California's wage and hour laws are considered to be among the toughest in the nation. Generally, a business registered in California with at least one employee working in the state is considered a California employer and is subject to the state's wage and hour laws. This includes non-exempt employees, such as executive, administrative, and professional employees, who are entitled to overtime pay and meal and rest breaks. California's wage and hour laws also apply to workers who live in other states but perform some work in California, as well as those who work in multiple states. However, there are certain exemptions to these laws, such as for independent contractors or exempt employees. Understanding the intricacies of California's wage and hour laws is crucial for both employers and employees to ensure compliance and protect their rights.

| Characteristics | Values |

|---|---|

| Application | California wage and hour laws apply to all non-exempt employees in the state of California. |

| California wage and hour laws do not apply to independent contractors. | |

| California wage and hour laws do not apply to exempt employees. | |

| California wage and hour laws do not apply to employees who live in other states but work for a California-based employer. | |

| California wage and hour laws do not apply to employees who work for a California-based employer but do not work in California. | |

| California wage and hour laws do apply to employees who work for a non-California-based employer but work in California. | |

| California wage and hour laws do not apply to public employees unless the law specifically states that they do. | |

| California wage and hour laws do apply to public employees in some situations. |

What You'll Learn

California wage and hour laws for non-exempt employees

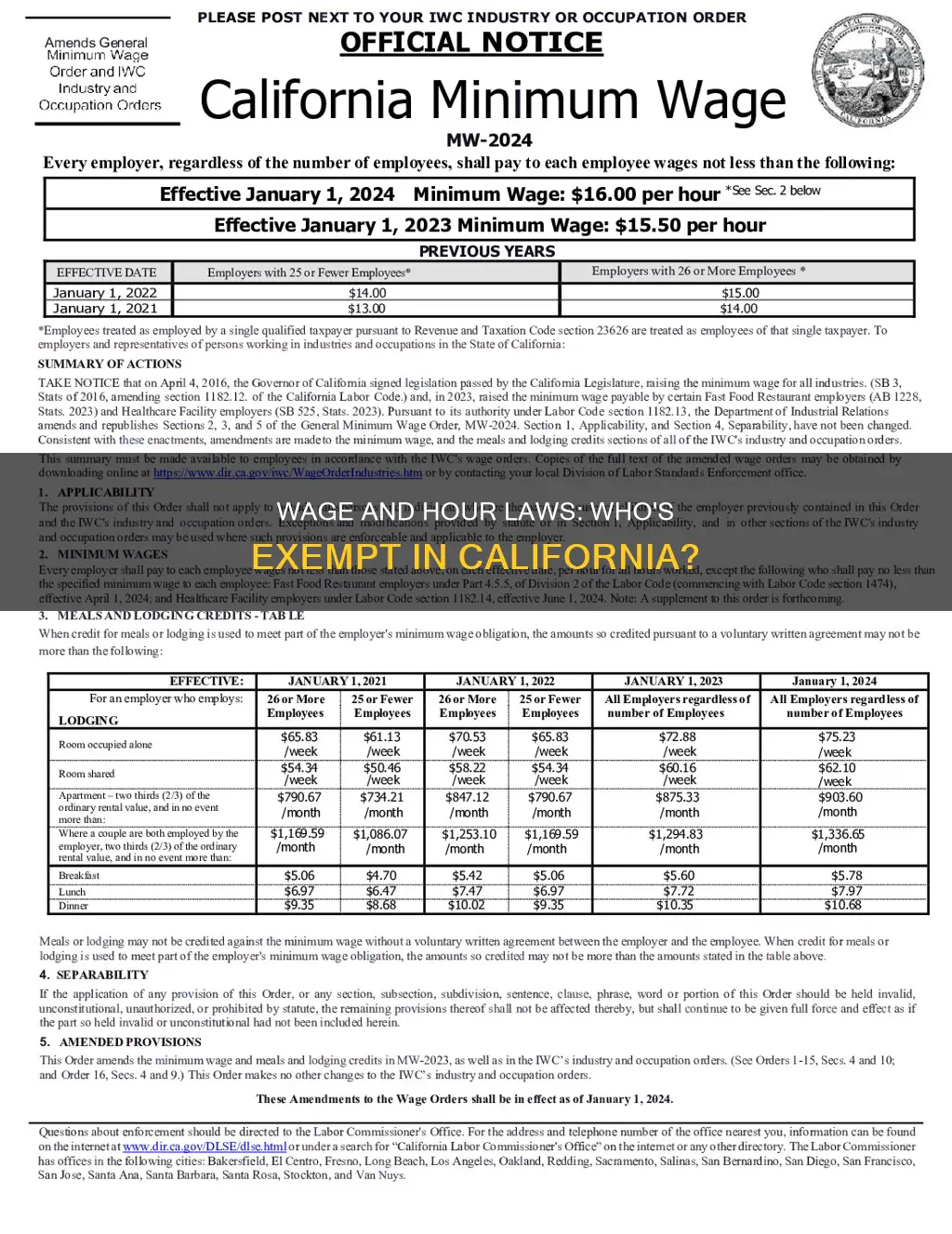

California wage and hour laws are considered to be among the toughest in the nation for employers to comply with. The state's laws and rules on wages are set forth in various provisions of the California Labor Code and in wage orders of the state's Industrial Welfare Commission (IWC). California's Department of Industrial Relations (DIR) regulates wages and hours for non-exempt employees.

Non-exempt employees in California are generally entitled to protections such as overtime pay, meal breaks, and rest breaks. For 2024, exempt employees in California must earn at least $1,280 a week ($66,560 yearly) to be exempt from such protections.

To be considered non-exempt, an employee in California will generally need to meet a strict duties test. For most exemptions, more than 50% of an employee's time must be spent performing exempt job duties. Job titles do not determine an employee's exempt or non-exempt status.

In addition to protections such as overtime pay and meal and rest breaks, there are a number of other rules and requirements that employers in California must follow with respect to non-exempt employees. These include rules regarding:

- Wage payment laws, such as minimum wages, wage deductions, and final pay rules

- Timing and method of payment

- Notices and record-keeping

- Travel time and breaks

- Alternative work schedules

- Split shifts

- Reporting time or "show-up" pay

- Wage statements

California's wage and hour laws apply to workers who live and work in California but also work in other states, as long as they perform some of their work in California for a California-based employer.

Laws on Private Property: What Applies and Why?

You may want to see also

California wage and hour laws for exempt employees

California's wage and hour laws are considered to be among the toughest in the United States. They apply to all companies registered in California with at least one employee working in the state.

In California, salaried employees can be classified as either exempt or non-exempt. Exempt employees are not covered by most of California's wage and hour laws. They are generally white-collar workers who are paid a salary rather than an hourly wage. Exempt employees are not entitled to the same wage and hour law protections as non-exempt employees, such as overtime pay, meal breaks, and rest breaks.

To qualify as exempt, an employee must:

- Have primary duties that involve executive, administrative, or professional tasks

- Have duties that require the exercise of discretion and independent judgment

- Earn a minimum salary equivalent to twice the state minimum wage based on a 40-hour workweek

For 2024, exempt employees in California must earn at least $1,280 a week ($66,560 yearly). This minimum salary has increased steadily over the years and is expected to continue doing so.

It's important to note that employers cannot arbitrarily decide to classify an employee as exempt. The job duties must meet the legal definition under the California Labor Code. Signing a contract or being paid a salary does not automatically make an employee exempt.

There are various job-specific overtime exemptions under California's wage orders that apply to certain occupations, such as outside salespersons, commissioned employees, commercial truck drivers, and live-in housekeepers. Additionally, some unionized employees may qualify for exemptions from overtime rules under specific collective bargaining agreements.

Exempt employees in California are not covered by the state's overtime laws. This means that employers are not required to pay time-and-a-half wages if an exempt employee works:

- More than eight hours in a workday

- More than 40 hours in a workweek

- More than six consecutive days in a workweek

Furthermore, employers are not mandated to provide regular meal and rest breaks to exempt employees, unlike non-exempt employees.

If an employer misclassifies an employee as exempt, the employee may be able to bring a wage/hour lawsuit to collect unpaid overtime compensation and compensation for meal and rest breaks that were not granted.

Congressional Accountability: Do Laws Apply to Lawmakers?

You may want to see also

California wage and hour laws for independent contractors

California wage and hour laws are considered to be among the toughest in the nation. They apply to all employers registered in California and with at least one employee working in the state.

The classification of workers as independent contractors or employees is complex and requires a careful review of the business relationship. Independent contractors in California do not have the same federal and state protections as employees. However, they are entitled to certain rights.

Right to Contract

An independent contractor agreement with the hiring party is recommended to protect the interests of both parties. This agreement can outline the parameters of the project, including the type and scope of services, fees or charges, and the schedule for completing the work.

Right to Payment

Even though independent contractors are not subject to state and federal tax requirements, they are still entitled to payment for work completed, as outlined in their contract.

Right to Correct Classification

Independent contractors have the right to be properly classified. Misclassification can result in severe penalties for employers, including fines ranging from $5,000 to $25,000 per violation.

Right to Legal Recourse

If an independent contractor agreement exists, both parties have the right to enforce its terms. Additionally, if an independent contractor has been improperly classified as an employee, they may pursue missing benefits or wages under California law.

Differences Between Independent Contractors and Employees

Employees in California are entitled to overtime pay, minimum wage, and federal and state benefits, such as unemployment insurance, retirement and health benefits, and workers' compensation insurance. Independent contractors are not entitled to these benefits but enjoy greater autonomy and flexibility in their work.

Determining Worker Classification

The California Supreme Court's decision in Dynamex Operations West, Inc. v. Superior Court, known as the Dynamex Decision, established the "ABC Test" for determining worker classification. A worker may be classified as an independent contractor if they meet all of the following criteria:

- The worker is free from the hiring party's control and direction in performing the work.

- The worker performs services outside the normal scope of the hiring party's business.

- The worker customarily engages in the same trade, occupation, or business as the work performed.

The ABC Test makes it difficult to classify workers as independent contractors, and even one criterion being unmet can result in a worker being classified as an employee.

Antitrust Laws: Nonprofit Sector's Friend or Foe?

You may want to see also

California wage and hour laws for public employees

California wage and hour laws are considered to be among the toughest in the nation. While the federal Fair Labor Standards Act (FLSA) applies to public employees in California, the state's laws are more protective. For example, unlike the FLSA, California law requires employers to provide meal and rest breaks and to pay overtime if employees work more than eight hours a day.

The California Supreme Court has agreed that provisions of the California Labor Code do not generally apply to public employees unless they specifically state that they do. However, there are a few situations where this is the case. For instance, in Sheppard v. North Orange County Regional Occupational Program (2010), the Fourth District Court of Appeal found that the minimum wage provisions of Wage Order 4-2001 apply to public employers as the order explicitly provides that its minimum wage section applies to employees directly employed by the state or any political subdivision. Similarly, in Marquez v. City of Long Beach (2019), the Second District Court of Appeal extended this holding to charter cities, which are generally authorized to govern themselves, free of state intrusion.

In Stoetzl v. Department of Human Resources (2019), the California Supreme Court essentially agreed with the analysis in Sheppard, confirming that Wage Order No. 4 applies to employees of the state government, but only in part.

Labor Code sections 201 and 202 require an employer to immediately pay wages to an employee upon that employee’s termination or layoff. Section 220, subdivision (b), provides that these sections do not apply to “employees directly employed by any county, incorporated city, or town, or other municipal corporation.” Therefore, a public employee who does not fall into any of these categories would be protected by Labor Code sections 201-203.

In Johnson v. Arvin-Edison Water Storage Dist. (2009), the Court of Appeal for the Fifth District held that Labor Code sections 510 and 512, which govern overtime and meal breaks, did not apply to public employees. The court noted that these sections did not mention public employers, indicating that the legislature did not intend to apply them to public entities.

In summary, while some provisions of California's wage and hour laws apply to public employees, others do not. It is important to carefully review the specific laws and court interpretations to determine which protections apply to public employees in the state.

Antitrust Laws: Should NCAA Play by Different Rules?

You may want to see also

California wage and hour laws for out-of-state workers

California wage and hour laws are considered to be among the best in the US for workers. But do they apply to out-of-state workers?

In 2020, the California Supreme Court ruled on two cases, Oman v. Delta Air Lines and Ward v. United Airlines, which provided some guidance on this issue. These cases built on an earlier 2011 case, Sullivan v. Oracle, in which three employees who did not live in California but performed some work for their employer in the state, claimed that California's overtime laws applied to the work they did there. The California Supreme Court agreed, for several reasons. Firstly, California's overtime laws apply to all employment in the state, regardless of the employee's residence. Secondly, other states have no interest in shielding California-based employers from the state's wage laws regarding work performed in California. Finally, even if they did, California's interest would override those of other states.

However, the Sullivan case left open the question of whether other wage and hour laws would apply to such workers. This was addressed in the 2020 cases of Oman and Ward. In Ward, the Court concluded that whether California Labor Code section 226 (which requires specific wage statements) applies to pilots and flight attendants who perform most of their work outside of California, depends on whether their principal place of work is in California. The Court held that workers can establish their principal place of work is in California by showing they work the majority of their time there, or that they have a definite base of operations in the state and perform at least some work there for their employer.

In Oman, the plaintiffs were flight attendants who worked mainly outside of California. The Court applied the test set forth in Ward, concluding that whether Labor Code sections 226 and 204 (which governs how often workers must be paid) applied, would depend on whether the workers were based in California for work purposes. The Court noted that California's power to protect workers within its borders is not limited by whether the worker is a non-resident or employed by a non-resident entity. Thus, if employees are based in California for work purposes, this is sufficient to trigger the requirements of sections 226 and 204.

In summary, California wage and hour laws can apply to out-of-state workers if their principal place of work is in California, or if they perform any work in the state. However, it is important to note that there may be exemptions and exceptions to these laws, and the specific circumstances of each case will need to be considered.

Miscarriages and Abortion Laws: Overlapping Boundaries?

You may want to see also

Frequently asked questions

California wage and hour laws apply to employees who perform some of their work for their employer in California. In Sullivan v. Oracle (2011), the California Supreme Court ruled that California's overtime laws apply to all employment in the state, regardless of the employee's place of residence.

No, California wage and hour laws only cover employees. An independent contractor is someone who renders a service under an agreement to produce a specified result for specified pay and maintains control over how the result is accomplished.

No, California wage and hour laws do not apply to "exempt employees". This includes executive, administrative, and professional employees who spend more than half of their work time doing intellectual, managerial, or creative work, regularly exercise discretion and independent judgment, and earn a monthly salary equivalent to at least twice the state minimum wage for full-time employment.