "may be substantially to lessen competition, or to tend to create a monopoly". The Clayton Act also prohibits an individual from sitting on the boards of competing corporations.

The FTC and the US Department of Justice (DOJ) enforce federal antitrust laws. They focus on areas of the economy with high consumer spending, such as technology, healthcare, and pharmaceuticals. Antitrust investigations often arise from pre-merger notification filings, congressional inquiries, or consumer and business correspondence.

When reviewing a merger, the FTC and DOJ analyse the totality of the evidence to assess the risk of harm to competition. They use a set of Merger Guidelines to help them evaluate the risk of a merger lessening competition or creating a monopoly. These Guidelines include examining market structure, direct evidence of the effect on competition, and other factors.

If the FTC or DOJ find that a merger violates antitrust laws, they may try to stop the merger or find a resolution. If no resolution is found, they may pursue legal action.

Thermodynamics Laws: Governing Energy Conversions and Efficiency

You may want to see also

Market allocation

The per se rule, which applies to restraints that are very likely to harm competition, is commonly applied to market allocation agreements. This means that further analysis of business justifications or pro-competitive benefits is not required. However, not all market allocation agreements are subject to the per se standard. If a court determines that a market allocation agreement is necessary to achieve a larger pro-competitive outcome, it will be assessed under the rule of reason framework.

The Sherman Antitrust Act prohibits conspiracies that unreasonably restrain trade, including agreements among competitors to allocate customers, workers, or markets. Violations of the Sherman Antitrust Act can result in fines of up to $100 million for corporations and $1 million for individuals, as well as prison terms of up to 10 years.

Applying Kepler's Third Law: Understanding Orbital Periods and Distances

You may want to see also

Frequently asked questions

Antitrust laws are statutes developed by governments to protect consumers from predatory business practices and ensure fair competition.

Antitrust laws apply to a wide range of questionable business activities, including market allocation, bid rigging, price fixing, and monopolies.

The core of US antitrust legislation was created by three pieces of legislation: the Sherman Anti-Trust Act of 1890, the Federal Trade Commission Act, and the Clayton Antitrust Act.

In the US, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) enforce antitrust legislation.

Monopolies are illegal because if one company dominates an entire market, competition will cease and consumers will be harmed.