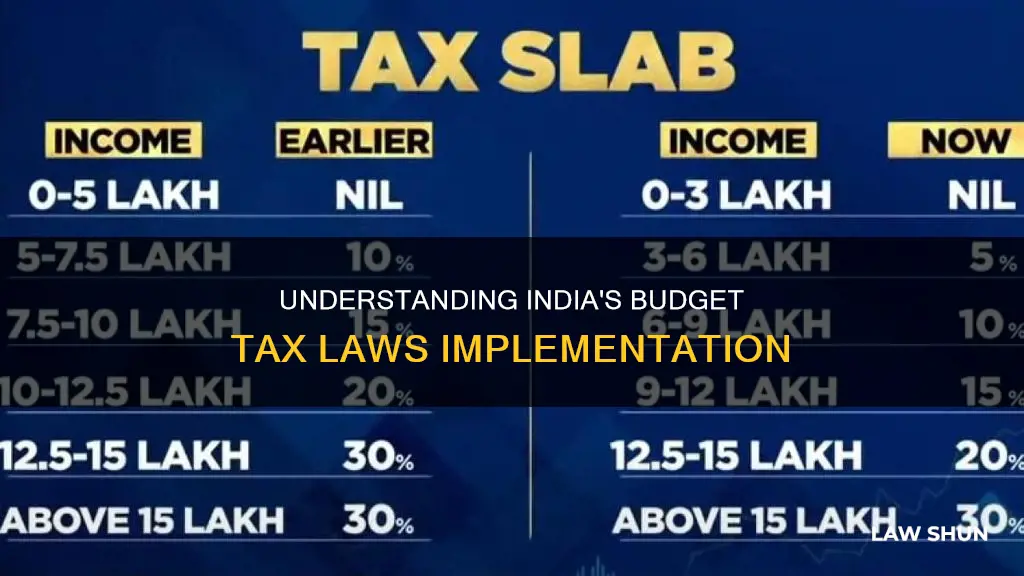

The Indian government presents its Union Budget annually, outlining its financial plans for the coming year. The budget for the fiscal year 2024-25 was presented on July 23, 2024, by Finance Minister Nirmala Sitharaman. The budget included changes to income tax slabs, standard deductions, and tax rates. The new income tax slabs are: nil tax for income up to Rs 3 lakh, 5% tax for income between Rs 3 and 7 lakh, 10% tax for income between Rs 7 and 10 lakh, 15% tax for income between Rs 10 and 12 lakh, 20% tax for income between Rs 12 and 15 lakh, and 30% tax for income above Rs 15 lakh. The standard deduction was increased from Rs 50,000 to Rs 75,000, and the limit for deduction of family pension was raised from Rs 15,000 to Rs 25,000. The budget also included changes to the capital gains tax regime, with the tax rate for long-term capital gains increased to 12.5% and the tax rate for short-term capital gains on certain financial assets increased to 20%.

What You'll Learn

- Taxpayers with outstanding direct tax demands up to Rs 25,000 till financial year (FY) 2009-10 will have their demands withdrawn

- Taxpayers with outstanding direct tax demands up to Rs 10,000 between FY 2010-11 and FY 2014-15 will have their demands withdrawn

- The Union Budget will be announced twice in 2024 due to Lok Sabha Elections

- The new tax regime has increased the rebate limit

- The new tax regime has increased the standard deduction limit for salaried employees

Taxpayers with outstanding direct tax demands up to Rs 25,000 till financial year (FY) 2009-10 will have their demands withdrawn

In her 2024 Budget speech, Finance Minister Nirmala Sitharaman announced a resolution for "disputed direct tax demand" dating back to 1962, the year the Income-Tax Act was enacted. The government has decided to withdraw outstanding direct tax demands up to Rs 25,000 for the period up to the financial year 2009-10 and up to Rs 10,000 for the financial years 2010-11 to 2014-15.

Sitharaman said this move is expected to benefit about one crore taxpayers, which could mean a likely impact for one in every eight tax filers. The outstanding tax demands were creating a hurdle in the issuance of refunds to taxpayers as the Income Tax department was unable to process complete refunds for the subsequent assessment year if the taxpayers had pending demands from previous years. The withdrawal of these disputes is expected to resolve this issue.

Sitharaman said: "In line with our government's vision to improve ease of living and ease of doing business, I wish to make an announcement to improve taxpayer services. There are a large number of petty, non-verified, non-reconciled or disputed direct tax demands, many of them dating as far back as the year 1962, which continue to remain on the books, causing anxiety to honest taxpayers and hindering refunds of subsequent years."

Revenue Secretary Sanjay Malhotra clarified that this should not be seen as a "waiver" but instead as a "withdrawal and correction of entries". He added that the government is now remitting 1.1 crore tax demands which will cost "less than Rs 3,500 crore". About 58 lakh demand entries are for the period up to the financial year 2009-10, and another 53 lakh entries pertain to the years from 2010-11 to 2014-15.

How Gas Laws Help Calculate Grams

You may want to see also

Taxpayers with outstanding direct tax demands up to Rs 10,000 between FY 2010-11 and FY 2014-15 will have their demands withdrawn

In her 2024 budget speech, Finance Minister Nirmala Sitharaman announced an income tax amnesty for taxpayers with outstanding direct tax demand disputes with the income tax department. This amnesty applies to taxpayers with outstanding direct tax demands up to Rs 10,000 between the financial years 2010-11 and 2014-15. These taxpayers will have their demands withdrawn.

The Finance Minister's announcement is expected to benefit about one crore taxpayers. The aim of the amnesty is to improve the ease of living and doing business for taxpayers. It is also intended to reduce anxiety for honest taxpayers and prevent refunds of subsequent years from being hindered.

The amnesty follows a surge in the filing of Income-Tax Returns (ITRs) for the assessment year 2023-2024, with a record 8.18 crore ITRs filed up to December 31, 2023, compared to 7.51 crore ITRs filed up to December 31, 2022. This represents a 9% increase from the total ITRs filed for AY 2022-23.

HIPAA Laws: Do They Apply to the President?

You may want to see also

The Union Budget will be announced twice in 2024 due to Lok Sabha Elections

The Union Budget for the fiscal year 2024-25 will be announced twice due to the Lok Sabha elections. An interim budget was presented on February 1, 2024, by Finance Minister Nirmala Sitharaman, and the final budget is expected to be presented on July 23, 2024. The budget session of Parliament will be held from July 22 to August 12, 2024.

The Union Budget is a key financial statement that involves estimating the revenue and expenditure for the upcoming fiscal year. This year, the focus of the Union Budget is expected to be on economic growth, stabilizing inflation, and allocating resources to sectors such as agriculture, education, healthcare, and infrastructure.

The budget-making process for the fiscal year 2024-25 began early, with the Ministry of Finance starting its work on September 4, 2023. The budget is usually presented by Finance Minister Nirmala Sitharaman every year. However, due to the Lok Sabha elections, an interim budget was necessary, and the final budget will be presented later in the year.

The Union Budget has significant implications for India's economy and the lives of its citizens. It outlines the government's financial plans and priorities for the upcoming year. The changes in the budget can affect tax rates, economic policies, and social welfare programs, among other things.

The final budget for the fiscal year 2024-25 will be closely watched as it will be the first full-year budget from the new government formed after the Lok Sabha elections. It will be crucial in addressing the country's economic development and the welfare of its citizens.

Understanding Blue Sky Laws: Relevance for LLCs

You may want to see also

The new tax regime has increased the rebate limit

The new tax regime in India, introduced in Budget 2020, offers a simplified tax structure with lower tax rates but fewer deductions and exemptions. In the Union Budget 2024, Finance Minister Nirmala Sitharaman announced changes to the new income tax regime, including revised tax slabs and an increased standard deduction. These changes are aimed at providing relief to taxpayers and encouraging a shift towards the new regime.

One of the key changes in the new tax regime is the increase in the rebate limit. Under the new regime, individuals with a total income of up to Rs 7 lakhs will have zero tax liability, as opposed to Rs 5 lakhs in the old regime. This means that taxpayers with an income of up to Rs 7 lakhs will not have to pay any tax under the new regime. The increase in the rebate limit provides significant benefits, especially to middle-class taxpayers, by reducing their taxable income and lowering their overall tax burden.

In addition to the increased rebate limit, the standard deduction for salaried employees has been raised from Rs 50,000 to Rs 75,000. This means that salaried individuals can deduct this amount from their gross income, resulting in a lower taxable income and, consequently, lower tax liability. Furthermore, the deduction on family pension has been increased from Rs 15,000 to Rs 25,000, providing additional tax relief to pensioners.

The changes in the new tax regime also include revisions to the tax slabs. The tax exemption limit has been increased to Rs 3 lakhs, and the slabs have been expanded to provide more favourable rates for certain income ranges. These revisions provide expanded thresholds, ensuring that a larger number of taxpayers benefit from lower tax rates.

The increase in the rebate limit, along with the other changes in the new tax regime, offers substantial financial relief to taxpayers, particularly those in the middle-income bracket. It is important to note that the decision to opt for the new or old tax regime depends on an individual's specific circumstances, including their income level and the deductions and exemptions they are eligible for. Individuals should carefully evaluate their tax liabilities under both regimes before making a choice.

Wills and Trusts: How Does Subsidiary Law Apply?

You may want to see also

The new tax regime has increased the standard deduction limit for salaried employees

The Indian government has introduced a new tax regime for the upcoming financial year, which includes changes to the standard deduction limit for salaried employees. This new regime simplifies the tax structure by offering concessional tax rates, though it disallows major deductions and exemptions.

Previously, salaried individuals could claim a standard deduction of Rs. 50,000, which was introduced during the 2018 Budget announcement. However, in the new tax regime for the 2024-25 financial year, this limit has been increased to Rs. 75,000. This means that salaried employees can now deduct this amount from their gross salary, reducing their taxable income. It is important to note that this increased limit is only applicable under the new tax regime and not the old one.

The standard deduction is a way to simplify tax filing and provide tax relief, specifically for middle-class salaried individuals and pensioners. It is a flat deduction, which means it is a fixed amount that can be subtracted without the need for detailed expense proofs. This deduction is available to all salaried employees, regardless of their category, and is claimed at the time of filing income tax returns.

The new tax regime now offers revised income tax slabs, which are common for all individuals, including senior and super senior citizens. These slabs include:

- Up to Rs. 3 lakh - NIL tax

- Rs. 3 lakh to Rs. 7 lakh - 5% tax

- Rs. 7 lakh to Rs. 10 lakh - 10% tax

- Rs. 10 lakh to Rs. 12 lakh - 15% tax

- Rs. 12 lakh to Rs. 15 lakh - 20% tax

- Above Rs. 15 lakh - 30% tax

The new regime also includes other benefits, such as increased limits for family pensioners, which have been raised to Rs. 25,000 from Rs. 15,000. Additionally, there are now provisions for transport allowances for differently-abled individuals, travelling allowances, deductions for new employees, and more.

Understanding Boyle's Law: Universal Application and Pressure-Volume Relationship

You may want to see also

Frequently asked questions

The Union Budget 2024 was presented on July 23, 2024, by Finance Minister Nirmala Sitharaman.

The Budget Session of Parliament is expected to begin on July 22 and last until August 12, 2024.

The main focus of Budget 2024 is economic growth, with a focus on stabilizing inflation, agriculture, education, healthcare, and infrastructure.

A Union Budget, also known as an annual financial statement, is an estimated statement of all the receipts and expenditures of that particular year.