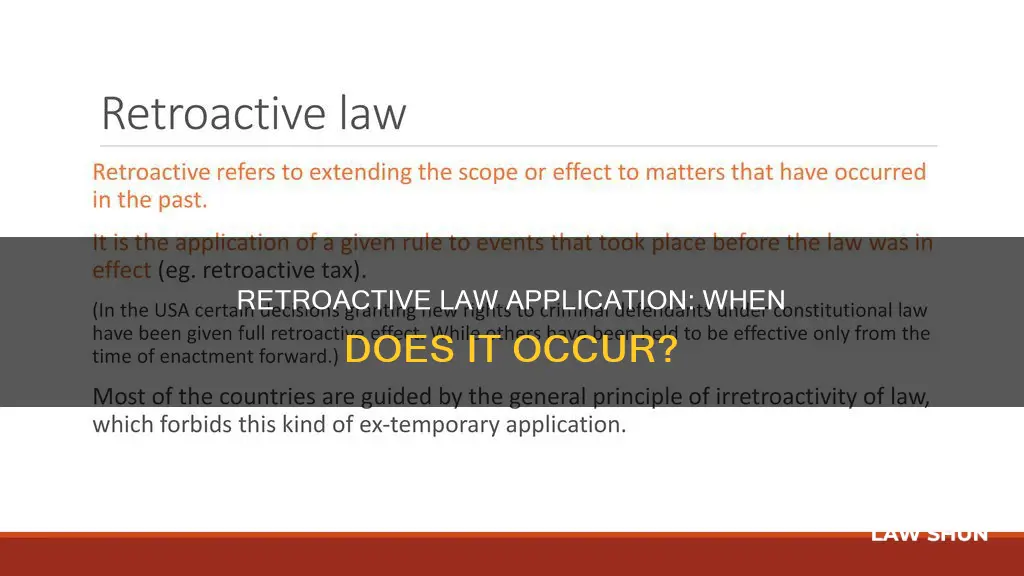

The retroactive application of laws refers to the imposition of liability on individuals for prior actions. In the context of criminal law, the retroactive application of laws is prohibited in most jurisdictions. However, in administrative law, the situation is more complex, and retroactive laws may be permissible under certain circumstances.

In the United States, the Constitution prohibits Congress from passing ex post facto laws, which retroactively change the legal consequences of actions committed before the enactment of the law. This prohibition extends to both federal and state governments.

The Supreme Court has held that federal and state courts must retroactively apply all new federal-constitutional rules of criminal procedure to direct appeals of convictions. This means that if a new rule would have affected the outcome of a case, individuals can petition a lower court to reconsider their sentence.

However, the retroactive application of laws is generally disfavored, as it is considered unfair to hold individuals liable for violating a law that did not exist at the time of the alleged violation. Nevertheless, courts may allow retroactive application under certain circumstances, such as when the benefits of retroactivity outweigh the mischief of producing a result contrary to statutory design or legal and equitable principles.

In the context of administrative law, the retroactive application of laws is not prohibited but is generally disfavored. Retroactive laws in this context can have significant implications for individuals' liberty and property rights, and courts will consider the public interest and the legitimate expectations of those affected when determining the lawfulness of retroactive measures.

Internationally, the retroactive application of criminal laws is prohibited by various human rights instruments, such as the Universal Declaration of Human Rights and the International Covenant on Civil and Political Rights. However, in administrative law, international law allows states to derogate from the principle of non-retroactivity by explicit provisions in treaties or legislation.

| Characteristics | Values |

|---|---|

| Nature | Criminal law, administrative law, civil law, tax law |

| Scope | Retroactive laws can criminalize actions that were legal when committed, aggravate a crime, change the punishment for a crime, extend the statute of limitations, or alter the rules of evidence |

| Jurisdiction | Retroactive laws are forbidden by the US Constitution, the European Convention on Human Rights, the International Covenant on Civil and Political Rights, and the law of many individual countries |

| Exceptions | Retroactive laws may be permitted in cases of "first impression", to correct a mistake, or to apply a new rule for the first time |

| Impact | Retroactive laws can affect equality, certainty, and predictability under the rule of law |

What You'll Learn

- Retroactive laws are generally disfavoured, but courts may allow them under certain circumstances

- Retroactive laws are prohibited by the US Constitution, but only in criminal matters

- Retroactive laws are allowed in civil matters, such as taxation

- Retroactive laws are prohibited in criminal law, but not in administrative law

- Retroactive laws are allowed in administrative law, but only if they pursue legitimate public policy objectives

Retroactive laws are generally disfavoured, but courts may allow them under certain circumstances

Retroactive laws are generally disfavoured because they are considered unfair. The idea is that people should only be punished for breaking laws that existed when they committed the act in question. This principle, called the "presumption against retroactive application of statutes," is derived from the Fifth Amendment of the U.S. Constitution, which states that people have a right to due process of law, ensuring fair treatment by the legal system.

However, courts may allow retroactive laws under certain circumstances. For example, retroactivity may be permitted if it is necessary to correct a mistake or if it is the first time a new rule is being applied. In such cases, the harm caused by applying the rule retroactively must be balanced against the harm caused by not applying it at all.

Additionally, courts have generally allowed retroactivity in tax law to ensure individuals pay the correct amount of taxes. Federal courts in the U.S. have also been receptive to retroactive application in certain cases, such as when an amendment corrects an error in a previous statute, or when an individual did not rely on the previous statute.

In the context of criminal law, the principle of non-retroactivity is widely accepted and has become a binding norm of international law. Most domestic jurisdictions explicitly recognise this principle, and international courts and tribunals have consistently applied it. However, in administrative law, the situation is more complex, and domestic legal systems differ in their approach to retroactive application.

Understanding CT Lemon Law: Travel Trailers Included?

You may want to see also

Retroactive laws are prohibited by the US Constitution, but only in criminal matters

Retroactive laws, also known as ex post facto laws, are generally prohibited by the US Constitution, as they are considered unfair. The Fifth Amendment of the US Constitution, which guarantees due process of law, forms the basis of this prohibition. The idea is that people should only be punished for breaking laws that existed when they committed the act in question. This is known as the "presumption against retroactive application of statutes."

However, this prohibition only applies to criminal matters. Retroactive laws are permitted in civil matters, and federal courts have been receptive to their application in tax laws. For example, in the case of SEC v. Chenery II, the US Supreme Court allowed the retroactive application of a new standard of conduct by the Securities and Exchange Commission (SEC), stating that such retroactivity must be balanced against the harm caused by not applying the new rule at all.

In another case, US v. Carlton, the US Supreme Court held that an amendment to a federal estate tax statute and its retroactive application did not violate the Fifth Amendment because the taxpayer did not rely on the previous statute, and Congress was correcting an error. The Court recognized the protections of the due process clause of the Fifth Amendment but allowed retroactivity in this instance because it was limited to one year.

While the US Constitution prohibits ex post facto laws at the federal and state levels, it is important to note that this only applies to criminal matters. Retroactive laws in civil matters, such as taxation, may be permitted, especially if they are deemed necessary to correct mistakes or apply new rules.

Jersey's Legal System: English Law Influence

You may want to see also

Retroactive laws are allowed in civil matters, such as taxation

In the US, for example, the Fifth Amendment of the US Constitution, i.e. the due process clause, protects against retroactive application of statutes. However, the US Supreme Court has held that an amendment to a federal estate tax statute limiting the availability of a deduction and its retroactive application did not violate the Fifth Amendment. This is because the taxpayer did not rely on the previous statute, Congress corrected an error in amending the statute, and the application only extended retroactively by one year.

In Canada, the Charter of Rights and Freedoms prohibits ex post facto criminal laws. However, changes to civil law in Canada can be, and occasionally are, enacted ex post facto. For example, in one case, a convicted murderer was ordered to forfeit proceeds from a book he had published under a Saskatchewan law that was passed long after his conviction. The courts ruled that such laws prescribe only civil penalties (as opposed to additional criminal penalties) and are thus not subject to Charter restrictions.

In the UK, ex post facto laws are permitted by virtue of the doctrine of parliamentary sovereignty. However, retrospective criminal laws are prohibited by Article 7 of the European Convention on Human Rights, to which the UK is a signatory.

HIPAA Laws and Minors: Privacy Rights Explained

You may want to see also

Retroactive laws are prohibited in criminal law, but not in administrative law

Retroactive laws are generally prohibited because they are considered unfair. The idea is that people should only be punished for breaking laws that existed when they committed the act in question. This principle is called the "presumption against retroactive application of statutes" and is derived from the Fifth Amendment of the U.S. Constitution, which guarantees the right to due process of law.

However, there are exceptions to this rule, and retroactive laws are sometimes allowed or even necessary. For example, in the U.S., retroactive laws are prohibited in criminal law by the Ex Post Facto Clause of the Constitution but are permitted in administrative law under certain circumstances.

In criminal law, an ex post facto law retroactively changes the legal consequences or status of actions committed before the law's enactment. It may criminalize actions that were previously legal, aggravate a crime by placing it in a more severe category, change prescribed punishments by adding new penalties or extending sentences, extend the statute of limitations, or alter the rules of evidence to increase the likelihood of conviction. Such laws are prohibited by the United States Constitution, which expressly forbids ex post facto laws at the federal and state levels.

On the other hand, administrative law, which governs the actions and decisions of federal agencies, may allow for retroactivity under specific conditions. Federal agencies can apply their rules retroactively if Congress has authorized them to do so. While retroactive regulation is generally disfavored by the courts, it may be permitted if Congress has expressly granted retroactive power to the agency.

Additionally, there are instances where retroactive laws are deemed necessary to correct mistakes or when a new rule is being applied for the first time. In these cases, the harm caused by applying the rule retroactively must be balanced against the harm caused by not applying it at all.

In summary, while retroactive laws are generally prohibited in criminal law to protect individuals from unfair punishment, they may be allowed or even necessary in administrative law to correct mistakes, apply new rules, or serve the community's best interests.

Charles' Law: Breathe Easy at Depth

You may want to see also

Retroactive laws are allowed in administrative law, but only if they pursue legitimate public policy objectives

Retroactivity refers to the application of a law or rule to actions that occurred in the past, before the law was passed. In the US, retroactive laws are generally not allowed as they are considered unfair, depriving citizens of notice and creating economic uncertainty. This is known as the "presumption against retroactive application of statutes", rooted in the Fifth Amendment of the US Constitution, which guarantees citizens the right to due process of law.

However, retroactive laws are sometimes permitted in administrative law if they pursue legitimate public policy objectives. While most US states discuss retroactivity in the context of procedural rules created by administrative agencies, retroactive application should not apply to steps already taken in pending actions. Retroactive application is allowed in cases where regulations clarify or codify an existing rule.

For retroactive laws to be permitted, the statute conferring rule-making powers to administrative agencies must explicitly state that the rules can have retroactive effect. The Federal Administrative Procedure Act (APA) states that rules created by administrative agencies should only have a prospective effect, defined as having future applicability.

Courts are generally bound to apply administrative regulations prospectively. However, if Congress expressly provides for the retroactive application of certain regulations, courts can give effect to this intention.

Sunshine Laws: Nonprofit Compliance and Transparency

You may want to see also

Frequently asked questions

Laws apply retroactively when a new law imposes liability on individuals for prior actions. This is generally disfavoured as it is considered unfair to hold someone liable for violating a law that did not exist at the time of the violation. However, laws may be applied retroactively under certain circumstances, such as when the benefits of retroactivity outweigh the "mischief" of producing a result that is contrary to statutory design or legal and equitable principles.

Laws do not apply retroactively when they are ex post facto, i.e., when they retroactively change the legal consequences or status of actions that were committed or relationships that existed before the law was enacted. Ex post facto laws are prohibited by the US Constitution and international law.

Laws can be applied retroactively when they do not impose liability and instead impose rules that are in the general interest, such as taxation laws.