The Social Security 2100 Act is a bill introduced in the US Congress by Representative John B. Larson of Connecticut. The bill, which was first introduced in 2019 and has since seen multiple iterations, aims to protect and improve Social Security benefits for current and future generations. The latest version of the bill, introduced in July 2023, proposes a range of benefit increases and tax changes to address the program's 75-year deficit. However, critics argue that the bill's temporary benefit increases, aggressive COLA adjustments, and overreaching revenue sources create more problems than they solve. With a predicted 0% chance of enactment, the bill faces an uncertain future in Congress.

| Characteristics | Values |

|---|---|

| Name of Act | Social Security 2100 Act |

| Year | 2023 |

| Sponsor | Senior Senator for Connecticut, John B. Larson |

| Sponsor's Party | Democrat |

| Bill Number | H.R.4583 |

| Congress | 118th |

| Status | Introduced |

| Date Introduced | 12/07/2023 |

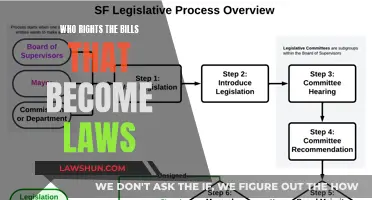

| Committees Referred To | House Ways and Means; Education and the Workforce; Energy and Commerce; Subcommittee on Health |

| Probability of Enactment | 0% |

| Previous Versions | 2019, 2021 |

What You'll Learn

The 2023 Social Security 2100 Act is a flawed version of a great bill

The Social Security 2100 Act, first introduced in 2019, has been described as a bill to "protect our Social Security system and improve benefits for current and future generations". The 2023 version of the bill, however, has been criticised as a "flawed version of a great bill".

The 2023 Act, authored by Rep. John B. Larson, includes 12 essential benefit increases and improvements, such as improving the Cost-of-Living Adjustment (COLA) to reflect the inflation experienced by seniors, increasing benefits for lower-income seniors, and restoring student benefits up to age 26 for the dependent children of disabled or deceased workers. The bill also proposes to ensure millionaires and billionaires pay their fair share by applying FICA to earnings above $400,000.

Despite these positive aspects, the 2023 Social Security 2100 Act has been criticised by some as a flawed version of the original bill. Alicia H. Munnell, a columnist for MarketWatch and director of the Center for Retirement Research at Boston College, identifies three key flaws in the 2023 legislation. Firstly, the introduction of temporary benefit increases may create pressure to make them permanent, using up a significant portion of the new money raised. Alternatively, if the enhancements are not made permanent, it could create chaos for the Social Security Administration and cause confusion for those receiving benefits. Secondly, the proposal to use the "higher of the two" when it comes to the index for cost-of-living adjustments is criticised as greedy, with Munnell arguing that the goal should be to ensure that the value of benefits is not eroded by inflation, rather than maximising the money received by retirees. Thirdly, the legislation proposes to raise about a third of its money from sources that are not rationally linked to the goals of the program, such as applying the payroll tax rate to net investment income.

In conclusion, while the 2023 Social Security 2100 Act includes a number of positive measures to improve the Social Security system and benefit Americans, it has been criticised as a flawed version of the original bill due to its introduction of temporary benefit increases, its approach to the cost-of-living adjustment, and its proposed revenue sources.

Title 42: A Controversial Law and its Enactment

You may want to see also

The 2019 Social Security 2100 Act retained and enhanced benefits

The Social Security 2100 Act, introduced in 2019 by Congressman John Larson (D-CT), retained and enhanced benefits while also increasing revenue to cover the program's 75-year deficit. The 2019 legislation offered four enhancements:

First, the Act proposed using the consumer price index for the elderly (CPI-E) to determine the cost-of-living adjustment (COLA) for benefits. This would ensure that the COLA reflects the inflation experienced by seniors.

Second, the first factor in the benefit formula would be raised from 90% to 93%. This change would increase benefits for all Social Security beneficiaries, including lower-income seniors, widows and widowers from two-income households, and dependent children of disabled, deceased, or retired workers.

Third, the legislation increased thresholds for taxation of benefits under the personal income tax. This would reduce taxes for middle-income beneficiaries.

Fourth, the special minimum benefit for those with very low earnings would be increased. This enhancement would boost benefits for those with the lowest incomes, including children living with grandparents or other relatives.

These benefit enhancements were designed to ensure that Americans can continue to retire with dignity, as promised by the Federal Government. By increasing revenue to cover the program's deficit, the legislation also aimed to safeguard Social Security for future generations.

While the 2019 version of the Social Security 2100 Act was well-received, subsequent iterations released in 2021 and 2023 have been criticised for introducing temporary benefit increases and overreaching on revenue.

Law Enforcement Careers: Is a Degree Necessary?

You may want to see also

The 2023 Act has temporary benefit increases

The Social Security 2100 Act, or H.R. 4583, was introduced in the House in July 2023 by Rep. John B. Larson. The Act proposes to increase and expand 12 essential benefits for Social Security beneficiaries.

The 2023 Act includes temporary benefit increases of 2% across the board for all beneficiaries, which would be the first increase in 52 years. It also improves the Cost-of-Living Adjustment (COLA) to reflect the inflation experienced by seniors. This is particularly important as the cost-of-living adjustments for 2025 are expected to fall short of the higher costs retirees are facing.

The Act also includes provisions to increase benefits for lower-income seniors, widows and widowers from two-income households, and dependent children of disabled, deceased, or retired workers. It restores student benefits up to age 26 and increases access to benefits for children living with grandparents or other relatives.

These temporary benefit increases are intended to provide immediate relief to Social Security beneficiaries, ensuring that their benefits keep up with their expenses. The Act also includes measures to ensure the long-term solvency of the Social Security program.

The Social Security 2100 Act is currently in the House Ways and Means, Education and the Workforce, and Energy and Commerce Committees. It has not yet become law, but it is expected to be considered further in 2024.

Law Degree: A Prerequisite for Teaching?

You may want to see also

The 2023 Act overreaches on the revenue side

The Social Security 2100 Act was introduced by Congressman John Larson in 2019 and revised in 2021 and 2023. The 2023 Act has been criticised for overreaching on the revenue side.

The 2023 Act proposes to raise about a third of its money by going after "irrelevant sources". Specifically, it would apply the 12.4% payroll tax rate to net investment income as defined under the Affordable Care Act. This is problematic because the program will be safer in the long run if its financing sources have a rational link to the goals of the program.

The 2023 Act also proposes to raise revenue by ensuring millionaires and billionaires pay their fair share by applying FICA to earnings above $400,000, with those extra earnings counted toward benefits at a reduced rate. This is a change from the 2019 Act, which proposed to apply the payroll tax on earnings above $400,000 and on all earnings once the taxable maximum reaches $400,000, with a small offsetting benefit for these additional taxes.

The 2023 Act also includes a provision to close the loophole of avoiding FICA taxes and receiving a lower rate on investment income by adding an additional 12.4% net investment income tax (NIIT) only for taxpayers making over $400,000. This is a more aggressive approach to revenue-raising than the 2019 Act, which did not include this provision.

Overall, the 2023 Act takes a more aggressive approach to revenue-raising than the 2019 Act, and this has been characterised as "overreaching". While the 2023 Act is intended to address the program's 75-year deficit, it has been criticised for not providing a sustainable solution and for creating more problems than it solves.

The Evolution of CAPTA: A Comprehensive Child Protection Law

You may want to see also

The 2023 Act is the third version of the legislation

The 2023 Act, the third version of the legislation, was introduced in July 2023. This version of the bill includes temporary benefit increases, which some critics argue is a terrible idea as it may create chaos for the short-staffed Social Security Administration and confuse people. The 2023 Act also proposes changing the index for cost-of-living adjustments from the CPI-W to the CPI-E (the consumer price index for the elderly), which some argue is not reasonable as it is meant to ensure that the value of benefits is not eroded by inflation. Additionally, the legislation proposes raising about a third of its money by going after irrelevant sources, such as applying the 12.4% payroll tax rate to net investment income.

Despite some criticism, the 2023 Act is a serious "down payment" on solving the 75-year deficit problem. Social Security actuaries concluded that the legislation would eliminate almost 90% of the program's 75-year deficit. However, some argue that the bill creates more problems than it solves, and that the original 2019 legislation should be resurrected instead.

Becoming an Administrative Law Judge in New York

You may want to see also

Frequently asked questions

The Social Security 2100 Act is a bill introduced by Congressman John Larson to protect and improve benefits for current and future Social Security beneficiaries in the United States.

The bill aims to increase and expand 12 essential benefits for Social Security beneficiaries, including improving the Cost-of-Living Adjustment (COLA) to reflect inflation, increasing benefits for lower-income seniors, and improving benefits for widows and widowers.

No, the Social Security 2100 Act has not yet become law. It was introduced in the House of Representatives in July 2023 and referred to various subcommittees for consideration. As of December 2024, it is still in the first stage of the legislative process.